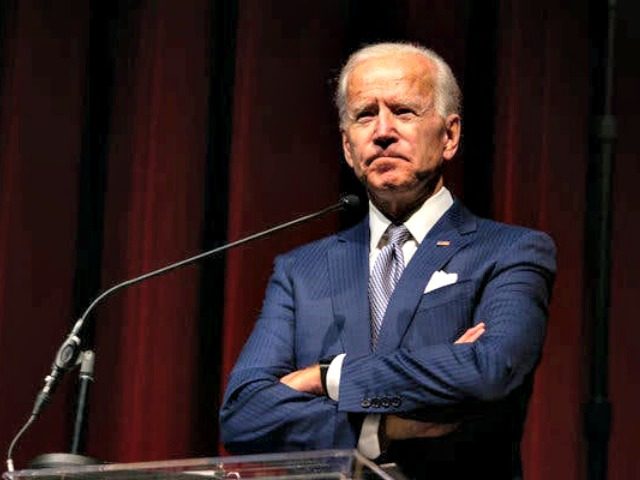

David Bahnsen, chief investment officer at The Bahnsen Group, discussed House Speaker Kevin McCarthy’s (R-CA) debt ceiling success earlier in the week and said President Joe Biden “will have to” negotiate with Republicans as a result.

Breitbart News Saturday host Matthew Boyle began the interview by discussing McCarthy’s recent success in passing debt ceiling legislation through the House. Then, Boyle asked Bahnsen to talk about what he expects to happen next and whether he anticipates Democrats coming to the negotiating table.

LISTEN:

Bahsen praised McCarthy for passing the legislation with “a much tighter House than” former Speaker John Boehner (R-OH). He said he expects the political pressure to force Biden to negotiate.

“And so many people just thought McCarthy wouldn’t get it done, and then there wouldn’t be no reason that Biden would have plenty of political cover to not put spending cuts through as an exchange for raising the debt ceiling. So I do think that the political pressure now reverts, there’s no chance, obviously, that the Senate is going to do this. But I do think you’ll have three or four senators that now tell the Biden White House, ‘Hey, you gotta go talk to McCarthy and you guys ping and pong this thing around a little bit, and we’ll end up with some form of spending reductions.’ So the politics of it moves substantially in Speaker McCarthy’s favor this week,” Bahnsen said.

Although Bahnsen noted the low unemployment rate, he criticized Biden’s economy for being on the verge of a recession amid a quarter with “very low economic growth.”

“You have a massive $31 trillion national debt that is built up under the last four presidents, that is a disaster. And you have very low economic growth. We’re not quite in recession right now. But we just found out this week that we got 1.1 percent Real GDP growth, annualized for the first quarter, annualized 1.1. And this is supposed to be the strongest quarter of the year. So we’re going to be, if he doesn’t go into recession this year, it’s going to be basically flat economic growth. This is an economy that should be growing at three to four percent net of inflation every year. So it isn’t a strong economy,” he said.

However, he faulted the Federal Reserve for keeping interest rates “excessively low” for too long and then “drastically” raising them.

“The Fed has done a number on us. And this isn’t something that Democrats can blame President Trump or are Republicans to blame President Biden, the central bank, this country has drastically distorted the economy,” Bahnsen said.

Bahsen explained that the Fed’s interest rate hikes are leading to some of the bank failures we see today.

“And by being too low for too long, excessively low interest rates, they built up a lot of excesses that now have to come out. We saw it last year with Bitcoin collapsing the stock market, S&P dropped 20%, Nasdaq dropped 35%, a bunch of really kind of overpriced, ridiculous stocks fell 70%. So a lot of those excesses started to come out last year. But now this year, it appears to be on the banks. Banks can’t make money if they have to take deposits that they pay at zero percent, but then lend money out at two percent. And then all of a sudden, deposit rates have to go up. That’s what’s happened. The Fed raised rates so quickly, so high, the banks are in a very difficult position,” he explained.

However, Bahnsen said we are “not even remotely” close to a 2008-level financial crisis because the “big banks are benefiting from what’s happening.”

“This is what they … Dodd-Frank is helping to build that up. The deposits are not leaving Silicon Valley Bank and First Republic Bank, which were both respectively between the 10th and 20th biggest banks, right? I think Silicon Valley was 16. First Republic 12 signature was somewhere around 20. Yes. So these are mid-tier banks that their deposits are leaving to go to the big, you know, Wells, Citi, J.P., etc. Their balance sheets are huge. They’re perfectly well capitalized. There’s no liquidity mismatches. Those banks are very strong,” Bahnsen added.

He criticized the Fed for “playing catch-up” and believing “that they are supposed to be the ones to help control the knob of how hot or how cold the economy is.”

He then discussed his recent op-ed in the Wall Street Journal titled “My Bid to Make JPMorgan Less Woke.”

As a shareholder with more than $100 million of J.P. Morgan stock through his investment firm, Bahsen explained his idea to get the banking giant to investigate purported claims of “debanking” against conservatives and Christians in America.

“I didn’t say I want you to stop doing things for woke people. And I didn’t say I want you to start doing really crazy things for my people, for the right for Christians, for you know, conservatives. All I said was you guys ought to run a study to evaluate if there has been discrimination against groups based on their political or religious beliefs. Because there’s a lot of stories that there have been, and there’s circumstantial evidence to think that’s been going on. And if you guys are really serious about not discriminating against people because of race, gender, and sexual orientation and all the other things, great, well, let’s make sure you’re also not discriminating on the basis of religion or politics,” Bahnsen said.

“The firm said, ‘No.’ We appeal to the SEC. And shockingly, the SEC took our side and said you know what? He has every right for this to be on there,” he explained.

“So my resolution is on the docket at the May 16 shareholder meeting, I get to give a three minute speech to shareholders, their board has opposed, it is unlikely to pass, but what will end up happening now, this has been significant public airing dialogue engagement,” Bahnsen added.

Breitbart News Saturday airs on SiriusXM Patriot 125 from 10:00 a.m. to 1:00 p.m. Eastern.

Jordan Dixon-Hamilton is a reporter for Breitbart News. Write to him at jdixonhamilton@breitbart.com or follow him on Twitter.

COMMENTS

Please let us know if you're having issues with commenting.