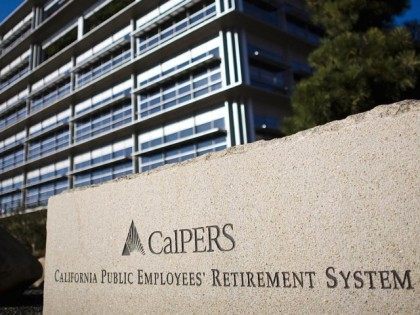

Hackers Steal Private Data of 769,000 CalPERS Retirees

The California Public Employees’ Retirement System (CalPERS) reported Wednesday that hackers stole names, social security numbers, birth dates and other confidential information of roughly 769,000 retirees and beneficiaries.