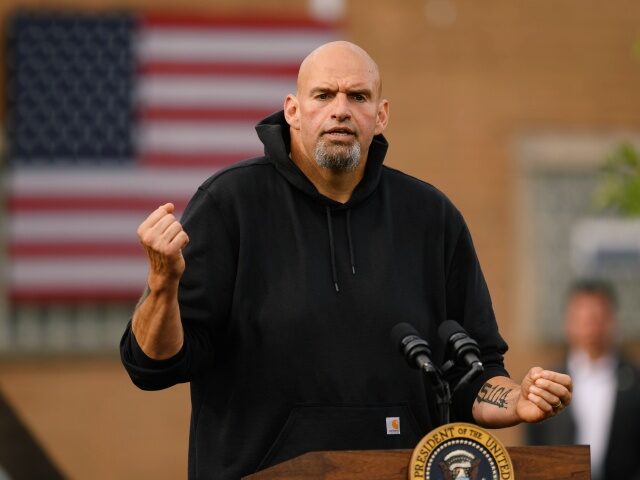

Sen. John Fetterman (D-PA) is leading Senators in demanding President Joe Biden’s administration save the United States Steel Corporation from being bought by a foreign company.

As Breitbart News reported, executives with U.S. Steel and Nippon Steel Corporation announced the nearly $15 billion deal, which would have the iconic American steel giant sold off to the Japanese company.

The deal is significant as U.S. Steel, based in Pittsburgh, Pennsylvania, played a critical role in the nation’s “Arsenal of Democracy” during World War II, which ultimately saw the Allied powers defeat the Axis powers, which included Imperial Japan.

Fetterman, in response, has written to Biden’s Treasury Secretary Janet Yellen who chairs the Committee on Foreign Investment in the United States (CFIUS). Fetterman, alongside Sen. Bob Casey (D-PA) and Rep. Chris Deluzio (D-PA), urges Yellen to block the deal.

“This proposed acquisition of U.S. Steel … would make a foreign-owned company a central part of the American steel industry, as well as a major employer,” they write.

The letter continues:

As you review this acquisition, we urge you to consider the national security implications of selling a company manufacturing some of our most important industries, including defense, power, and infrastructure, to a foreign company. CFIUS should block the acquisition of U.S. Steel by a foreign company, especially since there were bids made by American companies that would not trigger our expressed security concerns. [Emphasis added]

…

Steel is essential to our national security, and we believe that the United States’ marquee steel company should remain under American ownership. In fact, Section 232 tariffs on steel and aluminum were imposed following an investigation by the U.S. Department of Commerce on national security grounds and have been maintained by the Biden Administration. We question whether a foreign company that has been found to be dumping steel into the U.S. market at prices below fair market value is the best buyer for U.S. Steel. Of further concern, Nippon Steel has facilities in the People’s Republic of China, a foreign adversary of the U.S. [Emphasis added]

U.S. Steel cited this deal’s enormous value for their shareholders in their announcement. While the deal is certainly good for them, they are not the only stakeholders with an interest in this company. Thousands of United Steelworkers rely on this company for their livelihoods and transferred their collectively-negotiated right of first refusal over a sale to another U.S.-based, unionized company. Now their fate hangs in the balance. It is incumbent upon CFIUS to take a wider view of the stakeholders with an interest in this sale beyond just shareholders in U.S. Steel. Steel is a foundational part of the U.S. economy. Furthermore, it is a key input in our Nation’s infrastructure, electrical grid, buildings, and transportation. The U.S. steel market stands to be a major participant in the once-in-a-generation investments made by Congress in infrastructure and clean energy. Investments in bridges and new energy technology will use American steel thanks to provisions we fought for in Congress and that the Biden Administration has delivered on. [Emphasis added]

Sens. J.D. Vance (R-OH), Josh Hawley (R-MO), and Marco Rubio (R-FL) have written a similar letter to Yellen, asking her to have the deal blocked due to national security risks as well as economic concerns.

In a video message, Fetterman said he would work to block U.S. Steel’s acquisition by Nippon, saying “it’s absolutely outrageous that they have sold themselves to a foreign nation.”

The acquisition of @U_S_Steel by a foreign company is wrong for workers and wrong for Pennsylvania. I’m gonna do everything I can to block it. pic.twitter.com/9EqohwRhRJ

— Senator John Fetterman (@SenFettermanPA) December 18, 2023

The United Steelworkers (USW) is also putting pressure on Biden to block the acquisition, issuing a statement condemning the sale of U.S. Steel to Nippon as “the same greedy, shortsighted attitude that has guided U.S. Steel for far too long.”

“We remained open throughout this process to working with U.S. Steel to keep this iconic American company domestically owned and operated, but instead it chose to push aside the concerns of its dedicated workforce and sell to a foreign-owned company,” USW President David McCall said.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

COMMENTS

Please let us know if you're having issues with commenting.