The Contradictions of 2023 Capitalism

Marxists used to insist that the “internal contradictions of capitalism” would inevitably lead to collapse and the rise of socialism. Now markets are convinced that the contradictions of our current economic situation will bring about a “soft landing.”

The Federal Reserve Bank of Dallas on Monday released its monthly Texas Manufacturing Output Survey. It provided a great illustration of the contradictory currents running through our economy at the midway point of 2023.

The general business activity index came in at -20.0, the fifteenth straight negative score. The production index, a key measure of state manufacturing conditions, held “fairly steady” at -4.8. That’s a reading indicative of a mild contraction in output. The new orders index, a critical metric of demand, stumbled down to -18.1 and has been in negative territory for over a year.

The capacity utilization gauge improved but remained negative at -.24. The shipments index did the same, registering -2.2. Capital expenditures came in -2.4, with the Dallas Fed saying the index has “continued to bounce around in the same low or slightly negative range since February.”

The company outlook index pushed further negative to -16.9. The outlook uncertainty index moved up four points to 20.5.

Normally this would indicate that the manufacturing sector—and most likely the broader economy—was in a recession or close to one. You would expect employers to be paring back payrolls to reflect a year’s worth of cratering demand. None other than former Fed Chairman Ben Bernanke has taught us that businesses react by pulling back on investment and hiring when faced with increased uncertainty.

Labor Market Strength Despite Weak Demand

Yet the labor market remains strong. Indeed, the employment index rose eight points to 10.0, pushing above its average reading of 7.9 and suggesting faster job growth. Twenty-three percent of manufacturing firms said they were increasing net hiring, while just 13 percent said they were laying off workers. The hours worked index returned to positive territory after three months, coming in at 3.9. So, not only are companies hiring more workers, they are also giving them more hours.

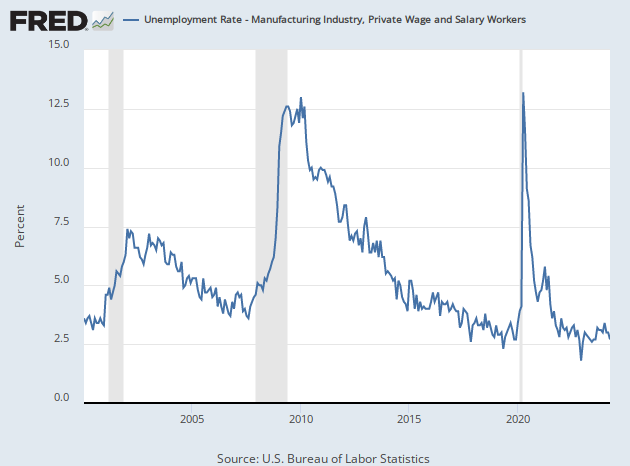

The unemployment rate for manufacturing workers in Texas was just 2.6 percent in June, according to the Department of Labor’s last employment situation report. That’s even lower than the already very low 4.1 percent unemployment rate for the state overall.

If unemployment is already ultra-low and employers are scrambling to hire more workers, that would normally be expected to lead to wage inflation, which in turn would be expected to lead to broader price inflation. Except that is not happening. The Dallas Fed said that the wages and benefits index fell six points to 19.1, near the long-term average reading and indicative of only a “moderate” increase in wage and benefit costs.

The index of raw materials prices did rise nine points to 10.5 in July. But this is well below its average reading of 27.6. The finished goods prices index moved up to 2.3, which the Dallas Fed said is consistent with “moderate price growth this month.”

In other words, Goldilocks has arrived in Dallas.

Hope and the Risk of Hope

So, business conditions are pretty bad, demand is falling, but manufacturers keep hiring. This, however, is not building further inflationary pressures that are showing up in wages or goods prices. We have to admit that the contradictions seem to be pointing to a soft landing.

Certainly, the Texas manufacturing companies seem to share this view. The expectations for future general business activity moved from -4.5 to positive 4.6, the first month in positive territory in more than a year. The future production index slipped to 15.5 but remains positive. The index for future new orders rose. The expectations barometer for capital expenditures was also up sharply.

There are, however, a few reasons to be cautious that the new optimism will last. There were sharp upticks in expectations for both prices of raw materials and finished goods. Solid majorities of manufacturers expect prices to keep moving higher over the next six months. Expectations of wage and benefits costs were also up. This raises the specter of a resurgence of inflation—which could prompt more Fed tightening than markets currently anticipate.

That’s is likely the biggest risk to markets right now: an upside surprise to inflation and interest rates that overturns the dream of immaculate disinflation.

Remember, Goldilocks was sleeping soundly, with her belly full of “just right” porridge, until the bears came home.

COMMENTS

Please let us know if you're having issues with commenting.