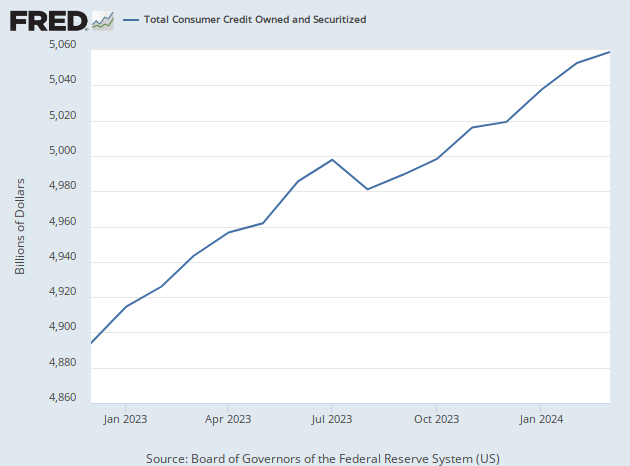

Americans largely stopped piling debt onto household balance sheets in December, data from the Federal Reserve showed Wednesday.

Total consumer credit inched up just $1.5 billion in December, on a seasonally adjusted basis.

Economists had expected ten times as much growth in consumer debt.

In November, consumer credit climbed by $23.4 billion.

That’s the lowest increase since last August, when consumer credit levels actually declined. But that decrease was driven by the Biden administration’s student loan forgiveness plans that courts declared illegal. If not the the student loan scheme, consumer credit would have risen in August as credit card debt jumped the most since the prior November.

Revolving credit, which is mostly credit cards, inched up at a seasonally adjusted one percent rate of growth in December. A month earlier, it registered a 16.6 percent rate of growth.

Before seasonal adjustment, revolving credit rose by $16.2 billion, down from the $39.8 billion month-to-month increase in November.

Nonrevolving credit, mostly auto loans and student loans, climbed just 0.2 percent after rising 1.8 percent a month earlier.

The Fed’s consumer debt figures do not include mortgages.

COMMENTS

Please let us know if you're having issues with commenting.