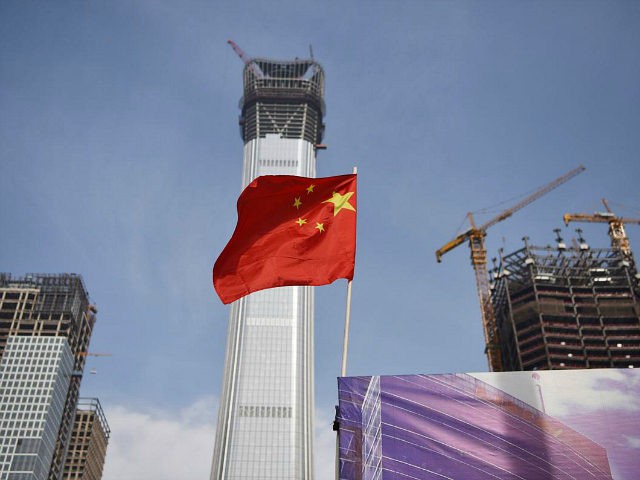

The Chinese economy continues to show signs of cooling as the trade war between the nation and the United States heats up.

According to the Wall Street Journal, China’s spending on factory machinery, public-works projects and other fixed-asset investments in the country’s non-rural areas grew 5.5 percent in the January-July period — a figure that matched a record low in 1999. For comparison, in the first seven months of 2017, China saw a spending growth of 8.3 percent.

“Investment, a key growth engine for China, contributed more than a third of China’s economic growth rate last year,” the Journal reported.

In addition to their spending decrease, unemployment reportedly went up to 5.1 percent last month, from 4.8 percent in June.

The United States recently imposed 25-percent tariffs on $34 billion of Chinese imports in the trade war that has been launched between the two countries. On August 23, that figure will nearly double to be imposed on $50 billion of goods.

In response to this, China has countered with tariffs on U.S. goods, specifically, subjecting 25-percent tariffs on $16 billion of American imports.

However, not everyone sees this as a smart move.

“China should avoid adopting a direct, confrontational approach in the trade fight with the U.S. and focus on strengthening its economy first,” Shuang Ding, an economist with Standard Chartered Bank in Hong Kong, told the Wall Street Journal.

China may, in fact, be fearful of engaging in a full-scale economic war with the United States.

As part of China’s 25-percent retaliatory tariff on the United States, Beijing quickly removed one essential item: oil.

U.S. oil imports to China are worth $8 billion.

“Analysts wonder if this conspicuous omission is a sign China is blinking in its economic staredown against the Trump administration,” Breitbart’s John Hayward wrote.

In June, the Wall Street Journal noted that oil was prominently listed as a target for retaliatory tariffs in June at a time when Beijing was trying to intimidate President Donald Trump out of taking punitive measures against Chinese imports.

However, removing them could be seen as “a massive revision to China’s retaliatory action, tantamount to stubbing someone’s toe after threatening to punch him in the nose” or as others might put it, a dog with “bark but no bite.”

Adelle Nazarian is a politics and national security reporter for Breitbart News. Follow her on Facebook and Twitter.

COMMENTS

Please let us know if you're having issues with commenting.