The Route 66 Dream

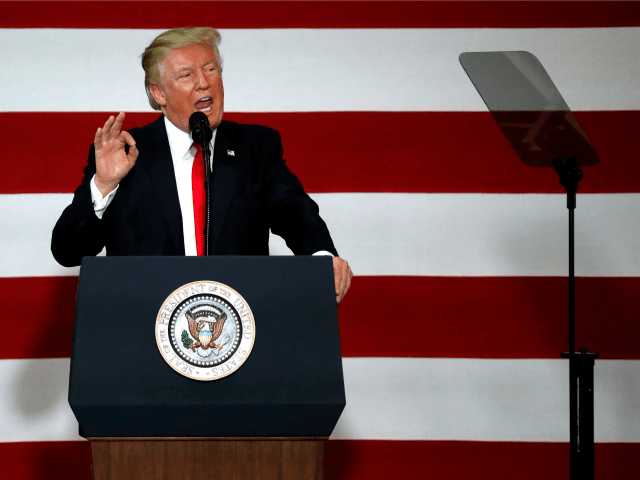

Kicking off his tax-reform campaign on Wednesday with a forceful speech in Springfield, Missouri, President Trump got right to the point. Tax reform, including tax reductions, should focus on Main Street, not Wall Street:

We’re here today to launch our plans to bring back Main Street by reducing the crushing tax burden on our companies and on our workers. Our self-destructive tax code costs Americans millions and millions of jobs, trillions of dollars, and billions of hours spent on compliance and paperwork.

As Trump noted, Springfield is the birthplace of the famed Route 66, a vital piece of infrastructure that was once the key roadway between the Midwest to the West. In his Trump Nation-friendly manner, Trump recalled,

For many decades, Route 66 captured the American spirit. The communities along this historic route were a vivid symbol of America’s booming industry. Truck drivers hauled made-in-America goods along this vital artery of commerce. Families passed through bustling towns on their way to explore the great American West. And high-quality manufacturing jobs lifted up communities, gave Americans a paycheck that could support a family.

Thus Trump laid out the stakes for his economic agenda. As he has been saying all along, his presidency should be judged as a success if it revives the American Dream for the cities, towns, and places along 66 and all the other Heartland arteries.

Yet of late, robust economic growth has been conspicuously lacking. As the President observed, “In the last 10 years, our economy has grown at only around two percent a year.” Such anemic growth has barely kept up with population growth, and so it’s no surprise that median real earnings are up just a tiny fraction over the last decade.

The basic economic logic is inescapable: Wages are a function of the demand for labor relative to supply. And so if economic growth is soft, then wage growth will be soft.

Meanwhile, Trump continued, other countries, notably China and India, have been enjoying GDP growth of seven percent or more. In other words, other nations—including nations that aren’t necessarily friendly—are gaining on us, big-time. Indeed if present trends continue, China’s economy is expected to overtake ours soon.

So we can quickly see: If China builds itself a bigger economy, it will also have more power, and that will, in turn, create still more power. Already, the Chinese are shrewdly using their newfound wealth—much of it gained through unfair trade deals with the U.S., which is a topic for another time—to launch a vast new infrastructure project, the Belt and Road Initiative, aimed at profitably connecting China to the Middle East, Africa, and Europe by land, much as Route 66 and the railroads once profitably connected the regions of the U.S.

In other words, the U.S. can’t afford to be complacent. Instead, this is a time to get the country moving again, to borrow the famous phrase of a famously pro-growth tax-cutting president, John F. Kennedy. As ably chronicled by economic maven Larry Kudlow in his recent book, JFK and the Reagan Revolution: A Secret History of American Prosperity, it was Kennedy’s tax plan in the 1960s that set the stage for Ronald Reagan’s similarly successful tax plan in the 1980s.

So Trump was right when he said in Missouri, “If we want to renew our prosperity, and to restore opportunity, then we must reduce the tax burden on our companies and on our workers.” The 45th president added, “If we achieve sustained three percent growth, that means 12 million new jobs and $10 trillion dollars of new economic activity over the next decade.” And yet, he also declared, if we can put the right policies in place, we can do much better than three percent growth.

Okay, so what policies do we, in fact, need? What must be done to unlock the true potential of the American people?

The Power of the Bully Pulpit

In his speech, Trump chose to focus on broad outlines and “must-have” principles, as opposed to micro-details. That was a wise approach, because, after all, it’s Congress that will have the final say on the legislation; all a president can do is sign the bill, or not.

In the meantime, of course, the commander-in-chief has his bully pulpit, and yet that’s best used for national leadership and exhortation; the nitty-gritty details will inevitably be hammered out in the smokeless smoke-filled conference rooms of Capitol Hill. (On Thursday, Treasury Secretary Steven Mnuchin expressed his confidence that the President would be able to sign a bill this year.)

True Reform

So Trump was better off outlining only his big-picture principles, which he defined as “a tax code that is simple, fair, and easy to understand … getting rid of the loopholes and complexity that primarily benefit the wealthiest Americans and special interests.”

Here we might pause to note that Trump said that we must do more than just stimulate the economy, as important as that goal is. So what do we mean by “more”? What else might be in the back of Trump’s mind?

He means this: To be sustainable, a pro-growth strategy must not be reckless; that is, we can’t build enduring prosperity on the basis of speculative bubbles, of the sort that we saw in the years leading up to the crashes of 1929 or 2008.

In addition, we can’t have an economic plan that stimulates the economic well-being of only the few. So most obviously, we don’t want a repeat of the hideously upward-income-transferring Wall Street bailouts of the Bush 43 and Obama years.

Moreover, we also want to build basic equity into our hoped-for revised pro-growth tax system, such that equal incomes are taxed equally—no more gaping loopholes that shock the conscience of the country.

Indeed, history tells us that if we can’t write those sorts of fair reforms into the code, then the legitimacy of the whole tax system will remain in question. And any perceived illegitimacy is an open invitation to the likes of Bernie Sanders and Elizabeth Warren to sweep in with their whole left-wing redistributionist agenda.

So as always, the prudent conservative envisions a plan that will stand the test of time, providing predictability to long-term investors, but not sneaky windfalls to greedheads and other get-rich-quickers.

As the great conservative statesman Edmund Burke liked to say, we must look at all things in reference and proportion. So with that Burkean wisdom in mind, let’s examine two specific examples of rightful reform, applying to personal and to corporate taxation.

Personal Tax Reform

First, as to personal taxation, one of the biggest—and probably most egregious—loopholes is the so-called “carried interest” provision, which allows investment managers and hedge-funders to pay a lower tax rate than tens of millions of Americans who earn only a smidgen of those lofty Wall Street-related incomes. In a nutshell, the carried-interest loophole privileges the income of investment moguls, allowing them to pretend that their income is a capital gain, and thus taxable at only half the rate.

One well-known beneficiary of this loophole is Mitt Romney, who managed to pile up a fortune measured in the hundreds of millions of dollars while paying a tax rate of 13 or 14 percent. (From those numbers, it would seem that Romney was benefiting from more than just the carried-interest loophole, but tax-reformers have to start somewhere.)

So where, exactly, is the Trump administration on this topic? During the 2016 campaign, Candidate Trump was clear: carried-interest loopholers were “getting away with murder.” He added,

The hedge fund guys didn’t build this country. These are guys that shift paper around and they get lucky … a lot of them—they are paper-pushers. They make a fortune. They pay no tax. It’s ridiculous.

However, since then, the Trump Administration has had less to say about this provision. Back in April, former White House chief of staff Reince Priebus said that “carried interest is on the table”—that is, on the chopping block. And of course, Priebus is no longer there.

On Wednesday, while Trump didn’t mention carried interest, he did blast “special interests” and “special interest loopholes” five times—and so we’ll just have to see what emerges from the Congressional “sausage factory.”

Yet in the meantime, we can say this: Tax reform that does not include the elimination of this pro-plutocrat loophole is something less than true tax reform.

To be sure, one should never let the perfect be the enemy of the good, and so progress in the right direction is still progress—and yet still, any tax-reform plan that fails to significantly nick Romney and his corporate-liquidator buddies at Bain Capital will fall short of mission: accomplished.

Corporate Tax Reform

Second, as for corporate taxes, Trump was right to shine the spotlight on our destructively high corporate tax rate. As he said,

In 1986, Ronald Reagan led the world by cutting our corporate tax rate to 34 percent. That was below the average rate for developed countries at the time. Everybody thought that was a monumental thing that happened. But then, under this pro-America system, our economy boomed. It just went beautifully–right through the roof. The middle class thrived and median family income increased.

Okay, so that was then; as we have seen, Reagan, like JFK before him, was a great pro-growth tax-rate-cutter.

Yet since 1986, Trump continued, the U.S. has stagnated, while other countries have been gaining on us; it is, after all, a dynamic world environment, in which countries scramble to gain comparative advantage:

Other countries saw the success. They looked at us … and they acted very swiftly by cutting their taxes lower, and lower, and lower, and reforming their tax systems to be far more competitive than ours.

Indeed, as our corporate rate has stayed still, rival nations have leapfrogged us:

Over the past 30 years, the average business tax rate among developed nations fell from 45 percent to less than 24 percent. And some countries have an unbelievably low tax, including, by the way, China and some others that are highly competitive, and really doing very well against us. They are taking us, frankly, to the cleaners.

Today, while the average corporate tax rate of our rivals is, as Trump says, less than 24 percent, the U.S. rate is the highest in the developed world, at 35 percent. This chart from the Tax Foundation nicely visualizes the discrepancy between the US and other countries, although since it was created in 2014, the gap has grown even wider, as other countries, including Japan and the United Kingdom, have further cut their corporate rate.

So it’s good news that Trump has proposed cutting the U.S. corporate rate to 15 percent, which would offer the promise of America once again being the best place in the world in which to do business.

And why is the corporate rate so important? Because the rate determines the value of corporate investment, which is judged by the after-tax return. In other words, the higher the tax rate, the lower the after-tax return—and thus the less worthwhile the investment.

As good economists say: If you want less of something, raise the tax on that something. That’s a point that should be obvious enough to anyone who is not a doctrinaire leftist, and yet since the Reagan era, D.C. politicians have dithered on this key economic variable, neglecting the reality of international competition—and as a result, America is worse off.

Of course, some will immediately point out that many corporations don’t pay tax at that 35 percent rate, or anything close. For instance, Amazon, controlled by Jeff Bezos—who also owns, and subsidizes, the perpetually Trump-bashing Washington Post—earned more than $3.5 billion from 2005 to 2009, and yet the company paid, according to calculations from Capital IQ, a tax rate of just 4.3 percent. How does Amazon manage that? One trick is that the Seattle-based company pretends that it is operating mostly in the European country of Luxembourg, where the effective corporate tax rate is a mere six percent. And from there, Amazon’s lawyers and accountants have managed to whittle its tax bill down even further.

Yet even as Bezos and other companies are making out like bandits, other companies are, in fact, paying the full corporate rate, or close to it. Typically, these are firms that operate—and hire—mostly in the U.S. Moreover, when state and local taxes are added in, American operators are in fact paying a hefty bill.

One such domestic company, according to a 2016 report from The New York Times and S&P Global Market Intelligence, is Wal-Mart—the Arkansas retailer pays a 31.2 percent rate.

Right away we can spot the unfairness: Amazon and Wal-Mart are both retailers—arch-rivals, in fact—and yet Amazon pays four percent, while Wal-Mart pays 31 percent—nearly eight times more.

To put those numbers another way, an investor in Amazon can expect to see 96 cents on each dollar of profit, while an investor in Wal-Mart can expect to see only 69 cents. Again, after-tax return on investment is a key metric for any company.

So it’s no wonder Amazon is now worth $474 billion, while Wal-Mart is worth about half of that. In the meantime, the rest of us can ask: Do we really want the tax code to reward certain companies, while punishing others? Do we think that such picking of winners and losers is good for the economy—and all of us? Especially when the winners operate mostly overseas, and the losers operate mostly at home?

Indeed, we can note a further wicked quirk in the current corporate-tax system: That 35 percent rate applies to all U.S. companies—even tax-dodgers such as Amazon—if they invest here.

In other words, the way to beat the high U.S. rate is not to invest in America at all, but rather, to make money overseas, and to keep it there. So that’s why Amazon labels itself as doing so much business in Luxembourg, a tiny country of less than 600,000 people.

However, that clever play by Amazon means more bad news for America. As Trump also said in Missouri, somewhere between $3 trillion and $5 trillion in American corporate profits are permanently parked overseas. Its U.S. owners simply have no intention of bringing that money home to face the 35 percent rate.

Yes, it’s slightly less convenient to have the cash stashed in offshore tax-shelters, and yet with the current high American rate, the net savings to the owners are anything but slight—so the money stays where it is.

So Trump made another good point on Wednesday when he said that a lower corporate tax rate would help bring that money home: “We can return trillions and trillions of dollars to our economy and spur billions of dollars in new investments in our struggling communities and throughout our nation.”

Thus we can see: Genuine reform of the corporate tax code would create a new, lower, rate for all. And yet real reform would have the effect of raising the effective rate paid by Amazon and other globalist companies, even as it reduced the effective rate paid by more domestic companies such as Wal-Mart. And at the same time, reform would encourage trillions of dollars to come home, thereby boosting our economy.

Needless to say, more than these reforms are needed to fully to revive the well-being of workers; we must address other issues, too, including trade and infrastructure.

Still, Trump has it right: Tax reform is the best place to start. And yet since true tax reform will rouse the swamp creatures to defend their swamp, Trump has no choice other than to rally the country to his side, just as Kennedy and Reagan did in decades past. As he said in Missouri,

Today, I am asking every citizen to join me in dreaming big and bold and daring things–beautiful things–for our country. I am asking every member of Congress, of which we have many with us today, to join me in unleashing America’s full potential. I am asking everyone in this room and across the nation to join me in demanding nothing but the best for our nation and for our people.

That’s a compelling message, for sure. And yet if Trump wishes to rally the power needed to steamroll the swamp things, he will have to spend less time inside the Beltway— and more time among the voters who live along Route 66, and all the 66s of this great big country.

The American people put Trump into office, and it will be those same people who push through his agenda.

COMMENTS

Please let us know if you're having issues with commenting.