Breitbart Business Digest: Why Miran Says Exporters Pay Most of the Tariffs

Federal Reserve Governor Stephen Miran delivered a speech Monday taking apart the tariff-inflation panic.

Federal Reserve Governor Stephen Miran delivered a speech Monday taking apart the tariff-inflation panic.

Federal Reserve Governor Stephen Miran argued Monday that inflation is significantly closer to the central bank’s two percent target than official measures suggest, making the case for faster interest rate cuts while systematically dismantling claims that tariffs are driving price

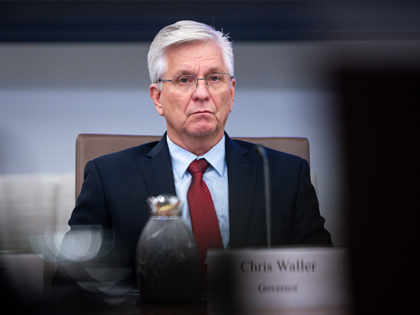

The Federal Reserve’s latest Summary of Economic Projections reveals that the inflation hawks have stood down, and Fed Governor Christopher Waller was right all along.

A Trumpier Fed Isn’t An Inflation Threat The financial press has been trying its best for months to gin up a panic over the independence of the Federal Reserve. We’ve had a number of dress rehearsals for the supposed death

Federal Reserve Governor Stephen Miran in a speech in November detailed how he believes that stablecoins might help lead America’s financial “reboot,” which may lower interest rates.

The man Trump calls a “stubborn ox” might prove stubborn enough to stick around when his term as Fed chairman expires, operating as a kind of monetary policy resistance leader for the next two years.

Minutes show a central bank torn between members who see inflation as largely vanquished and those who believe the fight has “stalled,” and split on whether the economy needs a gentle policy adjustment or aggressive stimulus.

When economists talk about immigration, they usually focus on jobs, wages, or fiscal costs. Federal Reserve Governor Stephen Miran wants to add another dimension: interest rates.

Federal Reserve officials are sharply divided over how aggressively to cut interest rates, with some warning that the central bank risks falling dangerously behind in addressing a deteriorating labor market while others remain focused on stubborn inflation that has persisted well above target for more than four years.

The September purchasing managers’ indexes from S&P Global showed companies in manufacturing and services reported sharply higher input costs, which they primarily attributed to tariffs. But weak demand and fierce competition prevented most from raising prices, leading to the weakest goods inflation since January.

Speaking at the Economic Club of New York, Miran argued that the Fed’s benchmark rate should be closer to two to 2.5 percent, roughly two points below its current level.

Jimmy Kimmel might have hastened his exit by spreading falsehoods about Charlie Kirk’s assassin, but he was marching toward the end long before this week.

The Senate on Monday confirmed Stephen Miran, chairman of the White House Council of Economic Advisers, to a seat on the Federal Reserve Board, giving President Donald Trump an influential voice inside the central bank at a critical moment for monetary policy.

The committee voted 13-11 along party lines to advance Miran’s nomination to the full Senate, where it is expected to come up for a vote on Monday.

Stephen Miran, President Trump’s nominee for an open Federal Reserve position, appeared to reassure Republican lawmakers about his commitment to central bank independence Thursday, weathering a barrage of attacks from Democratic senators during his confirmation hearing. Miran, who serves as

The United States is experiencing lower goods inflation than most of its international peers despite a modest recent increase, according to a new analysis from the Council of Economic Advisers that seeks to counter claims that trade policies are fueling higher prices.

President Donald Trump could potentially gain a new ally on the Federal Reserve if allegations of potential mortgage fraud force Federal Reserve Governor Lisa Cook to resign. Trump on Wednesday urged Federal Reserve Governor Lisa Cook to resign after Federal

President Donald Trump has selected Stephen Miran, chairman of the White House Council of Economic Advisers, to fill a vacant seat on the Federal Reserve Board, nominating a longtime ally and critic of recent central bank policy to serve out the remainder of an expiring term.