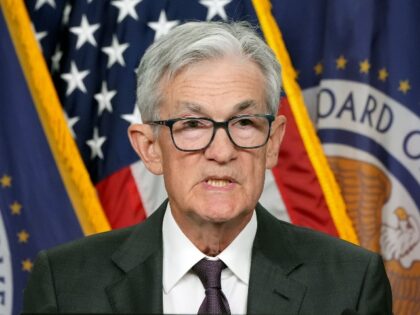

Watch Live: Federal Reserve Chairman Jerome Powell Testifies Before Congress

Federal Reserve Chairman Jerome Powell testifies before the Senate Banking, Housing, and Urban Development Committee on Tuesday, February 11.

Federal Reserve Chairman Jerome Powell testifies before the Senate Banking, Housing, and Urban Development Committee on Tuesday, February 11.

Jerome Powell did a fine job at his press conference Wednesday of staying out of the way of politics despite being peppered with questions from reporters practically begging him to weigh in against President Donald Trump’s policies.

Federal Reserve officials left interest rates unchanged in their first policy decision of 2025. “Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months,

President Donald Trump’s signature bravado was on full display at the World Economic Forum in Davos this week as he vowed to “demand” lower interest rates from the Federal Reserve.

A resilient labor market, the improving outlook among small businesses, and persistent inflation pressures are signals that the Fed’s September and October rate cuts may have been premature.

The Federal Reserve’s rate-cutting cycle has very likely come to an end—although it may take Fed officials several months to figure this out.

It is not just the bond market that is having doubts about the stance of monetary policy. Federal Reserve officials are also seeing the light.

The great clash between Donald Trump and the Federal Reserve may not happen after all.

Federal Reserve officials this week came as close as they are probably ever going to get to admitting that the aggressive interest rate reduction they enacted weeks before the 2024 election was a mistake.

The Fed seems bent on cutting rates again this month. Trump’s economic team is worried this could revive inflation.

The Federal Reserve is about to triple down on its September rate cut mistake by reducing its benchmark for a third consecutive time next week.

On Tuesday’s broadcast of CNN’s “OutFront,” Chicago Federal Reserve Bank President Austan Goolsbee stated that the Federal Reserve isn’t going to weigh in on tariffs, but “you’re never going to hear me say good things about tariffs. If they serve

Federal Reserve officials appear poised to repeat the mistake of September and November by cutting interest rates again when the economic data clearly calls for a pause.

The acceleration of inflation since the Federal Reserve cut interest rates in September suggests that the move was a mistake.

A question we get asked a lot about is how the Federal Reserve is likely to react to President-elect Donald Trump’s tariffs. The short answer is that the Fed is likely to ignore them.

The Fed is in a rate cut cycle as Trump is coming to the White House—just as he would prefer.

Donald Trump is not going to try to remove Jerome Powell as the head of the Federal Reserve or control monetary policy from the White House.

Michael Barr has accused Trump of damaging the banking system. Does it make sense for him to stay on as the Fed’s top bank regulator in a new Trump administration?

Breitbart News economics editor John Carney said Friday on Fox Business Network’s “Kudlow” that President-elect Donald Trump will have the power to remove Federal Reserve Chairman Jay Powell once in office.

The Fed now seems a bit less confident about inflation returning to its two percent target.

During CBS’s coverage of Tuesday’s election, CBS “Face the Nation” host and CBS Chief Foreign Affairs Correspondent Margaret Brennan said the president “has nothing to do” with grocery prices and voters who “don’t quite know” what the head of the Federal

The latest economic data suggests that the Federal Reserve should halt any further rate cuts.

The Fed’s cut is being reversed in the mortgage market.

Breitbart News economics editor John Carney said Thursday on Fox Business Network’s “Kudlow” that the politicization of the Federal Reserve is cemented in its decision to cut interest rates so close to an election.

After the Fed’s surprise 50-basis-point cut in September, the burning question now is whether the central bank overplayed its hand.

The Federal Reserve’s 50-basis-point rate cut in September wasn’t just premature—it was driven by political pressures.

During an interview with CNBC on Thursday, Treasury Secretary Janet Yellen responded to a question on if she thinks the Federal Reserve has rates that are too high by stating that the Fed’s members expect rates to be cut and

Fed officials now think it will take a higher rate to sustainably achieve two percent inflation.

We have discovered something that the supporters of Kamala Harris and Donald Trump agree on: the Federal Reserve’s half-point interest rate cut this week was a political gift to Harris.

Contrary to the president’s claim, Biden appointed Powell to lead the Fed for a second term in 2021 and has met with the chair multiple times.

The Federal Reserve’s decision on Wednesday to begin lowering interest rates raises the question of how fast rates should be expected to decline.

On Wednesday’s broadcast of CNN International’s “First Move,” CNN Business Editor-at-Large, International Business Correspondent, and host Richard Quest stated that 2024 Republican presidential candidate former President Donald Trump has a point that the Federal Reserve is “either playing politics or you’ve

On Wednesday’s broadcast of the Fox Business Network’s “Kudlow,” Breitbart News economics editor John Carney stated that the Federal Reserve should have waited until after the election to make rate cuts and that by announcing a cut of 50 basis points

Fed policy is not formally on the ballot in November, but interest rates over the next four years may turn on the results of the election.

Fed officials now see more unemployment and less inflation this year and next year.

As the Fed prepares to cut rates again, it’s worth remembering that rate cuts are never free, even when they seem like an easy fix. For the market, it’s always fun while it lasts, but the reckoning is rarely far behind.

If the Biden-Harris administration’s policies are not hurting the economy, why are prominent Democrats urging the Federal Reserve to announce a super-sized interest rate cut?

Someone call in the vice principal for student discipline! The market is bullying the Federal Reserve again.

The federal funds futures market is pricing in a cut in each of the remaining three meetings of the Federal Open Market Committee this year.

Cutting rates too quickly could lead to a resurgence of inflation, forcing the Fed into a tighter monetary policy stance down the road.