President Trump: Tariffs Will Lead to Income Tax Relief, Even Elimination

President Donald Trump said Sunday that his tariff policy will substantially reduce, even “completely eliminate,” income taxes for some American workers.

President Donald Trump said Sunday that his tariff policy will substantially reduce, even “completely eliminate,” income taxes for some American workers.

During a town hall on CNN on Thursday, 2024 Republican presidential candidate Florida Gov. Ron DeSantis stated that he wants to eliminate the IRS and a flat income tax rate “would be the ideal tax system to be able to

Spending promises Maine Gov. Janet Mills (D) made during her State of the State address Thursday night were met with swift backlash from state Republicans, who said Mills’ “federally-funded fantasyland” was not the answer to high inflation and unemployment rates.

The U.S. Treasury is reporting a record amount of taxes collected in the first two months of fiscal 2022 — $565,135,000,000.

Hungarian Prime Minister Viktor Orbán’s government has pledged to refund families their income taxes in 2022, around €1.7 billion (£1.45 billion/$2 billion).

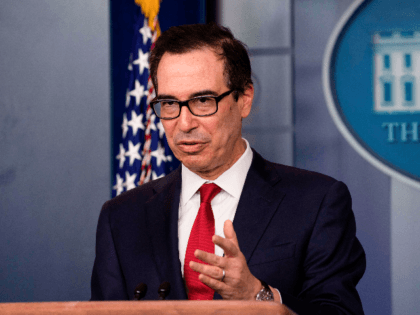

Treasury Secretary Steven Mnuchin announced that Americans can delay payments owed to the IRS without penalties for 90 days.

According to the financial website WalletHub, some cities across America are better places than others for veterans to settle down.

The sports world received a significant jolt on Tuesday, when the NCAA announced that they had taken the unprecedented step of allowing college athletes to profit off their name, image, and likeness.

A report from the Employment Orientation Council has claimed that as many as 2.5 million French work under the table, nearly five percent of the workforce over the age of 18.

Leading pro-Brexit Tory MP Jacob Rees-Mogg has slammed Theresa May’s government for seemingly breaking an election promise and moving towards tax hikes to fund the UK’s socialised healthcare system.

President Donald Trump’s new tax cut, which limiting state and local tax deductions, will cost rich Californians $12 billion more in federal taxes, with $9 billion coming from those making $1 million or more.