Spending by American consumers has kept the economy humming at an unexpectedly fast clip over the past year. The dark side is that credit card and auto loan delinquencies are surging.

“Both auto loans and credit cards have seen particular worsening of new delinquencies, with transition rates now above pre-pandemic levels,” the Federal Reserve Bank of New York said in a post on its Liberty Street Economics blog.

The serious delinquency rate—meaning, loans that are more than 90 days overdue—for credit cards jumped to 6.4 percent in the fourth quarter of last year, up from four percent a year earlier, data from the New York Fed showed Tuesday.

The serious delinquency rate for auto loans increased from 2.2 percent to 2.7 percent.

“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed. “This signals increased financial stress, especially among younger and lower-income households.”

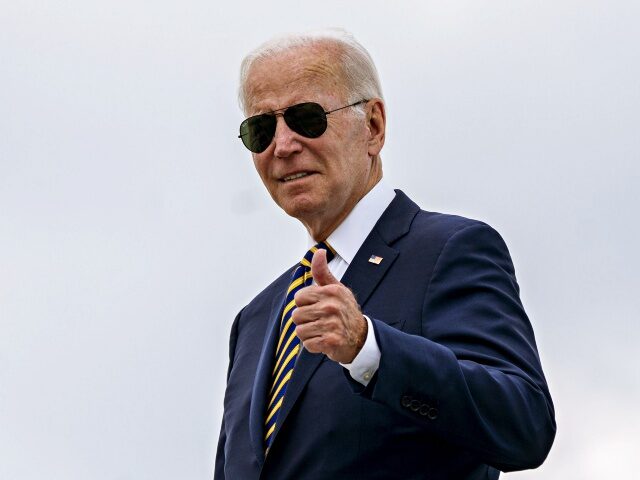

The high inflation that has haunted the economy throughout Biden’s tenure in the White House is playing a role. Prices of motor vehicles soared, inflating auto loan balances. The average amount borrowed on a car loan jumped 11 percent in 2021 and another 10 percent in 2022, according to the New York Fed.

By the end of 2022, the average initial loan amount on a car purchased with financing was nearly $24,000, up from $18,000 in the first quarter of 2020.

Prices have begun to fall but that might also increase delinquencies because it lowers the resale value of cars, making it harder for consumers to pay off loans when they face financial distress.

Overall credit card balances rose by $50 billion to $1.13 trillion in the fourth quarter. Auto loan balances climbed by $12 billion to $1.61 trillion.

While higher prices pushed up loan balances, higher interest rates have made those balances more costly for borrowers. Inflation, in other words, has been a one-two punch to U.S. consumers, hitting them first on prices of goods and second on the cost of debt that financed the purchases.

Delinquencies on credit cards are rising particularly sharply among Millenials. But on auto loans, the delinquencies are broader and have been rising sharply.

Credit card delinquencies have risen more quickly for Millennials than for other generations.

The share of auto loans to Millenials going into delinquency is also rising more sharply than for other generations, although the generation gap is less pronounced.

“All generations have delinquency transition rates that have been rising sharply over the past two years, with those for Millennials and Baby Boomers (born 1946-64) now being above their pre-pandemic levels,” the New York Fed said.

“Loans opened during 2022 and 2023 are, so far, performing worse than loans opened in earlier years, perhaps because buyers during these years faced higher car prices and may have been pressed to borrow more, and at higher interest rates,” the Liberty Street blogpost said.

COMMENTS

Please let us know if you're having issues with commenting.