Holiday Joy: Thanksgiving Meal Costs Decline To Lowest In Four Years

After years of Bidenflation raising prices at a staggering pace, American families are enjoying a less pricey Thanksgiving meal this year.

After years of Bidenflation raising prices at a staggering pace, American families are enjoying a less pricey Thanksgiving meal this year.

This week, the government finally revealed the September jobs data, and we learned about the mysterious resignation of yet another Fed official.

Tariffs paired with immigration policy, capital policy, and monetary policy are tools for breaking a low-wage equilibrium and pushing the economy toward more capital, more productivity, higher real wages, and a cooler price path.

“For too long we had trade negotiators that so believed in the fake idea of free trade over fair trade that they were willing to sell American workers down the river without actually negotiating in the interest of American workers,” Vance said.

The better-than-expected jobs report released Thursday shows that the Trump administration’s economic policies are working, Vice President JD Vance said.

More than twice as many as expected.

The new San Francisco Fed paper on tariffs opens the door for using customs duties in a way that the economics profession has almost never considered: as a macroeconomic policy tool.

Survey results released by the Federal Reserve Bank of Atlanta show that businesses have largely accepted that tariffs do not pose a risk of higher inflation.

The Federal Reserve spent 2025 worried about the wrong problem, mistakenly holding back on rate cuts out of fear that Trump’s tariffs are an inflation threat.

Year-t0-date, factory orders are up a solid 3.3 percent compared with the January through August period a year earlier.

“While underlying demand in the business remained relatively stable sequentially, an expected increase in demand in the third quarter did not materialize,” CEO Ted Decker said in the company’s earnings announcement.

A new paper from the Federal Reserve Bank of San Francisco suggests that the economic establishment’s narrative that tariffs drive up inflation is wrong.

Renaissance Macro economist Neil Dutta says the Federal Reserve is on the verge of making a serious policy mistake as various officials drift toward keeping rates steady instead of cutting next month.

The Census Bureau reported that construction outlays reached an annualized pace of $2.17 trillion, up 0.2 percent from July’s revised $2.165 trillion figure. The result beat economist expectations for a 0.2 percent decline.

Manufacturing activity surged across New York State in November, with a key Federal Reserve survey showing unexpected strength as business conditions hit their best level since last November and manufacturers expressed confidence about the months ahead.

The Federal Reserve released research proving its own rate-holding decision was based on a theoretical mistake.

Researchers at the Federal Reserve Bank of San Francisco examined major tariff changes from 1870 through 2020 across the United States, United Kingdom, and France. Their conclusion challenges the conventional wisdom that dominated economic policy debates in recent years: when countries raise tariffs, prices actually fall, not rise.

The Trump administration is floating an idea that sounds intuitive to a lot of people: portable mortgages.

Federal Reserve hawks may be on the verge of making a reckless bet based on incomplete information.

American companies operating in South Korea say the country’s antitrust regulator has turned enforcement into a political tool that unfairly targets them while protecting domestic competitors, according to a report released Wednesday by the National Bureau of Asian Research (NBR).

The 50-year mortgage risks converting a generation of would-be homeowners into highly leveraged tenants of their own dreams—a generation of owners in name but renters in substance.

The National Federation of Independent Business said Tuesday that its optimism index fell six-tenths of a point to 98.2. Five of the 10 components that make up the benchmark declined while four climbed.

American companies are freely purchasing Chinese AI services while Chinese companies have zero ability to purchase American AI services. That’s exactly the sort of one-way trade barrier that President Trump has promised to end.

The white collar workers in Brooklyn who elected Zohran Mamdani are experiencing the economic displacement felt by blue collar workers in the Rust Belt three decades ago. They are the natural next chapter of the Make America Great Again coalition.

Zohran Mamdani won big because he tapped into something that cuts across traditional class boundaries: a pervasive sense that the fundamental bargain of American economic life has broken down.

Key conservatives join liberals in doubting use of emergency law to impose duties on over 100 countries.

ADP report shows 42,000 jobs added, ending two-month decline.

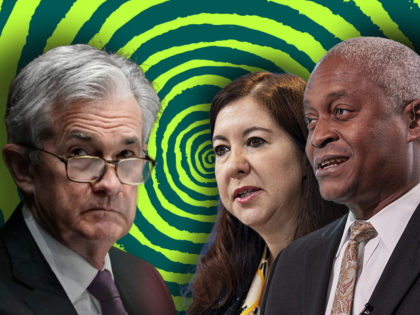

Yesterday we explored how the battle over rate cuts has scrambled old alliances inside the Federal Reserve. Today we look closer at what’s driving that split and what it means for markets.

Notably, the data shows no evidence of a sudden slump or worsening in October. The month’s decline of approximately 1.6 points is consistent with the 1-to-2-point monthly decreases observed since the 2022 peak.

Donald Trump gained an unexpected ally Monday in his fight with the Federal Reserve: Governor Lisa Cook, the Fed official he attempted to fire this summer.

The U.S. government announced a $1.4 billion partnership Monday with Vulcan Elements and ReElement Technologies to build a domestic rare-earth magnet supply chain, marking one of the Trump administration’s most significant investments in reducing America’s dependence on Chinese critical minerals.

U.S. manufacturing surveys released Monday showed welcome signs of easing inflationary pressures, with both major purchasing managers’ indexes reporting slower rates of price increases in October—a potentially encouraging signal for Federal Reserve policymakers as official government economic data remains unavailable

This is the Breitbart Business Digest weekly wrap, where we tell scary stories about this week’s economic news.

Retailers are rolling out discounts on Hershey chocolates and other sweets, giving consumers a rare break from rising prices, according to a Reuters report.

The recent Harvard Business School study on tariffs is deeply flawed in ways that undermine confidence in its findings.

Each year, more of what Americans buy is made abroad, and more of what Americans earn comes from borrowing that replaces the income lost to trade. The system sustains itself not through productivity but through the continual creation of dollar assets.

The Federal Reserve reduced its interest rate benchmark by a quarter-point for a second time this year on Wednesday, bringing the short-term borrowing rate to a range of 3.75 percent to four percent.

The U.S. fiscal deficit is the mirror of the trade deficit. Attempts to close one without addressing the other merely shift the imbalance around the balance sheet.

Consumer confidence slipped slightly in October, marking the third consecutive monthly decline, though Americans showed modest improvement in their views of current economic conditions even as concerns about the future intensified, according to data released Tuesday by the Conference Board.

Amazon is preparing to cut as many as 30,000 corporate jobs beginning Tuesday as it looks to rein in expenses after pandemic-era overhiring, according to people familiar with the matter cited by Reuters.