House Democrats approved hundreds of billions of dollars in tax cuts for their wealthy, blue state donors with the passage of President Joe Biden’s “Build Back Better Act.”

On Monday, House Speaker Nancy Pelosi (D-CA) oversaw the passage of the filibuster-proof $1.75 billion budget reconciliation package that would deliver billions in tax breaks to the wealthiest residents of blue states if approved by the Senate and signed by Biden.

As part of the package, the State and Local Tax (SALT) deduction cap would be increased from its current $10,000 to $80,000 which would effectively amount to a $625 billion tax cut for the wealthiest Americans living in blue states — paid for by working and middle class Americans.

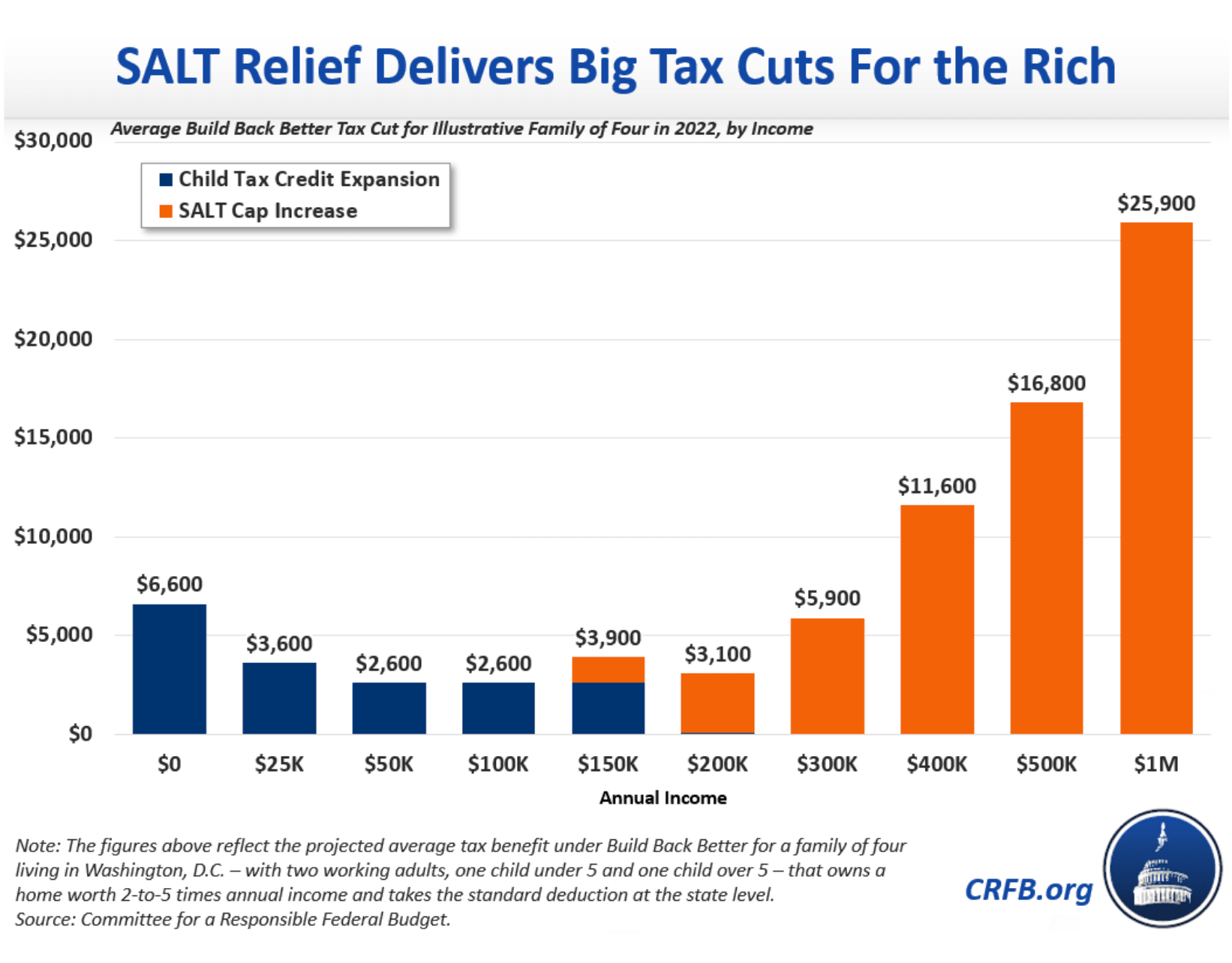

The Committee for a Responsible Federal Budget (CRFB) has noted that “a household making $1 million per year will receive ten times as much from SALT cap relief as a middle-class family will receive from the child tax credit expansion.”

“Roughly 98 percent of the benefit from the increase would accrue to those making more than $100,000 per year, with more than 80 percent going to those making over $200,000,” CRFB analysis has found.

The left-wing Tax Policy Center has assailed the tax cuts for billionaires, comparing it to the package’s tax increases on middle class Americans.

For instance, the package gives a tax cut to 66 percent of Americans earning more than $1 million annually while 78 percent of Americans earning $500,000 to $1 million will get a tax cut. At the same time, 27 percent of Americans earning $75,000 to $100,000 would see a tax increase along with 19 percent of Americans earning $50,000 to $75,000.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

COMMENTS

Please let us know if you're having issues with commenting.