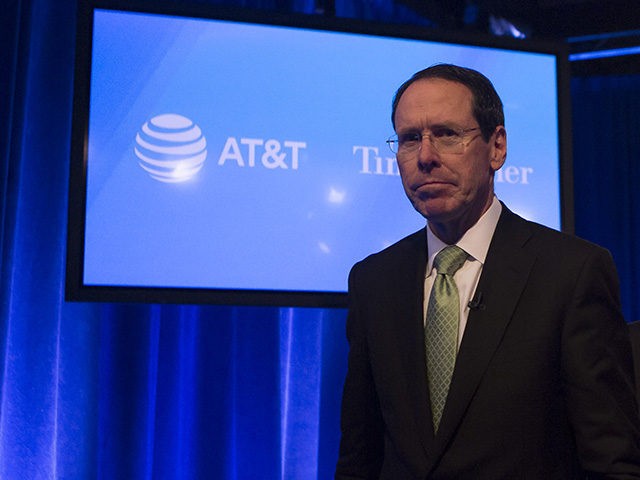

AT&T scored a major triumph in its scheme to become a telecom-media behemoth Tuesday when a federal judge gave the green light to its $85.4 billion takeover of Time Warner.

The decision by Judge Richard Leon is a setback for Makan Delrahim, President Trump’s appointee to the top spot in the Justice Department’s antitrust division, challenging his view of antitrust laws in the digital era. Most analysts believe that the decision is likely to set off a wave of takeovers and consolidation in tech, telecom, and media.

The merger was approved without any conditions, a stunning rebuke of the government’s case. Judge Leon even went so far as to urge the government not to seek a stay of his decision pending a possible appeal.

“The case stands as a testament to the wisdom of the combination of these two great companies,” Daniel Petrocelli, the lead trial attorney for AT&T, said after the judge’s ruling. “This decision was a sound and proper rejection of all of the government’s arguments to stop this merger.”

The lawyer added that the merger would be completed no later than June 20 of this year.

The case was closely watched by telecom and media industry analysts, corporate executives, and Wall Street. A line formed outside the court several hours before Judge Leon was scheduled to issue his decision.

Judge Leon delivered his opinion in a closed courtroom packed with reporters and telecom industry-watchers. With no phones or computers allowed into the courtroom, and attendees required to stay until after the judge had left the courtroom, the public was left in the dark for nearly 40 minutes Tuesday afternoon as they awaited the decision.

The fate of several big deals already underway is likely to turn on the decision. Verizon has been courting CBS, prompting CBS to resist the overtures of Viacom. Disney has bid for 21st Century Fox’s entertainment assets, a deal that appears to have been shaped to avoid a challenge by Delrahim’s antitrust squad. Comcast, which had earlier bid for the Fox assets but lost out to Disney, is expected to renew its pursuit now that AT&T has won.

“The deal floodgates will now open,” one investment banker told Breitbart News.

And, of course, the decision will have repercussions for Silicon Valley’s digital Masters of the Universe. Facebook, for example, has been edging toward become a media company of its own and has been rumored to be exploring building its own phones. Amazon already is a telecom and media company, creating its own movies and televisions shows and running much of the internet on its cloud service. Google owns the Android wireless phone-operating system and dominates online advertising.

AT&T argued that it was the very threats posed by the likes of Amazon, Netflix, and Facebook that demanded it expand into a media-tech titan.

Americans for Limited Government President Rick Manning said the decision was regrettable.

“We are disappointed that the court missed an opportunity to rein in the First Amendment-crushing mass media consolidation trend, which puts too much media power in the hands of too few,” Manning said in a statement. “We strongly urge the Justice Department to appeal this decision all the way to the Supreme Court if necessary. The immediate fallout of this decision is likely to be an attempt by Comcast to outbid Disney for the media content owned by Fox.”

In making its case, the U.S. government argued that the merger of AT&T could harm consumers in a number of ways. The merged companies could withhold programming from competitors, pressuring consumers to switch to AT&T services. It could tie products together, offering AT&T phone customers free access to Time Warner offerings, squeezing out competitors that do not own media companies. It could also demand higher prices from other distributors of cable and satellite television, a cost that would likely be passed on to consumers. Or it could hurt Netflix and other content producers by locking them out of AT&T’s multi-channel distribution network.

The decision by the Justice Department to sue to block the merger caught AT&T and many others in the media industry by surprise. In recent decades, the government’s antitrust enforcement actions have focused on deals where one company threatened to dominate too much of a specific industry. That is, deals where a company was buying its competitor, known in the legal jargon as a “horizontal merger.”

The proposed acquisition of Time Warner by AT&T was what’s known as a “vertical merger,” the integration of two companies in different areas of the economy. Many believed that these types of deals were unlikely to be blocked by the government, as they were thought to pose less risk of harm to the consumer.

But a changing corporate landscape and the rise of digital technology may have made those distinctions partly obsolete. If Facebook were to buy Netflix, would that a vertical merger between a social media company or a horizontal merger between two digital providers?

Some see the decision to challenge the merger as political, something the Justice Department has fiercely denied. During the trial, AT&T made several efforts to introduce evidence about political interference into the case but was rebuffed by Judge Leon.

Outside of court, however, critics of the lawsuit pointed to Trump’s frequent criticism of CNN, which is owned by Time Warner.

“AT&T is buying Time Warner, and thus CNN,” Trump said at a campaign rally in 2016. That was “a deal we will not approve in my administration. It puts too much power in too few hands.”

On Tuesday, Judge Leon ruled that the Trump administration could not block the deal.

COMMENTS

Please let us know if you're having issues with commenting.