Exclusive: Sen. J.D. Vance Seeks to Block Sale of Iconic American Gun Brands to Czech Conglomerate

Sen. J.D. Vance (R-OH) spoke exclusively with Breitbart News Wednesday about his push to block the sale of Remington to a Czech conglomerate.

Sen. J.D. Vance (R-OH) spoke exclusively with Breitbart News Wednesday about his push to block the sale of Remington to a Czech conglomerate.

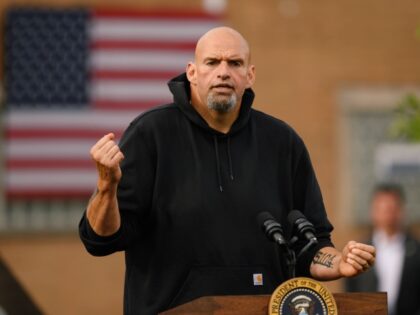

Sen. John Fetterman (D-PA) is leading Senators in demanding Biden’s administration save U.S. Steel from being bought by a foreign company.

Donald Trump Jr. on Tuesday called for anti-China regulations for all social platforms to ensure that Americans’ private data does not end up in the hands of the Chinese government.

Hunter Biden’s Chinese investment firm assisted China’s acquisition of “strategically sensitive assets” in the United States, according to a New York Post op-ed by the Government Accountability Institute’s Peter Schweizer and Jacob McLeod.

Foreign states — including China, Russia, and Saudi Arabia — procure U.S. intellectual property via venture capital, explained Jim Phillips.

Beijing Kunlun Tech Co Ltd, the Chinese company that owns popular gay dating app Grindr, is reportedly looking to sell the app based on the U.S. government calling it a “national security risk.”

President Donald Trump is set to announce tariffs and investment restrictions aimed at convincing China to halt practices the U.S. believes are a form of economic aggression, according to White House officials.

President Trump will clearly name China as a “strategic competitor” in the forthcoming National Security Strategy to be unveiled Monday, according to senior administration officials, who previewed the document in a call with reporters.

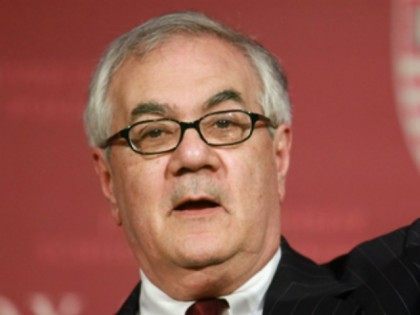

Retired Congressman Barney Frank (D-MA) tells Breitbart News in an exclusive interview that while he served as chairman of the House Financial Services Committee, Congress exercised no oversight over the activities of the Committee on Foreign Investment in the United States (CFIUS). The portrait of Frank that emerges from the exclusive Breitbart interview is of someone totally disinterested in exercising Congressional oversight responsibilities over any CFIUS approved transactions.

House Financial Services Committee Chairman Jeb Hensarling (R-TX) has sent a letter to Secretary of Treasury Jack Lew asking for answers on the 2010 approval by the Committee on Foreign Investments in the United States (CFIUS) of a controversial deal in which the Russian government gained control of 20 percent of America’s uranium deposits.

Rather than convincing a skeptical public that he did not benefit from the ARMZ-Uranium One “deal at the same time that [he was] writing checks to the Clinton Foundation,” a recent statement from the CEO and majority owner of U.S. Global Investors serves only to heighten interest in further disclosures about the company’s transactions.

In a political debacle of her own creation, Clinton now finds herself in a position where, in order to prove that she was not beholden to Uranium One executives for donations made to the Clinton Foundation prior to the CFIUS approval of the sale of their business to a company owned by the Russian government, she is now beholden to the authoritarian leader of that same Russian government.

The speedy approval of the ARMZ-Uranium One transaction (CFIUS Case No. 10-40) raises the possibility that the deal may have received expedited treatment, though the management of Canadian based Uranium One stated in a Management Information Circular/Notice to Shareholders published August 6, 2010 and dated August 3, 2010 that “Uranium One and ARMZ intend to submit a joint voluntary notice with CFIUS during the first week of August 2010.”