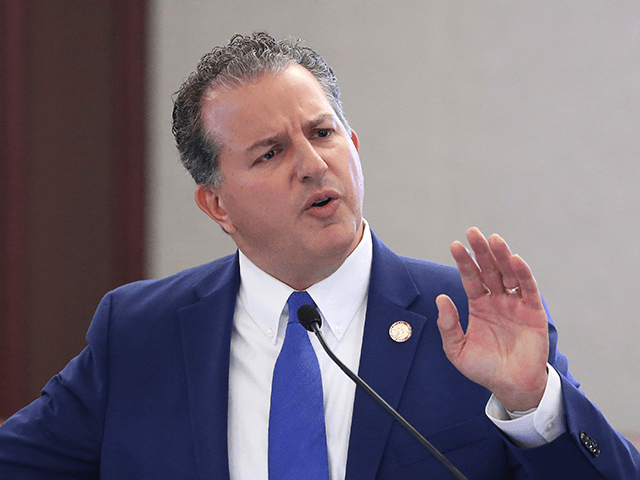

Jimmy Patronis, the chief financial officer for the state of Florida, warned on Monday about an under-the-radar report issued by the Federal Trade Commission earlier this year that reveals a staggering 70-percent increase in consumer fraud in 2021 compared to 2020.

“Last year, Florida ranked fifth in fraud reports nationwide, costing Floridians an estimated $331.3 million. Every day, fraudsters are looking for new and creative ways to steal your money and identity,” Patronis said in a statement issued from his office.

“Many scams can be prevented by doing your research, navigating to only reputable websites, and refusing to share your personal information,” Patronis said.

The FTC report says, in part:

Newly released Federal Trade Commission data shows that consumers reported losing more than $5.8 billion to fraud in 2021, an increase of more than 70 percent over the previous year.

The FTC received fraud reports from more than 2.8 million consumers last year, with the most commonly reported category once again being imposter scams, followed by online shopping scams. Prizes, sweepstakes, and lotteries; internet services; and business and job opportunities rounded out the top five fraud categories.

Of the losses reported by consumers, more than $2.3 billion of losses reported last year were due to imposter scams—up from $1.2 billion in 2020, while online shopping accounted for about $392 million in reported losses from consumers—up from $246 million in 2020.

Patronis’ office provided tips from Consumer Reports for avoiding frauds:

• Trust Your Gut: Scammers often urge you to act immediately. If you take some time to think about the message or offer you’ve gotten before acting on it, you may be able to sidestep a scam.

• Don’t Respond: Ignore calls, texts, and email if you’re unsure about who the sender or caller is. It’s better, for instance, to simply let an unexpected phone call go to voicemail. Also, if you generally rely on caller ID, be aware that it can be falsified. And never give your personal or financial info to anyone who contacts you out of the blue. If you think that a message might have merit, get in touch with the organization yourself in a way you’re sure is legitimate.’

• Check Before You Click: Don’t click on links in email and texts if you have any uncertainty; some may put your device’s security in jeopardy. Hovering your mouse over a link in an email will reveal the entire URL, which may help you determine if it’s fraudulent. Case in point: An “.ru” at the end of a URL means the link you thought was to a local retailer was created in Russia.

• Pay Wisely: With peer-to-peer payment methods like Cash App, Venmo, and Zelle, for instance, it’s best to use them only with people you know, says Bill Kresse, a fraud expert. Also, don’t send money to anyone who sends you an unsolicited check, even if the funds appear in your account, says Steven Baker, an international investigations specialist for the Better Business Bureau. It may take weeks for a bank to realize a check is fake—which may put you in a dicey position.

Follow Penny Starr on Twitter

COMMENTS

Please let us know if you're having issues with commenting.