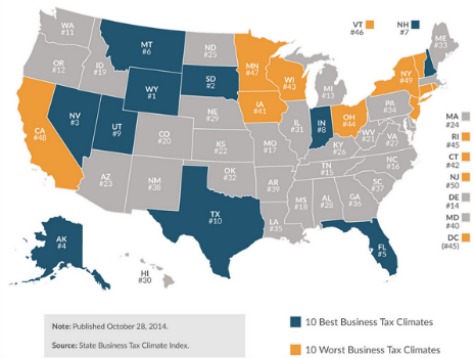

HOUSTON, Texas — California, New York, and New Jersey are home to America’s worst business tax climate, according to a new comprehensive index by the Tax Foundation. Texas, on the other hand, ranked in the top ten. This should come as no surprise to Texans, many of whom pride themselves as living in a state with relatively low taxes and reliable regulation.

Wyoming ranked first in the study, followed by South Dakota and Nevada. Texas ranked tenth.

The Tax Foundation’s index takes corporate taxes, individual income taxes, sales taxes, unemployment insurances taxes and property taxes into account. Over 100 variables were taken into account to determine the rankings.

The study additionally noted that ” states’ stiffest and most direct competition often comes from other states. The Department of Labor reports that most mass job relocations are from one U.S. state to another rather than to a foreign location.”

This is evidenced by the fact that blue state transplants continue to flock to Texas — and other states with healthy business climates — at an alarming rate. Cities situated in blue states — such as New York and L.A. — are losing people at a rapid rate to “second-tier” cities in red states. Bloomberg Businessweek recently compiled a list of the top fastest-growing large metros in the nation. Not surprisingly, four Texas cities made the top ten: Austin (which ranked number one), San Antonio, Houston, and Dallas. The bountiful job market and business-friendly environment have unquestionably been the driving forces behind the ever-increasing populations in Texan cities.

Texas’ healthy business tax climate unquestionably have a trickle effect, bolstering the state’s economy in many ways.

“Taxes matter to business,” the Tax Foundation wrote. “Business taxes affect business decisions, job creation and retention, plant location, competitiveness, the transparency of the tax system, and the long-term health of a state’s economy. Most importantly, taxes diminish profits. If taxes take a larger portion of profits, that cost is passed along to either consumers (through higher prices), employees (through lower wages or fewer jobs), or shareholders (through lower dividends or share value). Thus, a state with lower tax costs will be more attractive to business investment and more likely to experience economic growth.”

Follow Kristin Tate on Twitter @KristinBTate.

COMMENTS

Please let us know if you're having issues with commenting.