Hunter Biden agreed to plead guilty last week to two misdemeanor counts of failing to pay taxes on time, but according to the second whistleblower whose testimony was also released last week by the House Ways and Means Committee, he also willfully evaded paying millions in taxes in an elaborate tax scheme.

According to the second whistleblower — the lead IRS case agent for the Hunter Biden investigation whose name is redacted — Hunter Biden set up a scheme involving a Ukrainian natural gas company he sat on the board of and a Chinese business associate to willfully evade paying taxes.

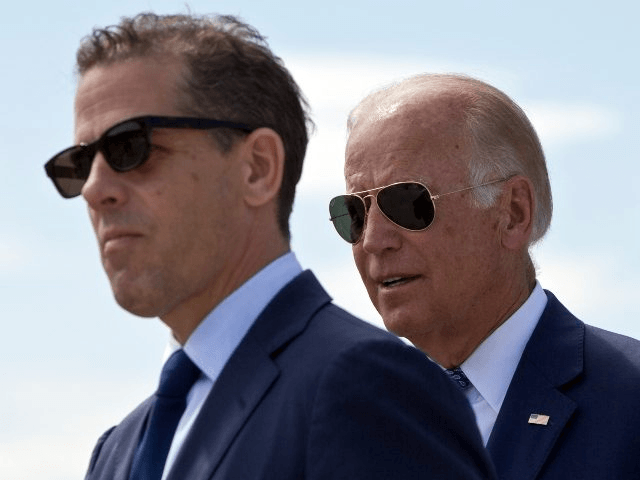

Hunter Biden during the White House Easter Egg Roll on the South Lawn on April 18, 2022. (Demetrius Freeman/The Washington Post via Getty Images)

The whistleblower said Hunter Biden had already owed hundreds of thousands of dollars in taxes long before his father became vice president. In 2014, when the Joe Biden was in his second term as vice president in charge of Ukraine policy and when Ukrainian natural gas company, Burisma, put Hunter on its board of directors, Burisma paid Biden $666,667 to do little or no work.

According to the whistleblower, Hunter Biden received the money from Burisma, and instead of reporting it as income and paying taxes on it, he put that money into a Chinese firm run by one of Hunter Biden’s associates, who then “loaned” the money to Hunter Biden.

RELATED VIDEO — White House Press Corps WRECKS Karine Jean-Pierre for Refusal to Address Hunter Biden Bombshell:

The whistleblower testified:

So [Hunter Biden] sets this out in this email and what ends up happening is — so imagine this. If you are an owner of a company and your friend tells you that, I want to pay my wages to your company and you’re going to loan the money back to me, that’s essentially what happened here. He took loans from that corporation — which were distributions. And he didn’t pay taxes on those loans.

…

So essentially for 2014, we had found that Hunter didn’t report any of the money he earned from Burisma. So the reason why this is important is because Hunter set it up this way, to not — to essentially earn the money through his friend’s corporation and then have his friend pay him back half of the money as loans, quote, unquote, loans. …

The whistleblower continued, “None of it was taxed. … So none of this has been paid or prosecuted. And I would also like to note that the statute has run out on these tax years or on the 2014 tax year.”

The whistleblower said the Justice Department believed Biden’s defense that the money was a loan.

“You can’t loan yourself your own money. It just doesn’t make any sense,” the whistleblower said.

When asked if the transactions seemed to be a “sham,” the whistleblower answered, “So, yes, I would agree that the transactions would — you would want to sham the transactions, yes.”

So how did Hunter Biden's Burisma tax evasion scheme actually work? IRS whistleblower explains: Ukrainians gave Hunter money. Hunter then gave it to Chinese company. Chinese company then 'loaned' the money to Hunter. Bingo! No income to tax! https://t.co/ExFmXqTwIn pic.twitter.com/cgW1wTcNC4

— Byron York (@ByronYork) June 26, 2023

As the Washington Examiner’s Byron York noted, Biden’s income in 2014 was not part of the misdemeanor charges against him, and the statute of limitations was allowed to expire.

The whistleblower also noted that Hunter Biden’s friend, a wealthy Hollywood celebrity lawyer named Kevin Morris, had paid off the $2.2 million that Hunter Biden owed the IRS for years 2014 through 2019.

The whistleblower said on Hunter Biden’s 2020 tax returns he included a note that he had received financial support from Morris of $1.4 million, which both agreed to treat as a loan with 5% interest to be paid between 2025 and 2027.

“The taxpayer is treating this amount as a loan for tax purposes. The balance of the financial support is treated as a gift. No amount of the support is treated as a reported taxable event on this return,” the note said.

RELATED VIDEO — Biden: Hunter Has “Done Nothing Wrong” and His Situation Impacts My Presidency “By Making Me Feel Proud of Him”:

Morris would give Hunter Biden approximately $800,000 more, totaling $2.2 million to pay off the taxes he owed.

When asked if that transaction had been investigated, the whistleblower said he did not know since he and the other whistleblower, Gary Shapely, were removed from the investigation by then.

York wrote:

And now the matter has been resolved with two misdemeanor charges. The conclusion is deeply frustrating to IRS agents like [whistleblower #2]. Hunter Biden failed to file returns, failed to pay his taxes for several years, and falsely claimed deductions. … The agents’ conclusion is that just because Hunter Biden’s new friend bailed him out — no repayments required until 2025 — does not mean Hunter Biden did not violate the tax laws repeatedly in the 2010s.

“At the end of WB2’s deposition, a Republican lawyer asked this question: ‘If someone meets all the elements for a crime of willful evasion and are found to, in conjunction with that, owe a liability, and they pay off that liability years later when they’ve been caught, has a crime been committed?’ WB2 answered simply: ‘Yes.'” York concluded.

Follow Breitbart News’s Kristina Wong on Twitter, Truth Social, or on Facebook.

COMMENTS

Please let us know if you're having issues with commenting.