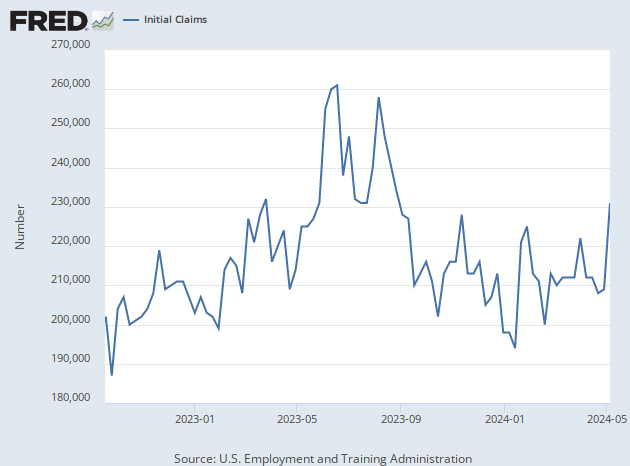

Applications for unemployment benefits in the U.S. fell to the lowest level since January, a level so low that it challenges the notion that supply and demand conditions in the labor market were reaching a better balance.

Initial jobless claims dropped by 20,000 to 201,000 in the week that ended on Wednesday, September 16, the Labor Department said Thursday.

Claims have fallen in five out of the last six weeks, indicating that employers are keeping workers on payrolls as consumer demand has held up much better than expected and the economy appears to be growing at the fastest pace of the year.

Six months ago, many economists believed the economy would be in a recession or experiencing very low growth in the second half of 2024. The median expectation of Federal Reserve officials at the March meeting of the Federal Open Market Committee was for economic growth of just 0.4 percent in 2023. In May, the median forecast among professional economists survey by the Federal Reserve Bank of Philadelphia was for the economy to contract at an annual rate of 0.1 percent in the third quarter and grow at a 1.2 percent annual rate in the third quarter, which would have put the U.S. on the edge of a recession.

On Wednesday, Federal Reserve officials updated their outlooks for the economy. The media expectation is now for the economy to grow 2.1 percent this year. In August, the Philly Fed’s survey of professional forecasters indicated that economists expect the economy to grow 0.6 percent in the third quarter and to be flat in the fourth quarter. The Atlanta Fed’s GDPNOW barometer of growth indicated on Wednesday that the economy appears to be growing at an annual rate of 4.9 percent in the third quarter.

Economists did not see last week’s plunge in jobless claims coming. The consensus forecast was for jobless claims to rise to 225,000 from the prior week’s 220,000. The bottom of the range of forecasts was 222,000, so this result shows stronger demand for labor than even the most bullish forecasters predicted.

Initial claims are a proxy for layoffs. They typically reflect demand for labor, rising when demand for workers is declining and falling when demand for workers is rising.

The recurring declines in jobless claims could push unemployment back down after a recent rise to 3.8 percent. This could force some Fed officials to rethink their view that the labor market is softening enough to ease inflationary pressures.

“The labor market remains tight, but supply and demand conditions continue to come into better balance,” Powell said on Wednesday, prior to the release of the claims data.

Continuing claim to to 1.66 million in the week that ended on September 9. (These get reported with a one-week delay.) That is the lowest level since mid-January of this year.

COMMENTS

Please let us know if you're having issues with commenting.