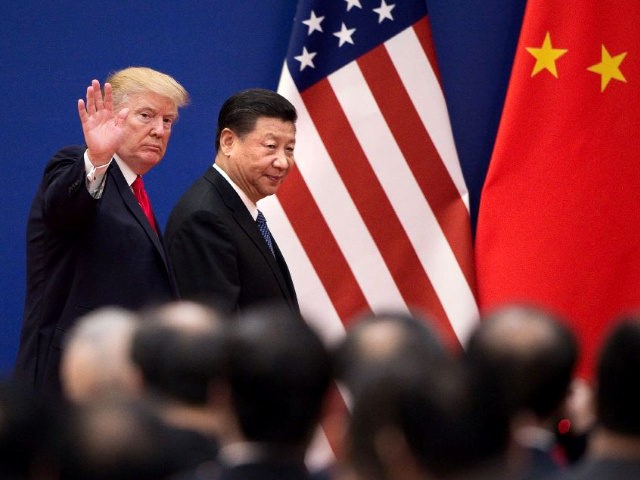

One of the dirtiest little secrets about the Chinese Communist Party (CCP) and its success in amassing immense power to oppress its own people and increasingly to threaten ours has just been exposed by President Donald Trump: We have been underwriting and, thereby, enabling it.

In a decision last week, Mr. Trump – to his great credit – made plain this outrage and took a vital first step towards ending it. Now, we must finish the job.

The urgently needed impetus to do that was provided when Donald Trump intervened personally to prevent the federal Thrift Savings Plan (TSP) from investing an estimated $4.5 billion in CCP companies currently registered in, and transferring immense wealth from, our capital markets to pay for their activities on behalf of “the motherland.”

Some of those malevolent activities include providing the means by which the Party is able to monitor all aspects of the lives of 100 million Christians – and countless Uighur Muslims, Tibetans, Buddhists, and other Chinese – and to use such data brutally to repress them.

Other CCP corporations selling stocks and bonds on Wall Street build weapons designed to kill our men and women in uniform. Some of them are being bought to destroy the rest of us and our country.

Some of the Chinese companies raising money in our capital markets have actually been sanctioned by the U.S. government. Unbelievably, it may be illegal to do business with them, but it’s not illegal to invest Americans’ pension funds, college endowments, and personal savings so as to allow such proliferators and human rights violators to continue doing business.

Fortunately, in executing the President’s stand-down order to the board that oversees the Thrift Savings Plan, National Economic Council Chair Lawrence Kudlow and National Security Advisor Robert O’Brien implicitly made clear in writing why it is unacceptable to have CCP companies like these getting money from any Americans, not just federal government employees, past and present, and their military counterparts:

This action would expose the retirement funds to significant and unnecessary economic risk. And it would channel federal employees’ money to companies that present significant national security and humanitarian concerns because they operate in violation of U.S. sanction laws and assist the Chinese Government’s efforts to build its military and oppress religious minorities.

[…]

The financial impact of this risk is significant: scandals involving Chinese companies in recent years have cost investors billions of dollars.

Then, Messers. Kudlow and O’Brien explained how this could possibly be happening: “The Chinese government currently prevents companies with Chinese operations listed on U.S. exchanges from complying with applicable U.S. securities law, leaving investors without the benefit of important protections.”

The trouble is that, to date, the institutions American and other investors the world over rely upon to provide such protections and, in so doing, make our capital markets secure and attractive – namely, the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB) – have allowed the Chinese Communist Party to get away with refusing to play by our rules.

Until now.

What should have been unacceptable conduct thus far, is today – especially in the wake of the CCP virus and the other, burgeoning evidence of Communist China’s enmity towards us –intolerable.

Consequently, 51 former senior U.S. government officials and legislators, influential financial sector figures, China experts, religious leaders, and other patriots have just issued an open letter urging that President Trump’s logic in the microcosmic TSP case be applied to the nation’s capital markets more broadly. Signatories of the open letter organized by the Committee on the Present Danger: China (CPDC) and sent on May 17th to SEC Chairman Jay Clayton and PCAOB Chairman William Duhnke wrote (emphasis in the original throughout):

We welcome the President’s decision and strongly second the concerns he has rightly expressed about the lack of transparency, PCAOB covered audits and material risk disclosure by Chinese companies in our capital markets. The Chinese Communist Party’s claims that corporate financials and other such data are “state secrets” only raise further questions about the advisability of giving its corporations a pass on conforming to the same statutory and regulatory standards that registered American companies are required to meet. Put simply, Chinese companies are today receiving preferential treatment over their American corporate counterparts on your watch.

[…]

The country needs strong leadership on this issue now. We believe President Trump has defined the requirements for Chinese companies to enjoy the benefits of having access to our capital markets. It is up to you both to enforce these requirements and genuinely protect American investors, as well as our national security and fundamental values, by ensuring that the risks associated with investing in Chinese Communist Party-tied securities registered with the SEC and listed on U.S. capital markets are as transparent and disclosed as are those of the registered securities of American corporations.

Federal regulators must heed this urgent call for ending the preferential treatment they have thus far accorded Chinese Communist Party companies. Otherwise, similar, bipartisan efforts in Congress – notably those being mounted by Senate Banking Committee members John Kennedy (R-LA) and Chris Van Hollen (D-MD) – will likely shortly compel them to do so.

By acting voluntarily and promptly to make the Communist Chinese companies play by our rules, Messrs. Clayton and Duhnke and their respective institutions will make a signal contribution to performing their statutory duties of protecting the integrity of our capital markets and prevent real reputational harm to U.S. exchanges that, as the open letter put it, “have long been and must remain the gold-standard for the financial world.”

Frank J. Gaffney acted as an Assistant Secretary of Defense under President Ronald Reagan. He is currently the Vice Chairman of the Committee on the Present Danger: China.

COMMENTS

Please let us know if you're having issues with commenting.