McCarthy vs. Biden on the Debt Ceiling

The debate over the debt ceiling is heating up again thanks to House Speaker Kevin McCarthy‘s speech this week at the New York Stock Exchange. The reaction from the Biden administration and its supporters would appear to increase the chances of a federal government funding disruption.

As Rep. McCarthy (R-CA) correctly pointed out, the debt limit offers Americans an opportunity to “examine our nation’s finances.” The requirement for Congress to authorize additional borrowing tends to helpfully focus public attention on fiscal policy, government spending, the size of our federal debt, and the pace at which our debt is accumulating.

Back in February, the Congressional Budget Office (CBO) reported that federal spending is equal to 23.7 percent of gross domestic product, and the budget deficit is expected to hit $1.4 trillion this year. The CBO estimates that the deficit will be 5.3 percent of GDP this year and swell to 6.1 percent in 2024 and 2025. There is a brief decline in the two years after that, followed by a return to increasing deficits.

By 2033, the deficit is expected to reach 6.9 percent of GDP, a level exceeded only five times since 1946. Federal spending as a share of the economy is expected to reach 24.9 percent—a level only exceeded twice since 1946, in 2020 and 2021.

The fact that overall spending and the deficit is so high at a time of extremely low unemployment and high inflation is a scandal. There’s no economic need for the government to be adding aggregate demand at anything close to these levels. What policy goals could the Biden administration imagine it is accomplishing by keeping deficit spending so high?

This level of spending may have something to do with the administration’s climate change agenda and, more specifically, Biden’s push to transition the U.S. transportation infrastructure toward electric vehicles. But it certainly is not advancing traditional Democrat economic goals like equality or prosperity for the least well off Americans.

More Inflation = More Inequality

The primary effect of loose fiscal policy in a time of tight labor demand and high inflation is higher-interest rates. Mortgage rates have soared during the Biden presidency as the Federal Reserve has raised its overnight benchmark rate nine times in the past twelve months. As a recent study from an economist at the Federal Reserve argued, this exacerbates wealth inequality by putting home ownership out of reach for more Americans. So, Biden’s deficits are contributing to wealth inequality.

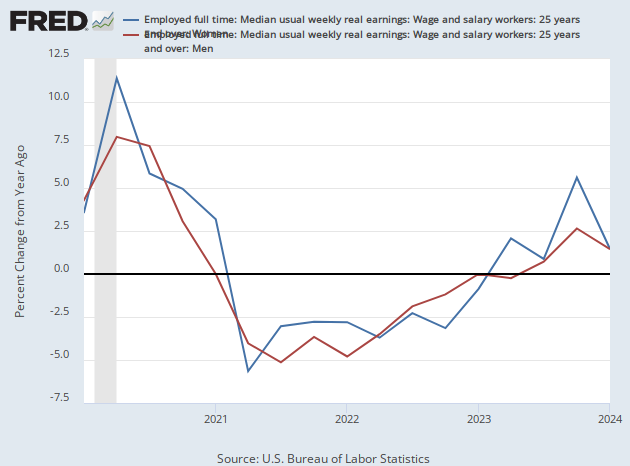

The deficits are also contributing to lower real household incomes by pushing up inflation and therefore pushing down real wages. One result of this is increased inequality between women and men. As the chart below shows, since the second quarter of 2022, women’s real weekly earnings (blue line) have been falling faster than those of men (red line). In the first quarter of this year, weekly earnings for men aged 25 and over were flat compared with a year earlier. Women’s weekly earnings fell by 0.9 percent.

Yet rather than agree to rein in spending now that the pandemic is in our past and something like maximum employment has been restored, the Biden administration is insisting that Congress increase the debt limit without even an agreement to limit future spending increases. The Democrats have shown a willingness to engage in extreme brinkmanship on the debt ceiling in the hopes that they can win political points in the next election.

Will Biden Try to Get Around Congress with the Fed’s Help?

Some on the left would go even further. A recent opinion piece in Politico argued that the Biden administration should “consider their unilateral options” for getting around the limit on borrowing. Nathan Tankus points out that the transcript from a 2013 Federal Reserve conference call appears to indicate that Fed officials would have endorsed buying defaulted Treasury bonds if a legislative agreement to raise the debt ceiling was not reached. The argument from the Fed would be that bond buying would become necessary to preserve or restore financial stability in the face of a default.

Federal Reserve Board Chair Jerome Powell speaks as President Joe Biden during a press conference on November 22, 2021, in Washington, DC. (Alex Wong/Getty Images)

That strikes us as an unlikely scenario. The U.S. Treasury’s receipts are more than enough to pay any interest or principal coming due on debt, so there would be no reason for the federal government to default on bonds. Instead, the government might have to pause other payments to government contractors. That would make it much harder for the Fed to intervene because there would simply be no defaulted securities to purchase.

COMMENTS

Please let us know if you're having issues with commenting.