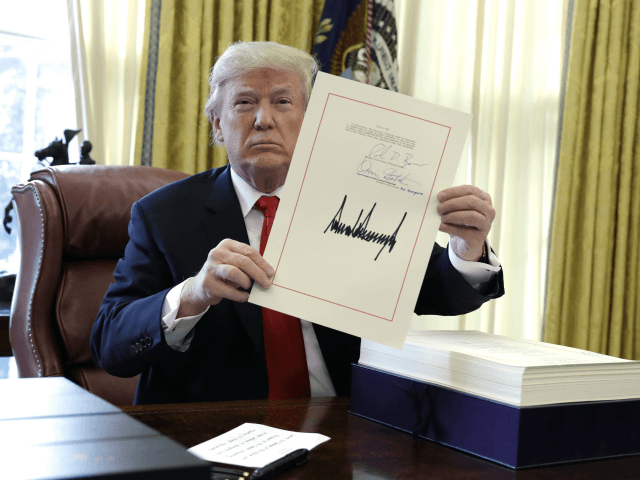

American companies have brought $1 trillion back to the United States since the passage of President Donald Trump’s tax cuts in 2017, according to new U.S. Department of Commerce data.

Bloomberg News reported the repatriation figure since the Tax Cuts and Jobs Act of 2017 took effect last year, though noting that it was short of the $4 trillion that Trump had initially promised:

Investment banks and think tanks have estimated that American corporations held $1.5 trillion to $2.5 trillion in offshore cash at the time the law was enacted. Before the overhaul, companies were incentivized to keep profits overseas because they owed a 35% tax when bringing it back and could defer payment by keeping funds offshore. The law set a one-time 15.5% tax rate on cash and 8% on non-cash or illiquid assets.

As the Tax Foundation has noted, the tax on past overseas profits is payable over eight years, whether or not the funds are repatriated. Going forward, companies will only be taxed on earnings in the U.S.

The repatriation rate is somewhat slower than initially expected, the Wall Street Journal reported last year, because the U.S. tax rate is only one factor in companies’ decision to keep profits abroad:

Some companies, such as Chevron Corp. and Archer Daniels MidlandCo. , have long plowed foreign profits into foreign factories, equipment and other assets that aren’t likely to move. Other companies said they need funds overseas for acquisitions, debt retirement and expansion in growing markets. Moreover, foreign regulators require banks and other financial companies to maintain substantial capital reserves abroad. Those corporations don’t plan to bring much cash home.

Even without the federal government taxing new foreign income as it comes home, costs remain to moving cash across borders. Some U.S. states tax repatriated profits, and some countries impose taxes on dividends paid to parent companies.

President Barack Obama had long decried the practice of companies shifting profits abroad, though he and his party proposed to add taxes and penalties to “unpatriotic” companies, rather than changing taxes and regulations to create new incentives to invest at home.

The Department of Commerce Bureau of Economic Analysis report also noted that the current account deficit had narrowed by 0.9% in the third quarter of 2019.

Joel B. Pollak is Senior Editor-at-Large at Breitbart News. He earned an A.B. in Social Studies and Environmental Science and Public Policy from Harvard College, and a J.D. from Harvard Law School. He is a winner of the 2018 Robert Novak Journalism Alumni Fellowship. He is also the co-author of How Trump Won: The Inside Story of a Revolution, which is available from Regnery. Follow him on Twitter at @joelpollak.

COMMENTS

Please let us know if you're having issues with commenting.