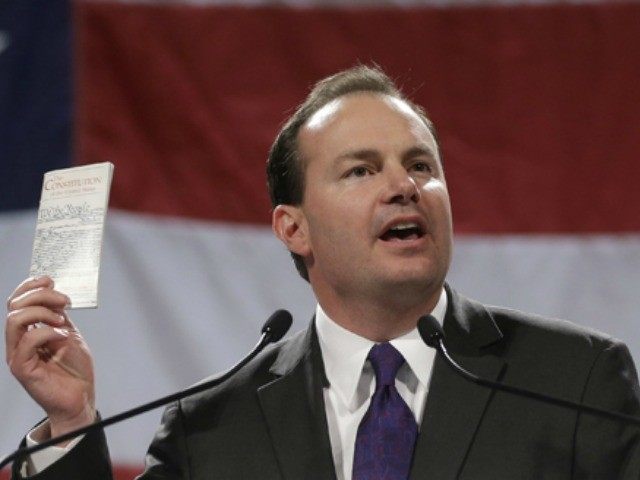

Conservative champion Sen. Mike Lee (R-UT) explains that abolishing the entire Internal Revenue Service in favor of a flat tax might not be the best idea for Middle Class taxpayers and their families.

“As I’ve looked at it, as I’ve examined it, I can’t find an effective way to move us to a single rate system that protects America’s Middle Class, that doesn’t involve raising taxes on a whole bunch of middle class Americans,” Lee said in response to a question from Breitbart News during a tax forum at the Heritage Foundation.

Lee and his conservative colleague Sen. Marco Rubio (R-FL) held a tax day event today at the non-profit policy center highlighting their joint reform proposals to simplify the tax code in America.

Lee’s friend in the Senate, Sen. Ted Cruz, who is now running for president, repeatedly campaigns on the idea that Americans should “abolish the IRS” in favor of a flat tax.

The Utah senator says he loves the idea of abolishing the IRS, and he reminded the audience that the entire United States tax code, if printed out, would stand about 12 feet high.

“I love the idea, the simplicity, that would go along with the single rate taxation system,” he said, acknowledging that if the United States was “starting from scratch,” perhaps a completely flat tax system could have been implemented.

But Lee explained that, as reformers, it was important for conservatives to start reforming the current system instead of trying to enact a system that “might have been.”

Lee’s plan, drafted with presidential contender Marco Rubio, would increase the child tax credit and a maintain the mortgage interest deduction as well as have different taxation rates for different income levels. A system like that would still require the existence of the IRS to enforce the simplified tax proposal.

Cruz’s call to “abolish the IRS” is based on the idea that a simple flat tax would effectively end the agency’s power over Americans. In subsequent conversations with the media, Cruz’s political team has admitted that some department must remain to enforce the tax code, but that the “IRS as we know it would be gone.”

Rubio agreed that the IRS had too much power over Americans which was directly a result of the complexity of the current tax code.

“The more complexity we build in the tax code, the more power we give government to collect taxes, or administer laws, the more powerful all bureaucratic agencies become, especially the Internal Revenue Service,” he said.

A simpler tax code, Rubio argued, would help “reduce the size and the scope” of the IRS, effectively reducing the power of the agency on every day citizens.

COMMENTS

Please let us know if you're having issues with commenting.