Sendai (Japan) (AFP) – A deep divide over currency policy bubbled over at a G7 meeting in Japan on Friday as a senior US Treasury official warned against Tokyo’s bid to tame the resurgent yen.

Japan, which is hosting the two-day talks, is keen to win an endorsement for its position that fiscal stimulus is the way to kickstart the world economy, after a rally in the yen hit exporters and worsened a slowdown at home.

But Tokyo’s recent threat of a market intervention to reverse the rally is putting it on a collision course with its G7 counterparts, including the United States and Germany, which have ruled out such moves.

On Friday, a senior US Treasury official said the yen’s strengthening did not justify Tokyo manipulating its currency.

“The notion that exchange rate targeting is being used creates a whole different set of questions in terms of reason for it,” the official told reporters.

“If the perception or the reality is that (intervention) is for gaining unfair advantage, that is very disruptive to the global economic system.”

French Finance Minister Michel Sapin has also waved off the idea of countries gaining a trade advantage by manipulating their own currencies.

“Today we are in a cooperation phase, and not in an intervention or a currency war phase,” he told AFP in an interview.

The G7 group — also including Britain, Canada, and Italy — is also focused on using the talks to hammer out a strategy for keeping a global recession at bay.

In April, the International Monetary Fund cut its world growth forecast for the third time in less than a year, as a slowdown in China and other emerging economies raised fears that the worst was yet to come.

“Proactive financial policies and monetary easing are necessary, but not enough,” said Ivan Tselichtchev, an economics professor at Japan’s Niigata University of Management.

“The G7 has to do more to pursue structural reforms, to raise economic efficiency… to boost investment, including investment from large emerging countries.”

– Money laundering –

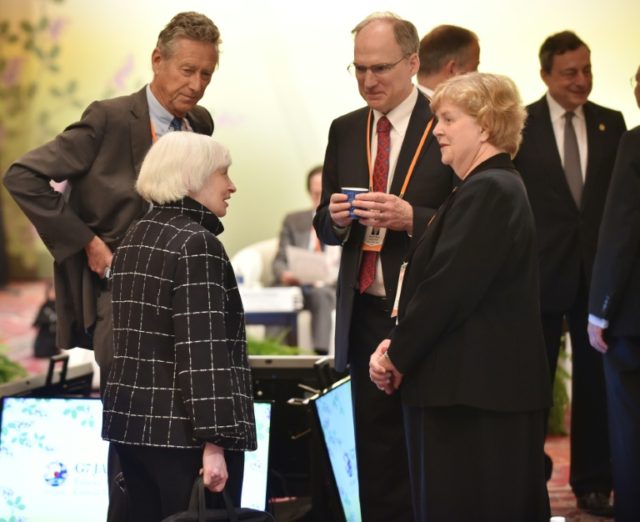

US Treasury Secretary Jacob Lew, Federal Reserve chief Janet Yellen, European Central Bank president Mario Draghi and IMF chief Christine Lagarde are among the others at the meetings in a hot spring resort in Sendai, an area battered by the 2011 quake-tsunami.

Other items being discussed include terrorist financing and offshore tax havens at the heart of the Panama Papers investigation.

A debt relief deal for Greece and Britain’s referendum on its future in the European Union are also hot topics.

European Economic Affairs Commissioner Pierre Moscovici said negotiators were “very close” to reaching an agreement over cash-strapped Greece.

“We are approaching a crucial moment in these discussions and I am confident and hopeful that we can reach a positive conclusion because it is simply in everyone’s interest to do so,” Moscovici told a news briefing at the G7 meeting.

“We’re very close, very, very close.”

However, finding agreement on how the group can stimulate their own economies, and global growth, could be a different story.

Japanese Prime Minister Shinzo Abe’s pitch for large-scale stimulus spending got a cool response from German Chancellor Angela Merkel and British Prime Minister David Cameron this month.

Merkel suggested Germany was already doing its part to put the global economy back on track, pointing to the extra economic activity generated by the arrival of one million refugees and migrants last year.

Her Finance Minister Wolfgang Schaeuble this week pointed to reforms as the way forward, rather than focusing on more government spending and monetary policy.

The finance ministers’ meeting comes a week before a G7 leaders’ summit in Ise-Shima, a region between Tokyo and Osaka.

After that meeting, Barack Obama will go to Hiroshima in a hugely symbolic trip as the first sitting US president to visit the nuclear-bombed city.

COMMENTS

Please let us know if you're having issues with commenting.