The Federal Reserve’s preferred inflation gauge showed consumer prices were up 6.6 percent in March compared with a year earlier, indicating that inflation accelerated from the 6.4 percent pace recorded in February, according to data from the Bureau of Economic Analysis released Friday.

Economists had expected an even larger gain of 6.8 percent. Despite coming in lower than the consensus forecast, the jump in prices in March is likely to confirm the view that the Federal Reserve will have to act aggressively in the months ahead to bring inflation down toward its two percent target.

This was the largest year-over-year gain since 1982.

Compared with February, the personal consumption price index rose 0.9 percent, matching the consensus forecast.

The personal consumption price index is produced by the BEA, a unit of the Department of Commerce. It tracks a larger basket of goods and services than the better-known Consumer Price Index, which is compiled by the Department of Labor’s Bureau of Labor Statistics. It takes into account when consumers substitute cheaper goods for more expensive ones, like buying frozen juice for fresh. Some say that makes it a better measure of consumer spending while others say this means it undercounts the impact of inflation on the cost of living.

The Fed uses the personal consumption price index as the barometer for its inflation target and its forecasts. It particularly focuses on so-called core PCE inflation, which excludes food and energy costs.

Core inflation rose 5.2 percent in March, slightly lower than the 5.3 percent recorded in February. That’s the first decline in year-over-year core PCE inflation in more than a year. The tick down suggests that the high price of food and fuel may be hurting consumers’ ability to afford other items.

The month-t0-month measure, however, did not decline and showed a 0.3 percent gain.

The Fed will meet next week to assess the economy and announce changes in interest rates and monetary policy. It is widely expected to raise its target rate for overnight interbank loans and interest it pays on reserve by half a percentage point. That would put the rate at a range of 0.75 percent to one percent. The Fed is expected to raise rates at a similar pace at subsequent meetings this year.

Prices have soared because the Biden administration pushed through extraordinary spending measures, in the form of the American Rescue Plan, even when the economy had already begun to recover from the pandemic slump last year. This is why many now have nick-named the current period of escalating prices “Bidenflation.” The Biden administration’s push for even more spending in the form of the infrastructure bill that passed and the social spending bill that stalled also likely contributed to inflation by raising the chances that deficit spending would stay high for longer.

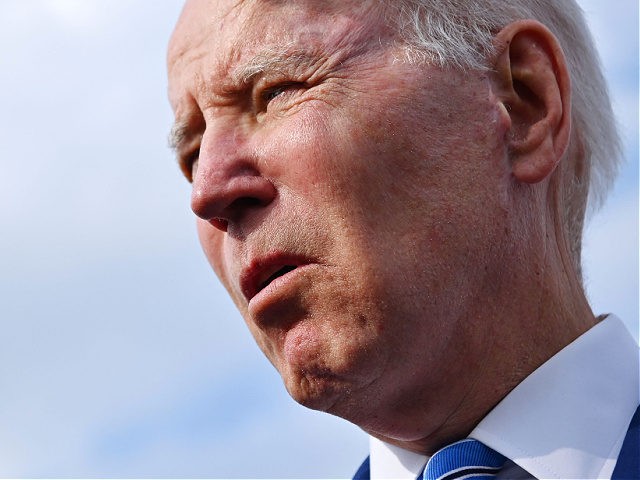

President Joe Biden has sought to avoid blame for high prices by passing the buck. At first, his administration attempted to blame corporate greed. More recently, Biden has taken to referring to inflation as “Putin’s price hikes,” trying to link inflation to the invasion of Ukraine. Polls show the public are not persuaded and continue to think the U.S. president bears responsibility for inflation triggered by profligate fiscal policy.

The Federal Reserve and Fed chair Jerome Powell also contributed to inflationary pressures by holding rates low for too long, continuing to expand the central bank’s balance sheet, and inaccurately insisting that inflation was transitory throughout most of last year. Most analysts now believe this left the Fed “behind the curve,” forcing the central bank to raise rates more rapidly and to a higher terminal rate than it would have if it had recognized the inflation problem earlier. This, in turn, is contributing to expectations that the economy will fall into a recession due to Fed hikes—or even that a recession may be necessary to stem inflation.

COMMENTS

Please let us know if you're having issues with commenting.