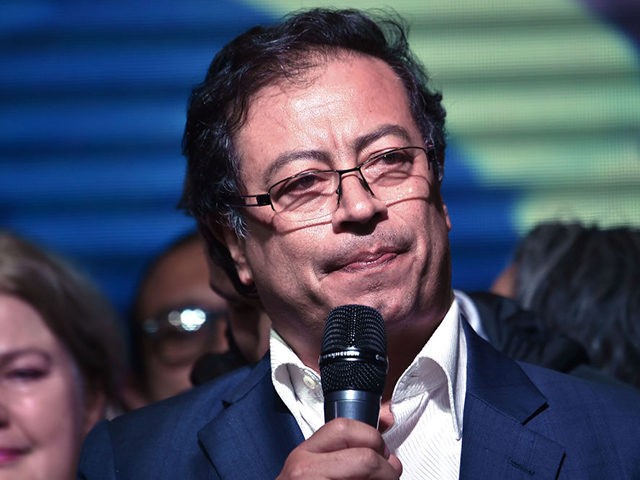

The ambitious tax reform spearheaded by Colombia’s far-left president Gustavo Petro was finally approved by both chambers of Colombia’s Congress on Thursday. The tax plan, introduced by Petro a day after he took office in August, hopes to collect upwards of 20 billion Colombian Pesos ($4 billion) from 2023 onwards.

One of the industries most affected by the upcoming tax reform is Colombia’s oil and coal industries, both of which the far-left president vehemently campaigned against with ‘green’ policies that seek to transition the South American nation away from fossil fuels.

Historically, Colombia has been the South American country with the least amount of taxes. The new reform, considered by far to be the most significant in more than three decades, makes the nation’s coal and oil industries responsible for 9 out of the 20 billion Colombian pesos that the far-left government hopes to receive.

The changes introduce the non-deductibility of royalties in the income tax paid by hydrocarbon and mining companies, with additional surcharges that can be imposed on carbon and oil extraction. The surcharges, which will depend on fluctuations on international market prices, range from 5 to 10 percent for coal, and from 5 to 15 percent for oil. In the case of oil, the total tariffs can reach of up to 50 percent if international oil prices go above 60 percent of its 10-year average.

The upcoming tax reform has also caused uncertainty in the future of the country and it’s currency, the Colombian peso, which lost 20 percent of its value between August 7 and November 7, reaching historical lows of more than $5,000 Colombian pesos per U.S. dollar. Colombia’s inter-annual inflation reached 12.22 percent in October, the highest recorded percentage in the century.

In an interview given to the Wall Street Journal on Friday, Colombian Finance Minister José Antonio Ocampo defended the reform. “There is no reason to fear for Colombia’s macroeconomic stability,” Ocampo said, “the private sector is responsible for the panic and needs to stop sending negative signals.”

The WSJ report also quoted Ricardo Triana, director of Colombia’s Council of American Companies, who said that the tax changes could open Colombia to lawsuits from U.S. firms that could see the new changes as “a breach of contract and violation of the free-trade agreements” signed between the two countries.

The Colombian Association of Petroleum Engineers also reacted to the upcoming changes.

“We express great concern and signs of alarm for the country and its inhabitants due to the tax reform approved in the Congress of the Republic, given that it makes the hydrocarbon industry responsible for contributing almost $9 billion, of the $20 billion that the National Government expects to collect, a clear sign of asymmetry and fiscal inequity with a sector that today is one of the main generators of current income, exports and direct foreign investment in our nation,” the association said.

The tax reform also imposes new sweeping changes to Colombian citizens, who will have to pay new income taxes and new taxes imposed to food and services.

Colombians who earn more than 10 million Colombian Pesos (roughly $2,000) per month will see an increase in their income taxes. An increase on the ‘occasional income’ taxes — which housing related transactions fall into — from 10 to 15 percent will heavily affect the housing market in Colombia, making it harder to sell and more expensive to buy properties.

The Petro plan also introduces ‘healthy taxes’ on groceries such as sugary drinks, sausages, hamburger meat, and chocolates, as well as in other product that the Colombian government has deemed that “help promote diseases and deterioration in the health of Colombians,” such as instant coffee, sauces, sweet cookies, nuts, peanuts, sugary drinks, and marshmallows.

Big-bottomed ants, a traditional food from Colombia’s Santander department (i.e. state), were also included in the taxes as “ultra processed” foods. While bread was not taxed, other pastry and bakery products will now incur taxes, raising costs to Colombian consumers.

Churches and elderly pensions, which were going to be taxed under the reform’s original draft, were left exempt from the approved version. Online digital platforms such as online music or television streaming services, or study-related digital platforms, will be subject to new taxes under the upcoming code.

Petro’s government seeks to use the increased tax revenue on social spending programs. Both chambers of Colombia’s congress are expected to conciliate the approved reform on Tuesday for its corresponding signing by president Gustavo Petro at some point later.

COMMENTS

Please let us know if you're having issues with commenting.