U.S. prices jumped higher as consumers spent more on goods, housing, and imports in the first quarter compared with earlier estimates, data from the Commerce Department showed Thursday.

Personal consumption expenditure jumped 11.3 percent in the January through March period compared with the prior quarter, an unexpected increase from the preliminary estimate of 10.7 percent.

The upward revision to consumer spending indicates the economy was on a stronger footing as the year began than was thought, bringing into doubt the need for the Biden administration’s costly American Rescue stimulus plan and possibly hurting the chances of the other big-spending plans the White House has been pushing.

Price increases were also revised up, indicating stronger inflationary pressures than seen earlier. The personal consumption price index rose 3.7 percent, up from the earlier estimate of 3.5 percent and a big acceleration from the 1.5 percent increase recorded in the fourth quarter of 2020.

Excluding volatile food and energy prices, so-called core PCE inflation increased 2.5 percent, up from the earlier estimate of 2.3 percent and 1.3 percent in the fourth quarter.

Consumption spending on goods soared 25.6 percent, compared with the earlier estimate of 23.4 percent. Durable goods spending jumped 48.6 percent, versus the earlier estimate of 41.4 percent. Nondurables rose 14.0 percent, a bit below the 14.4 estimated in April.

Spending on services expanded 4.6 percent, as estimated earlier. Services spending grew more slowly in the first quarter than it is thought to be growing now because many face-to-face businesses remain fully or partially closed.

Imports were revised higher, with spending on imported goods rising 6.5 percent versus 5.5 estimated earlier. Imported services rose 7.6 percent versus the earlier 6.5 percent estimate. This is another indicator that consumer demand was stronger than thought in the first quarter. But imports subtract from Gross Domestic Product because spending by U.S. consumers does not become income for U.S. workers. In short, some of the stimulus payments went into spending on goods and services made abroad.

Housing expenditures jumped 12.7 percent, up from the earlier estimate of 10.8 percent.

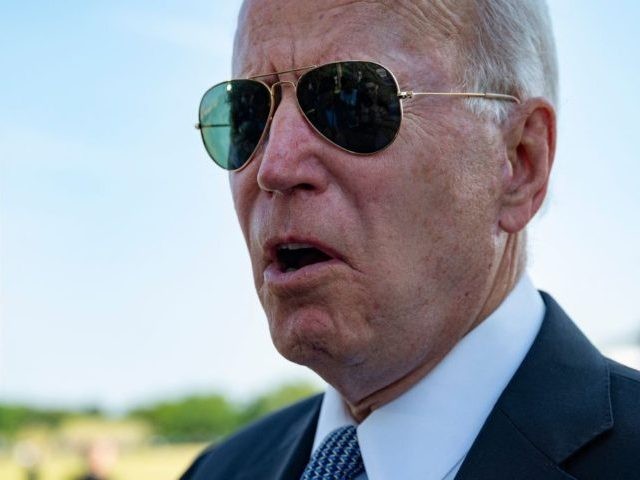

The upward revisions to consumer spending, housing investment, and inflation may provide ammunition to opponents of President Joe Biden’s big spending plans. On Thursday, the New York Times reported that the Biden administration plans to propose a budget over $6 trillion, nearly $2 trillion larger than the pre-pandemic budget. That will strike critics as excessive fiscal expansion given the stronger-than-expected rebound in consumer spending.

The estimate for first-quarter Gross Domestic Product growth remained unchanged at 6.4 percent, confounding the expectations of some for a slight uptick. The increases in consumer spending were offset by a decline in exports. Many of the trading partners of the U.S. lag in terms of economic recovery, vaccinations, and control of pandemic.

COMMENTS

Please let us know if you're having issues with commenting.