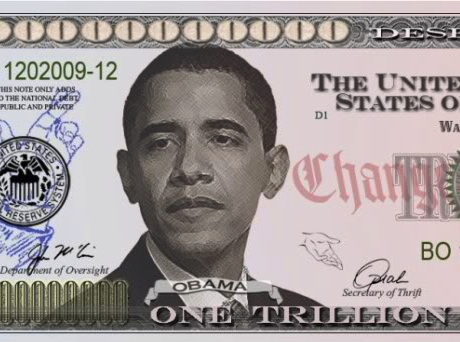

The trillion dollar coin is now apparently being taken seriously as an alternative way for the Obama administration to cover the gap between borrowing and spending by simply adding to the resources of the U.S. Treasury, and without convincing Congress to raise the debt ceiling.

Through a legal loophole that permits the government to mint platinum coins, President Barack Obama could produce a $1 trillion platinum coin, and bank it.

If he did so, the trillion dollar coin would join several other currency gimmicks that have been used–often by third-world kleptocracies, like California–to shore up failing fiscal systems and cover up massive spending and debt.

The U.S. has tended to avoid such currency games, aware that international creditors do not take them seriously. (The failure of the Continental currency in the Revolution also inspired the gold and silver clause in the Constitution, which prevents states from printing money to pay debts.)

However, we are breaking new ground every day in the “transformative” Obama presidency. As Mark Steyn put it recently: “We’re already broker than anyone has ever been ever. But this is America, where we can always do better–or anyway bigger, and broker.”

Here are some other examples of currency tricks–many of which ended badly:

Bearer cheque (Zimbabwe, 2000s) – Over the past ten years, as the regime of Robert Mugabe has terrorized the populace and destroyed the country’s once-prosperous economy, Zimbabwe has experienced hyperinflation–and cash shortages. To bridge the gap, the country’s central reserve bank issued “bearer cheques“–currency in large denominations that had specific expiration dates, and which did little to stop the crisis.

Argentino (Argentina, 2001) – In the midst of an acute financial crisis that had been somewhat exacerbated by the pegging of the Argentine peso to the U.S. dollar, the government suggested an interim, cash-only currency–the Argentino–whose value would float while preserving the official peso-dollar exchange rate. The dual-currency plan was merely a devaluation in disguise, critics argued, and was never implemented.

Wooden bills (Germany, 1920s) – During the world’s most infamous outbreak of hyperinflation, enterprising locals began printing their own “commemorative” currency on wood, silk, and other media. Not only was the currency good for local exchange, but it also tended to bring actual currency back into circulation as collectors bought up the novelty currencies. Needless to say, the currency was useless for international debts.

IOU (California, 2009) – As the state suffered a severe cash crunch, Gov. Arnold Schwarzenegger began printing registered warrants or “IOU’s” to its creditors, including individuals and small businesses to whom the state owed money. Large banks began refusing to accept them, and creditors scorned them. The crisis was relieved somewhat by the passage of a state budget–but California remains on the verge of bankruptcy.

Leaves (Douglas Adams, 1980) – In The Restaurant at the End of the Universe, the second book in the (fictional) Hitchhiker’s Guide to the Galaxy series, a race of mediocre space exiles crash-lands on prehistoric Earth. Wishing to be wealthier, they declare leaves legal tender (money grows on trees!)–leading to massive leaf hoarding and hyperinflation. The exiles agree to solve these problems through a large-scale deforestation campaign.

Image credit: Elephant Bar

COMMENTS

Please let us know if you're having issues with commenting.