Breitbart Business Digest: The Economy Refuses to Play Nice with the Fed

The Fed is stuck between crosscurrents: too strong to ease, too shaky to hike. The best they can do is what they’ve been doing—waiting for the fog to lift.

The Fed is stuck between crosscurrents: too strong to ease, too shaky to hike. The best they can do is what they’ve been doing—waiting for the fog to lift.

Federal Reserve officials this week came as close as they are probably ever going to get to admitting that the aggressive interest rate reduction they enacted weeks before the 2024 election was a mistake.

Donald Trump on Wednesday threw a monkey-wrench into the plans of Democrats to claim he wants to cut Social Security when he proposed ending federal taxes on the benefits of retirees.

Will Fed officials stick by their forecast of a single rate cut this year or capitulate to financial markets that are pricing in multiple cuts this year?

The Fed has finally come around to the idea that interest rates are very likely to be higher for as far as the eye can see.

All eyes will be on the dots tomorrow when the Federal Reserve releases its quarterly economic forecasts known as the Summary of Economic Projections, or SEP.

Jerome Powell’s No Cut Thunderbolt Groucho Marx famously said he would not join any club that would have him. What happens, however, when the club joins you? We have been arguing since early December that economic growth was too strong

Wall Street has not let go of its conviction that the Federal Reserve will cut interest rates next year.

The Federal Reserve is planning on staying “patient” at this week’s meeting of the Federal Open Market Committee.

The announcement of the Federal Reserve’s interest rate target is likely to be the least interesting thing coming out of this week’s Fed meeting.

Now we know why Federal Reserve officials at the March meeting yanked down their expectations for economic growth for this year and next: the economics staff of the central bank warned that a recession is on the way.

Jerome Powell fumbled his first press conference of the year.

The staff of the Federal Reserve board believe the potential output of the U.S. economy is even lower than thought.

Fed officials have a very wide range of projections for Fed policy two years from now.

The facts are changing again. Can the Federal Reserve’s monetary policy keep up?

What if the problem is not just the nonexistence of a “free lunch” but a shortage of lunches altogether?

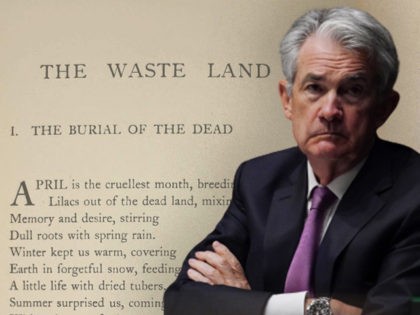

For the stock market, April has indeed been the cruelest month in part because it has seen a blossoming awareness that inflation is not going to die of exhaustion after hitting 40-year highs.

The Federal Open Market Committee’s March meeting minutes indicate that the Federal Reserve still believes it can bring down inflation painlessly.

The wave of euphoria that washed over the stock market on Wednesday following the long-awaited rate hike should probably be taken as a warning sign.