Stagnant wages threaten a national crisis of political legitimacy, so business CEOs should ally with unions to urgently raise wages, says the leading Democrat on Wall Street.

Robert Rubin’s resume includes 26 years at Goldman Sachs, four years as President Bill Clinton’s Treasury secretary and ten years running the Citigroup banking firm, during a decades-long period when Americans’ wages were mostly flat.

But Rubin’s call for CEO/union action on wage-increases is also a strategy to help Wall Street escape the economic impact of President Donald Trump’s low-immigration/high-wage policies — especially if Trump is reelected in 2020 on a populist platform.

Trump’s immigration policies promise to give Americans higher wages and lower real-estate prices nationwide by shifting wealth from CEOs and Wall Street investors. That is why Trump’s immigration policies were strongly opposed by Wall Street advisors during the 2016 election.

Rubin’s call for higher wages came February 28 at a meeting of his D.C.-based investor-dominated Hamilton Project think-tank:

Those who support market-based economics — and the business community certainly does that — should also support collective bargaining to provide a true labor market with a fair balance of power between business and labor, rather than a market with all the power on [business’] side.

Rubin made clear that Trump-style immigration-reforms are beyond the pale, even though he admitted that a shortage of workers helped drive up wages for Americans during several of Clinton’s eight years. He described that 1990s partial success:

First in the mid-90s, earlyish, and then rest of the 1990s, as we all know, wages increased at a robust level at all quintiles, and that was in some fair measure, due to tight labor markets, which in turn, at least in my, view, were a function in some fair measure, of good policy.

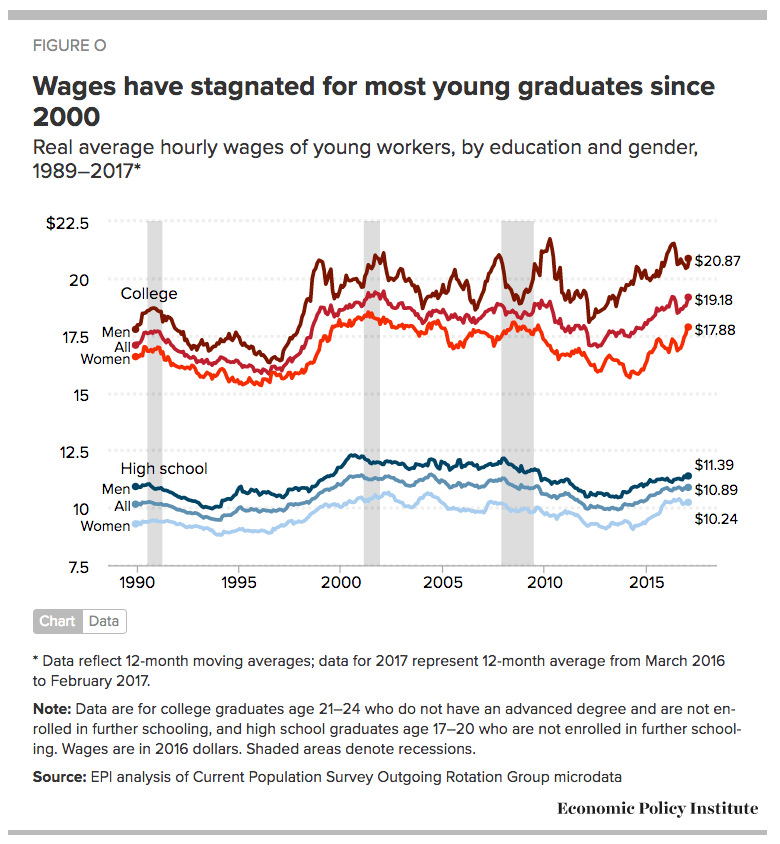

Wages did grow in the late 1990s, but wage growth ended in 2000 as the flood of new labor overwhelmed the economic boom created by new computer technology. From January 1992 to January 2001, the number of people in the workforce — American and immigrant, legal or illegal — jumped by 15 million up to 143.8 million. That was a 12 percent jump in eight years.

Rubin’s February event was held to showcase a book of recommendations for raising wage levels. The book was assembled by contributors to Rubin’s Hamilton Project. The 200-page book lists many useful options for raising wages but it pointedly excludes immigration reform. The book “manifests how broad the range of those policies should be,” Rubin said.

The proposals include more education spending, easing the migration of Americans from backwater home communities to distant job opportunities, collective bargaining with union leaders, raising workers’ productivity, barring employer hiring contracts that hinder workers’ post-employment careers, and reducing employment-related collusion by employers.

But none of the useful proposals can consistently raise wages nationwide because none would limit the inflow of foreign workers. Without Trump-like curbs on immigration, CEOs and investors can always hire the next person in line rather than raise pay when an American — including white-collar college graduates — asks for higher pay, regardless of training union complaints, etc.

Rubin’s call for CEOs to unite with union leaders to manage wage raises is also a call for corporatist coordination, not a free-market economy. That corporatism implies that CEOs and union leaders should also manage workers’ wages to keep company costs down, inflation low, and profit at agreed-upon levels.

“I think business will do far better over time if their workers succeed and do well,” he said. “I also think that workers are best served by their unions – and what I am about to say is what many unions are doing — if the unions take into account the success and economic well-being of the institutions that the workers are employed by.”

Much of Rubin’s speech was indirectly aimed at Trump’s populist policies, suggesting that Rubin’s call for saving the “economic system” is also a call on CEOs to help defeat Trump’s reelection in 2020. He said:

For quite some time, we have had enormous dysfunction in our political system, and the result is a great preponderance of our policy issues have not been addressed. And that, at least in my view, makes policy development by non-government institutions all the more important in order to create intelligent work-product for that time when the federal government is again able to function effectively on these matters.

Rubin declined to answer questions from Breitbart News.

Rubin’s opposition to Trump’s free-market political platform is rational for Wall Street investors because investors tend to gain when the federal government artificially inflates the labor supply — and deflates the price of labor — via mass legal immigration.

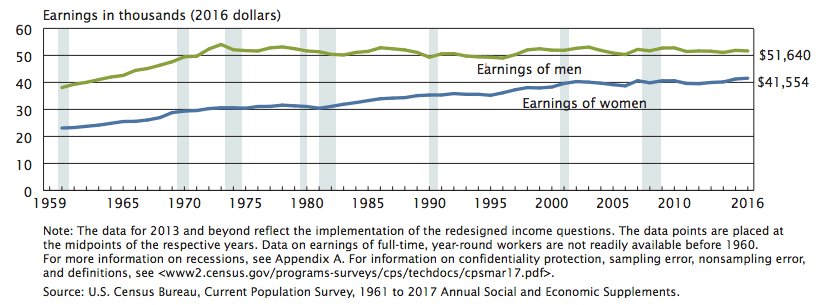

Since immigration was raised in 1965 and raised again in 1990, wages have remained mostly flat, according to the U.S. Census Bureau.

Americans’ wages tend to rise steadily as the reserve pool of unemployed workers outside the labor force drops below 24 percent.

https://twitter.com/Henry_Curr/status/959527766021505025?ref_src=twsrc%5Etfw&ref_url=http%3A%2F%2Fwww.breitbart.com%2Fimmigration%2F2018%2F02%2F28%2Fassociated-press-college-graduates-boosted-by-imported-low-wage-workers%2F

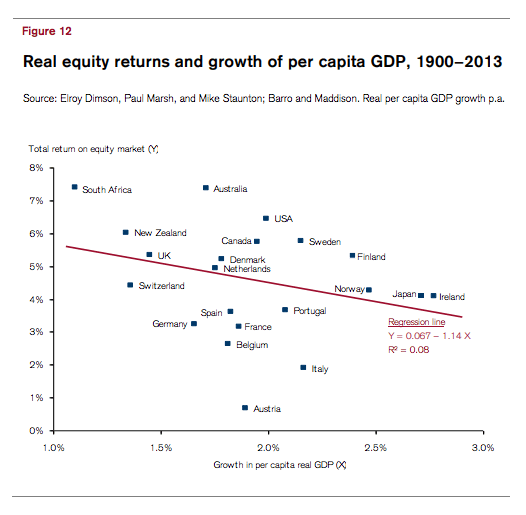

But investor data show that rising per-capita wages tend to reduce investment returns for Wall Street as wealth is shifted from profits to wages.

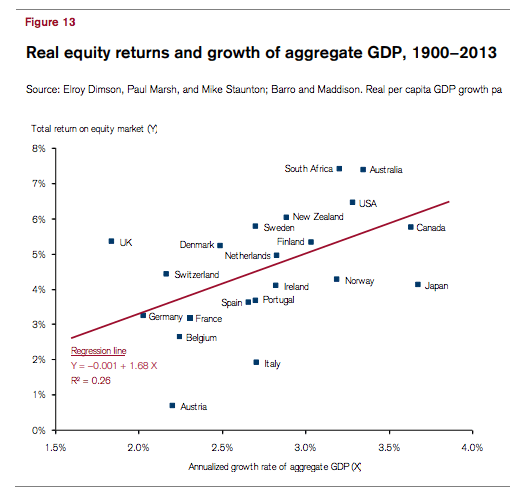

Moreover, immigration grows the population, consumption and business activity, and so raises Wall Street investment returns.

Population growth is especially valuable for real-estate values. Rising immigration tends to push up the price of land, especially in cities. That’s good for real-estate investors and banks, such as Citigroup. But it is bad for young Americans trying to buy a house in suburbia and start a family. The advisory council at Rubin’s Hamilton Project includes several real-estate investors, such as Penny Pritzker.

Rubin says higher wages are needed to prevent a national political crisis that could threaten “the economic system.” He made his argument in the foreword to the Hamilton Project’s book:

One simple question—are wages rising?—is as central to the health of our democracy as it is to the health of our economy. Without rising wages, the dreams of American families to live in good homes, to support their families, to retire comfortably, and to see their children do better—what we call the American Dream—simply cannot be realized…

Wage stagnation does more than constrain family budgets: it also leaves workers and families feeling discouraged, even disenfranchised. Working year after year without a meaningful rise in wages weakens workers’ confidence in the economic system. Even more, it undermines their faith in democratic institutions to make the necessary changes in public policy to deliver a robust improvement in their standards of living. As former Treasury Secretary Lawrence Summers, a member of our advisory council, wrote in September 2017, “The central issue in American politics is the economic security of the middle class and their sense of opportunity for their children. As long as a substantial majority of American adults believe that their children will not live as well as they did, our politics will remain bitter and divisive” (Summers 2017). Stagnant wages divide us not only by income, but also by our understanding of what it means to be an American and to have our own shot at the American Dream. For this reason, with so much at stake, the task of restarting wage growth has taken on great urgency.

But Rubin’s determination to avoid a national crisis is secondary to his focus on preserving Wall Street returns.

In September 2017, eight months after Trump’s inauguration, Rubin delivered a similar speech arguing that economic growth — which is vital to Wall Street — and “broad-based economic wellbeing” — are both needed. But Rubin and other speakers at that September event also downplayed the role of mass-immigration in freezing middle-class wages.

Immigration polls which ask people to pick a priority, or to decide which options are fair, show that voters in the polling booth put a high priority on helping their families and fellow nationals get decent jobs in a high-tech, high-immigration, low-wage economy. Those results are very different from the “Nation of Immigrants” polls which are funded by CEOs and progressives, and which pressure Americans to say they welcome migrants.

Four million Americans turn 18 each year and begin looking for good jobs in the free market.

But the federal government inflates the supply of new labor by annually accepting roughly 1.1 million new legal immigrants, by providing work-permits to roughly 3 million resident foreigners, and by doing little to block the employment of roughly 8 million illegal immigrants.

The Washington-imposed economic policy of economic growth via mass-immigration shifts wealth from young people towards older people, it floods the market with foreign labor, spikes profits and Wall Street values by cutting salaries for manual and skilled labor offered by blue-collar and white-collar employees. It also drives up real estate prices, widens wealth-gaps, reduces high-tech investment, increases state and local tax burdens, hurts kids’ schools and college education, pushes Americans away from high-tech careers, and sidelines at least 5 million marginalized Americans and their families, including many who are now struggling with opioid addictions.

COMMENTS

Please let us know if you're having issues with commenting.