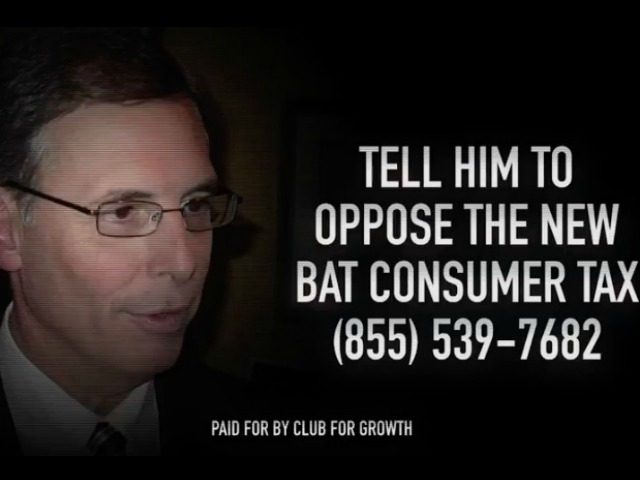

The Club for Growth released a new digital ad campaign urging four Republicans to oppose the House leadership’s border adjustment tax.

Club for Growth President David McIntosh said, “All of the good progress Congress is poised to make on tax reform could be sunk if Republicans persist in creating a new trillion-dollar consumer tax. The BAT would drive up prices on everyday items for typical American families. Constituents in these four districts should urge their Representative to oppose the BAT, which would slam hard-working families with a massive new tax.”

The advertising campaign will run on TV and digital platforms as part of a $500,000 ad buy starting Tuesday in the districts of the following House members:

- TN-06 Diane Black

- AL-02 Martha Roby

- SC-07 Tom Rice

- TX-07 John Culberson

The conservative action group launched ads against House Budget Chairman Diane Black (R-TN) and Congressman John Culberson (R-TX), an appropriations subcommittee chairman. The ads accuse the congressman of staying quiet on the border adjustment tax (BAT), a plan backed by Speaker Ryan and House Ways and Means Committee Chairman Kevin Brady (R-TX). The BAT taxes imports at 20 percent while exempting exports from taxation.

All four Republicans targeted in the advertising campaign come from safe conservative districts, meaning that the members could be vulnerable to a primary opponent in 2018.

Breitbart News spoke with Andy Roth, vice president of government affairs for Club for Growth, about his organization’s campaign against the border adjustment tax.

Roth said, “We are opposed to the border adjustment tax opposed on policy grounds, it’s a $1 trillion dollar tax hike, and we think that this is horrible messaging. Raising taxes on working families to pay for lowering taxes for large corporations? I don’t think is a smart thing going into a contentious midterm election. The Democrats are already messaging on this issue, and I believe that it’s politically unwise.”

Roth told Breitbart News that there are many other ways of offsetting the missing revenue from tax cuts. He explained, “You can get rid of loopholes and deductions and sell off land rights in the Midwest, and even cut spending to make up for the missing revenue.”

The Club for Growth executive explained that creating a new tax could allow future Democrat administrations to raise the border adjustment rate. He said, “I think there are concerns that future Democratic administrations can raise the border tax at some point in the future and let’s not forget the trade concerns. As it is understood it is not compliant with the World Trade Organization and other countries will retaliate if they institute this tax and create significant turbulence for the future.”

A common argument from border adjustment advocates states that the cost of taxes on imports would be offset by a stronger dollar through more exports. Roth countered that argument, saying, “We think as a whole that political courage is lacking on Capitol Hill and that many lawmakers will not risk their political future to the currency market. You see a lot of opposition in the Senate and the White House is at best ambivalent. The only people that are pushing this are Speaker Paul Ryan and Ways and Means Chairman Kevin Brady. I don’t think there’s any appetite to test the currency market.”

Andrew Roth said that now is the time for the House leadership and the White House to work with conservatives on tax reform to avoid another debacle similar to Ryancare.

He said, “We, especially after the health care debacle, want to lock arms with President Trump and House leadership from the beginning and push a pro-growth tax reform bill. By doing that, we want to push the conservative base first and not wait until after the House leadership already crafted their proposal. If they got rid of the border adjustment tax or replaced it with something we like, they will find a great ally in Club for Growth.”

COMMENTS

Please let us know if you're having issues with commenting.