Breitbart Business Digest: There Are No Fed Cuts Ahead This Year

It is unlikely that the Fed will cut rates at all this year; and, if inflation stays hot, it may find that it will need to begin a new cycle of rate hikes sometime next year.

It is unlikely that the Fed will cut rates at all this year; and, if inflation stays hot, it may find that it will need to begin a new cycle of rate hikes sometime next year.

The pace of economic growth in the first three months of the year was far more sluggish than anyone expected—and inflation was much higher.

On Wednesday’s broadcast of CNBC’s “Squawk Box,” Professor of the Practice of Economic Policy at Harvard University and the Harvard Kennedy School Jason Furman, who served as Chairman of the Council of Economic Advisers under President Barack Obama and on the

As is so often the case with Bidenomics, even good news is bad news because of the upward inflationary pressure.

Jerome Powell spoke today from our nation’s capital and indicated what we all know to be true: The Fed has no business cutting rates at this time.

Delinquency rates among American credit card holders are at an all-time high, according to a Federal Reserve Bank of Philadelphia report.

The victory over inflation that the Biden administration and many on Wall Street were eager to celebrate last year now seems to have been, well, transitory.

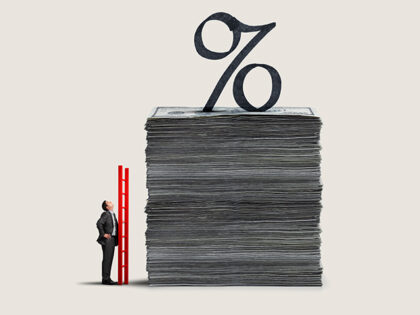

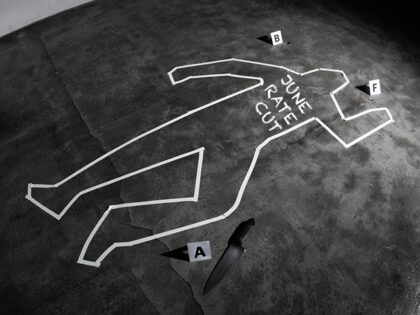

The dream of a June rate cut is dead.

In the economic seas we’re currently navigating, the idea of a Fed rate cut is starting to look like a theoretical exercise detached from the practical realities on the ground.

The Atlanta Fed said inflation is falling much more slowly than expected, so the Fed will probably not cut rates until the end of the year.

The potential that the Fed’s next move is up instead of down is arguably the most underpriced risk in the market.

The job of rebuilding the collapsed Francis Scott Key Bridge in Baltimore is going to take a lot longer than many people initially thought—and cost a lot more money.

During an interview aired on Friday’s edition of Bloomberg’s “Wall Street Week,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers stated that the “huge set of

The latest dispatch from the Federal Reserve left the expected path of interest rates over the next year unchanged. Yet it hinted at a potentially tumultuous shift beneath the calm facade, a shift to a higher rate of interest over the long term.

Fed officials now expect it will take slightly higher interest rates to get inflation down to their two percent target and to keep it there.

When Jerome Powell steps into the congressional coliseum to deliver his semi-annual testimony to the House and Senate, he is very likely to be met with an aggrieved chorus of Democratic lawmakers arguing that monetary loosening is long overdue.

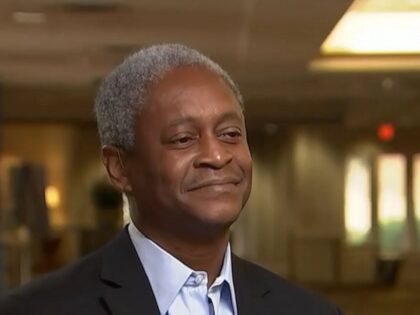

Raphael Bostic warned on Monday that a premature Fed cut could spark an economic boom that would send inflation higher again.

Fed Governor Christopher Waller argues that there is no reason to fear that we are sailing into a recession, which is the thing that usually prompts rate cuts from the Fed.

New home prices in China slipped again in January, and existing home sales slipped even more, notching the steepest decline in nine years.

The decision of the Fed to start cutting interest rates bears a strong resemblance to the decision to marry. It can be reversed but only with a great deal of awkwardness, some economic difficulty, and often a reputational cost.

The disinflationary forces that convinced so many that we were marching into a period of easing have receded. When Wall Street will recognize the pattern on the wall is still an open question.

The evidence is mounting, as solid and as undeniable as the ground beneath our feet. Inflation is here, it’s real, and it’s time to pay attention.

Inflation, having long since overstayed its welcome, announced on Tuesday that it was just getting comfortable.

The Federal Reserve justifiably received a lot of criticism for its tardy response to the surge of inflation. Now its critics accuse it of being too hesitant to lower interest rates.

The economy appears to be able to operate at a high rate of growth with interest rates that would have been seen as highly restrictive in the pre-pandemic era.

Fed officials continue to push back against the market’s forecast for an aggressive cutting cycle this year.

The most underpriced risk in financial markets right now is a rate hike from the Federal Reserve.

The possibility of an interest rate hike is “the most underpriced risk in the market right now,” Breitbart Economics Editor John Carney told Fox Business host Larry Kudlow.

The Bond Market Is Like a Dog Walking on Two Legs We have it on the authority of James Boswell that in the summer of 1763 Samuel Johnson said that “a woman’s preaching is like a dog’s walking on his

The surprisingly strong January jobs report reflects real employment and productivity growth and not just growth in government or government-adjacent hiring, Breitbart Economics Editor John Carney told Fox Business host Larry Kudlow.

The much-better-than-expected jobs data for January demonstrates that the Federal Reserve was absolutely right this week to rule out a March rate cut. Even a May rate cut now looks unlikely.

Jerome Powell’s No Cut Thunderbolt Groucho Marx famously said he would not join any club that would have him. What happens, however, when the club joins you? We have been arguing since early December that economic growth was too strong

Will the Fed defend the position it staked out in December or capitulate to the view of bond traders?

The economy is signaling that it does not need a rate cut to keep growing. The question is whether the Federal Reserve is listening.

This week’s economic data very likely pushed the timing of a rate cut further out on the calendar.

Despite all of the data and the statements from Fed officials, the market has clung to the conviction that a rate cut is coming as early as March.

Nothing in the latest economic data provides a justification for the Federal Reserve to cut interest rates after its March meeting, Breitbart Economics Editor John Carney told Fox Business host Larry Kudlow.

The American consumer’s strength may be the force that wrestles the market out of the conviction that the Fed will cut interest rates this March.

The prospects of a soft landing for the economy is no reason for the Federal Reserve to rush into rate cuts.

The basic premise behind the conviction that the Federal Reserve will start cutting rates in the first quarter of next year is looking shakier.