“Please God, just one more bubble” was a popular bumper sticker in the San Francisco Bay area’s fabled Silicon Valley after the late 1990s “Dot Com” bubble burst.

For the last five years, U.S. stocks have relentlessly climbed by 210% from their March 2009 lows. Cynics have just as relentlessly warned that a new tech bubble meant speculator Armageddon was dead ahead. But every time it seems like tech valuations cannot go higher, a deal like Snapchat comes along and defies all the cynics’ logic.

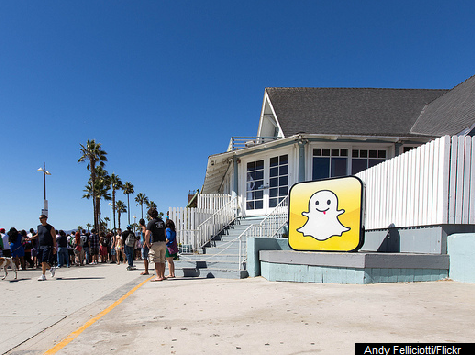

Snapchat was started in 2011 by Evan Spiegel, 23, and Bobby Murphy, 25, two former Stanford fraternity brothers. It lets users send photo and video messages that disappear after they are viewed. Snapchat quickly gained an underground reputation as an easy way for teens to send sexually suggestive photos, but it also picked up steam as a fun and easy way to trade photo messages.

In May 2013, Snapchat turned down a $3 billion deal from Facebook and an even bigger deal from Google. The offer came only a few months after Benchmark Ventures led a $13.5 million group of investors that purchased a third of the company. Despite an investment return for the VC firm of 40 times their money in less than six months, they unanimously turned down both offers.

Josh Green, a venture capitalist who is Chairman of the National Venture Capital Association, told the New York Times last year, “All business activity is driven by either fear or greed, and in Silicon Valley we’re in a cycle where greed may be on the rise.”

“Man, it feels more and more like 1999 every day,” tweeted Bill Gurley, one of the leading tech venture capitalists. “Risk is being discounted tremendously.”

The Times cynically warned, “Although several startups found even greater success by passing up a billion dollars or more, including Facebook and Twitter, Silicon Valley is littered with many more entrepreneurs whose big dreams went unfulfilled.”

But Julie A. Ask, an analyst at Forrester Research, was less pessimistic, “I think this is classic bird-in-hand versus bird-in-bush. Snapchat must believe the bird-in-bush is bigger.” A year later, it looks like Ask was right.

The photo-messaging service just unleashed an update on May 1st that went viral with its young users and disrupted high school classrooms all across the United States. The latest tweak of the app included a much-anticipated“chat” feature that allows text or video chat with their friends and then automatically self-destructs once the chat is complete.

According to the New York Post, the Snapchat release turned out to be every school teacher’s worst nightmare. “In 16 years of teaching, I can’t think of anything that has ever disrupted my classroom more than today’s @snapchat update,” tweeted Tracie Schroeder, a teacher at Council Grove High School in Kansas. Schroeder, who likened the addictive app to “crack,” said she had to take away her students’ phones.

“I have no idea what all was included in the update, but you would have thought it was crack,” she said in an interview with Silicon Alley Insider, a tech blog. “They seriously could not keep away from it. I even had one girl crawl under the table with her phone.”

According to critics, what seems to generate such appeal among teens is that the service is mostly used for “sexting.” The activity is so wildily distracting to teens, that former Mayor Michael Bloomberg banned cellphone use in New York City schools.

Snapchat is a now a much bigger “bird-in-the-hand” for its two twenty-something founders, who are undoubtedly more fabulously rich than they might have been just a year ago. Wall Street whispers say the firm’s “user momentum” with the key teen demographic makes it worth at least $20 billion to a strategic buyer like Twitter, Facebook or Google.

The market values for new tech companies probably are in bubble territory more than they were last year. But Snapchat proves that bubbles can get alot bigger before they pop.

The author welcomes feedback and will respond to comments by readers.

COMMENTS

Please let us know if you're having issues with commenting.