Wall Street Keeps Getting the Economy Wrong

The American economy grew at a defiant pace last year.

Predictions of an imminent recession were everywhere at the dawn of 2023. The Fed had raised interest rates seven times and were signaling more rate hikes ahead. Bond yields were inverted, the index of leading indicators had deteriorated for nine straight months, the money supply’s moonshot pandemic growth had reversed, and both bond and stock prices had seen a rare and punishing parallel plunge.

Excess household savings, built up during the pandemic, were thought to be near depletion. Bank lending standards were tightening. A Wall Street Journal survey found that more than two-thirds of economists at large financial institutions were predicting a recession. Goldman Sachs had one of the rosiest views of growth for the year, forecasting a one percent rise in gross domestic product.

The Federal Reserve itself was predicting a recession. The summary of economic projections released in December of 2022 showed that the median expectation for growth in 2023 had fallen from 1.2 to 0.5 percent. When the Fed had the opportunity to revise its view in March, it forecast even lower growth of 1.4 percent.

On Thursday, the Commerce Department’s Bureau of Economic Analysis said that gross domestic product rose 3.1 percent from the fourth quarter of 2022 through the fourth quarter of last year. The third quarter pace of 3.3 percent was much stronger than the two percent forecast by Wall Street and followed a 4.9 percent growth rate in the third quarter.

Where the Growth Came From

The biggest source of the upside surprise in the fourth quarter was household spending. Throughout the year, consumer spending defied predictions of a slump and the last three months of the year was no different. Household expenditures grew 2.8 percent and contributed 1.9 percentage points to the GDP figure. That’s nearly 60 percent of the growth.

The source of the strength of household spending is not exactly a mystery. The labor market has remained extremely strong, with unemployment at the lowest level in decades and hiring robust. Even though hiring has slowed, quits have leveled off, and job openings have come down, the labor market remains tight by historical standards. When households feel confident in their jobs, they spend freely.

Government spending was another source of growth last year. Robust government hiring helped keep payroll numbers up and feeds directly into household consumption. As Joe Lavorgna as SMBC Nikko Securities has shown, there has been a record large $3.3 trillion in cumulative excess (defined as above prepandemic trend) federal spending since Biden took the oath of office. Government spending in the third quarter grew at 3.3 percent annual pace, faster than expected. Federal non-defense spending grew 4.6 percent.

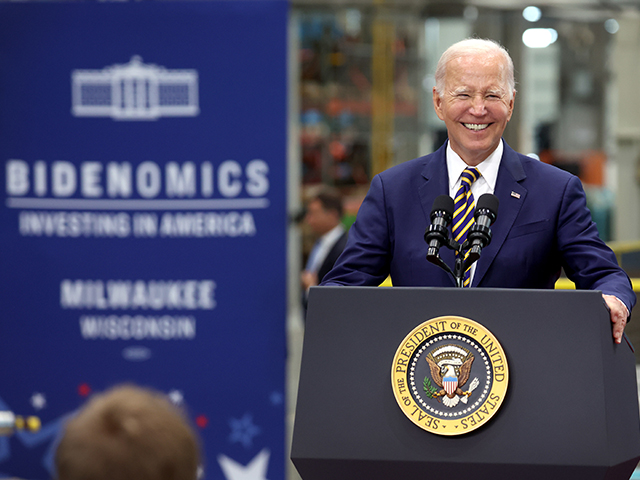

President Joe Biden speaks about “Bidenomics” on August 15, 2023 in Milwaukee, Wisconsin. (Scott Olson/Getty Images)

The total impact of Biden administration policies was even greater because various subsidies in the Inflation Reduction Act and the CHIPS Act were likely responsible for a good portion of the growth in structures investment, which expanded at a 3.2 percent pace in the fourth quarter and an 11.2 percent pace in the prior quarter.

This implies that the private sector may be weaker than the headline GDP numbers suggest. But it is not as simple as subtracting government spending driven growth from GDP because government spending and subsidies crowd out private investment. Some of the growth that was fueled by government in the past year would likely have been fueled by private sector spending and investment in a less spendthrift administration.

Our Year of Forecasting Dangerously

We took the other side of the recession forecast early on, pointing out in early January of 2023 that the forecasters were wrong about just everything in the prior year. The consensus view looked like it was based on flawed and dated views of the economy and was largely ignoring the strength of the labor market and household spending.

“Last year began with a consensus about markets, economic growth, and inflation that was wrong in every important aspect. It’s worth considering that this year’s consensus might not be any better,” we wrote.

By early February, we were writing that there were no signs the economy was likely to slip into a recession in 2023. “Retail Sales, Industrial Production, and Homebuilder Confidence Scream ‘No Landing’ March,” we wrote. In March, we noticed that revised information from the Fed showed that the money supply had grown for longer than preliminary data had shown, which likely meant that growth would hold up for longer.

As we also predicted, inflation remains a serious problem. Despite many proclamations that inflation has been defeated, the latest consumer price index (CPI) showed a year-over-year gain of 3.4 percent and core CPI was up 3.9 percent. Median CPI, our gold standard for underlying inflation, was up 5.1 percent through November (the latest figure available).

Now the consensus is that the economy will slow significantly this year and the Fed will cut five or six times. We’re still on the other side, dangerously forecasting more growth, fewer cuts, and more inflation than markets foresee.

COMMENTS

Please let us know if you're having issues with commenting.