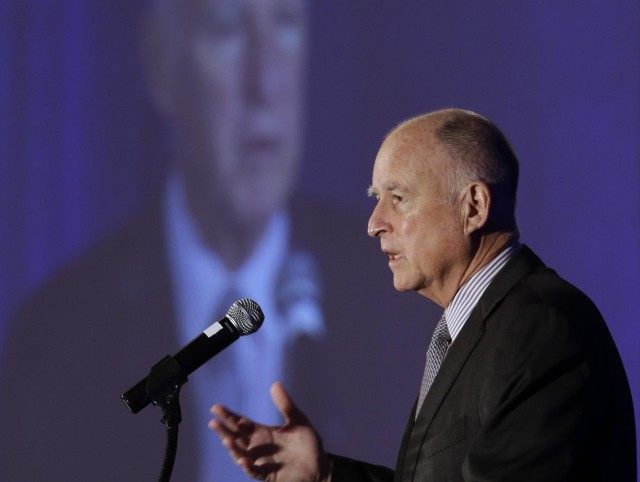

Gov. Jerry Brown vetoed $300 million of “feminist” tax breaks on Tuesday, thanks in part to worries about falling stock prices wiping out up to $10 billion of California’s capital gains tax revenue.

With the U.S. stock market down $600 billion in the last three days of trading, Brown vetoed seven bills passed in the pre-election legislative session. He rejected efforts by lawmakers to eliminate sales taxes on tampons, feminine hygiene products and diapers, calling them one-off efforts to circumvent the 2016-2017 balanced budget negotiated in June.

“As I said last year, tax breaks are the same as new spending — they both cost the General Fund money. As such, they must be considered during budget deliberations so that all spending proposals are weighed against each other at the same time,” Brown said in a statement. “This is even more important when the state’s budget remains precariously balanced.”

The reason for Gov. Brown’s new conservatism is the tremendous pressure he is under as a result of the recent Moody’s Global Credit Research stress-test, which found California is the least prepared large state to weather the next recession.

Moody’s report, titled, “State Government — US: Fiscal Stress Test: Ability to Withstand Next Recession Depends on Reserves, Flexibility,” cautions that the average economic expansion in the United States since 1854 has lasted for 39 months, but the current expansion has now lasted for 86 months. Moody’s analysts determined that California is more brittle than other large states, thanks to its revenue volatility, weak financial flexibility, and lower reserve levels. The credit rating agency warned that California now faces similar fiscal challenges as America’s perennial fiscal basket-case, known as Illinois.

In “California is Greece, But with Capital Gains,” Breitbart News reported that the glow of the Golden State has already been tarnished with highest poverty rate in the U.S. California’s tax collection was up about $15 billion last year, mostly due to 11.9 billion in capital gains taxes. But if capital gains tax revenue falls to $2.7 billion, as it did in the last recession, we warned:

Like gamblers on a hot streak that seem to lose all sense of reality, and double-up their bets against high odds, California’s Governor Brown and the Democrat-controlled legislature are doubling-up spending on the welfare “magnet.” But if the stock market takes a nasty hit and state revenues plunge, California will be just as broke as Greece.

Feminist lawmakers in Sacramento had demanded California scrap the so-called “tampon tax” as an unfair burden on a necessary female-only hygiene product.

Assemblywoman Cristina Garcia (D-Bell Gardens), who authored the tampon bill and sponsored the diaper bill, sent out a tweet calling Brown’s explanations for vetoing the bills “mansplaining.”

Today’s lesson: my uterus should carry the burden of fiscal responsibility for the state. Thank goodness GovBrown is around to #mansplain it

— Cristina Garcia (@AsmGarcia) September 14, 2016

She told the Los Angeles Times, “It is time to end this out of date practice and support gender equity in the State of California’s tax code.” Garcia added, “Today Governor Brown sent a clear message to all women in California. He told us periods are a luxury for women. … Men purchase Viagra and they don’t get taxed.”

Brown also vetoed on September 12 measures that would have exempted homeowners whose mortgage debt has been forgiven from paying income tax on what is considered taxable income. The governor did sign bills that require SeaWorld to follow through on its plan to end killer whale breeding and entertainment shows, plus approved a measure that distributes about a billion dollars in cap-and-trade revenues.

Brown’s new fiscal concerns came as a shock to progressives at the end of the 2015-2016 fiscal year ending on June 30, when he vetoed liberal-favored tax bills, including:

- SB907, which would have extended personal income tax relief for forgiven debt from mortgage relief provided to homeowners for homes that were underwater during the mortgage crisis;

- AB2127, which would have lowered the amount of ethanol required in a gasoline blend in order for it to qualify for a discounted gas tax;

- AB2728, which would have extended an expiring tax break for investments by insurance companies in lower-income communities;

- SB898, which would have exempted animal blood used by veterinarians from sales taxes. Human blood is already exempt; and

- AB724, which would have given the Jimmy Doolittle Museum in Vacaville, California, an exemption from paying sales taxes on items purchased for exhibits, allowing the museum to buy a restored Shell Lockheed Vega flown by the famed World War II commander, similar to a tax break for the San Diego Air and Space Museum and the California Science Center.

COMMENTS

Please let us know if you're having issues with commenting.