A white paper from investment advisory corporation RegentAtlantic finds that New Jersey is losing high percentages of its revenue to wealthy residents moving out to states like Pennsylvania and Florida in the hopes of escaping the highest taxes in the nation.

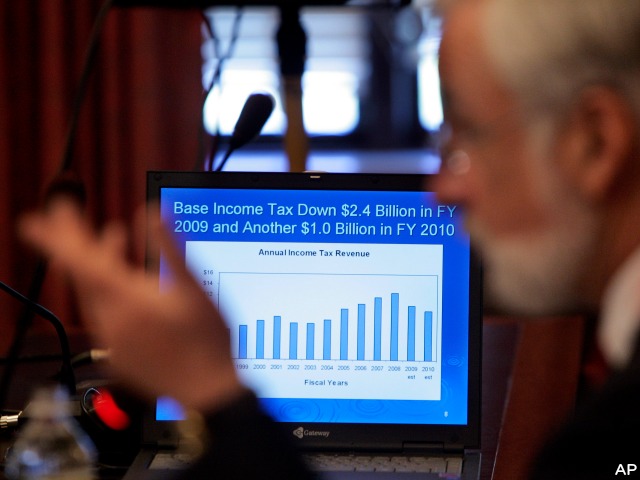

New Jersey reached record levels of debt last year and Moody’s lowered its outlook for the state, citing insufficient revenue to maintain the burdensome state infrastructure that boasts an unwieldy number of public pensions and municipal governments. Moody’s chided Chris Christie’s administration for its “sluggish” recovery from the late-2000s recession and blamed the state’s insufficient revenue for the problem. As a result, Democrats in the state are pushing for higher taxes on the wealthy to generate more revenue.

RegentAtlantic finds in their recently-released white paper that much of the reason for the low revenue intake is that the state’s tax burden is disproportionately upon the shoulders of the wealthy, a high percentage of which are simply moving out and taking their money with them.

While a steady trickle of wealthy New Jerseyans began to leave the state at the turn of the century, the exit was exacerbated by 2004’s state “millionaire’s tax,” an increase in taxes that creates a situation for the wealthy where they owe New Jersey more taxes than they do the federal government annually. The millionaire’s tax puts those who make over $1 million a year in their own heavily taxed bracket. The study finds that, after the passage of the millionaire’s tax, “the net outflow during this period reversed 70% of the wealth gained in the prior four years.”

New Jersey’s property taxes are also the highest in the nation, and the state takes both an inheritance and estate tax from those who inherit more than $675,000 in real estate, securities, or cash, plus a charities tax for those giving non-profits any sizable donation. One attorney told RegentAtlantic that the limit might seem high, but it “means that if you have a small pension and you have a house in Morris County you are very likely over that limit.” Another attorney estimated that “about 95%” of his clients from New Jersey had stopped doing business there.

The taxes have taken a toll on the high-income population of the state. New Jersey lost 87,630 tax returns to other states between 2009 and 2010, a $5.5 million taxable revenue drop for the state. 70% of those losses were to Pennsylvania and Florida, states with significantly lower tax burdens on the wealthy; Florida also has no estate tax.

New Jersey’s government tax revenue is not the only income impacted by the wealthy fleeing the state. Other wealthy professionals who would be making enough to carry some of the burden find themselves leaving, as well, because their client pool in the state has diminished. This, the study finds, is true of many lawyers, accountants, agents, and other individuals whose clients are mostly in high income brackets. “When people move out of New Jersey,” the study finds, “the state not only loses the tax revenue from that person, it may also lose revenue because the income of other New Jersey professionals is likely impacted.”

Charities also lose out, as much of their revenue comes from philanthropic high-income individuals who can afford donations. Aggregate charitable donations decreased since the implementation of the millionaire’s tax, and the study found that many accountants and attorneys have told their clients to donate to charities outside of New Jersey to avoid the tax burden.

The study does not provide an answer to the problem, though it notes some of the potential sources: more and higher paid police officers than anywhere in America and more municipalities than any similarly-sized area in the country. More municipalities means more public officials to pay from a tax pool that is shrinking. Naturally, the study concludes that attracting wealthy New Jerseyans back to the state is a start, and lowering taxes is key for that.

As revenues continue to dwindle and New Jersey teeters on the brink of economic crisis, the state’s tax code will be at the forefront of government reforms.

Read RegentAtlantic’s full white paper here.

COMMENTS

Please let us know if you're having issues with commenting.