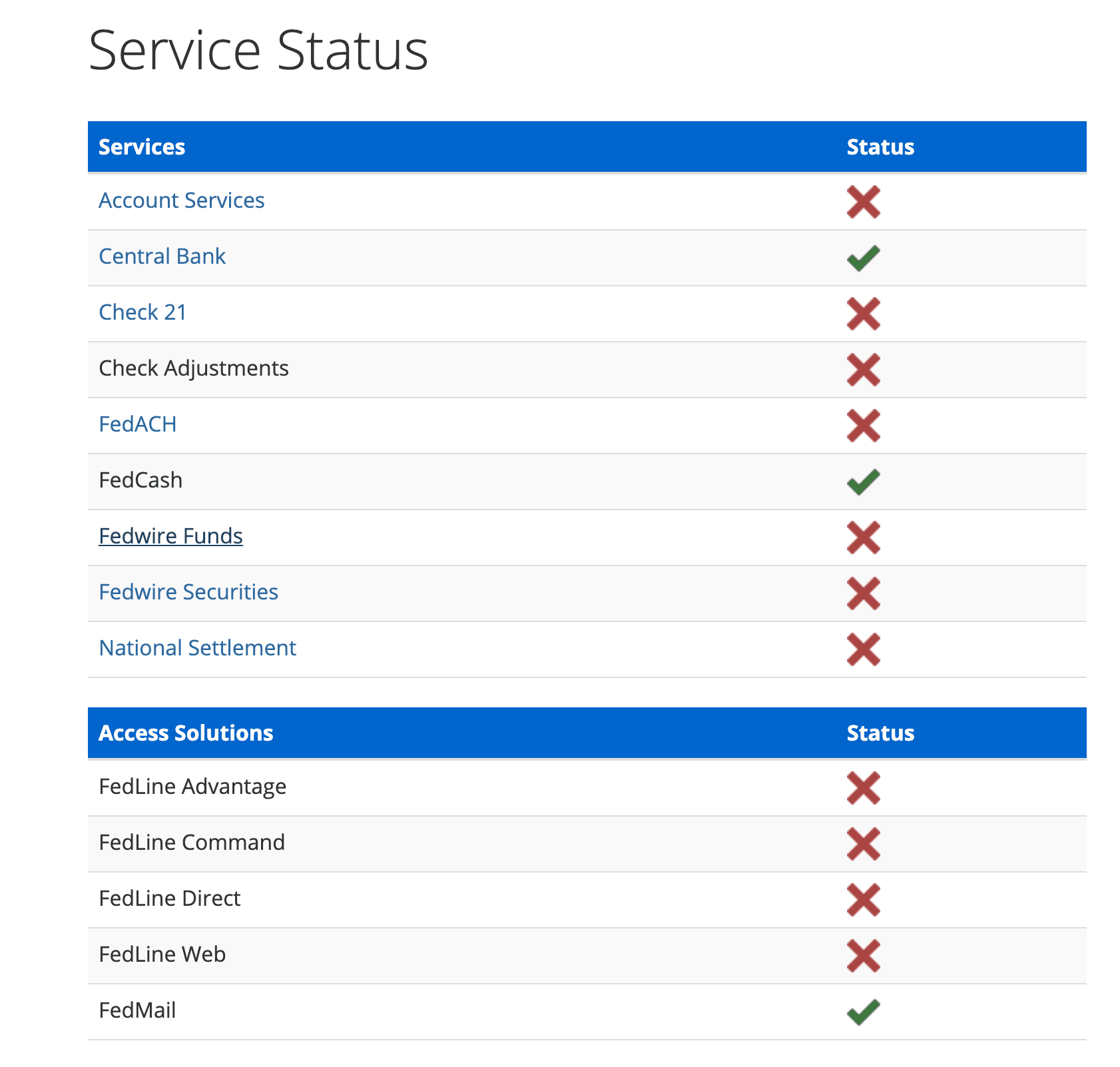

The Federal Reserve’s systems for electronic money transfers between banks suffered a widespread disruption Wednesday.

Update from the Fed:

The Fedwire Funds Service, Fedwire Securities Service, and National Settlement Service have resumed processing and are operating normally. The Federal Reserve Banks have taken steps to help ensure the resilience of the Fedwire and NSS applications, including recovery to the point of failure. Nevertheless, it is critical that you reconcile the messages you believe you had sent or received through the services after waiting several minutes for the backlog of messages to finish processing before you submit additional messages to the Fedwire Funds Service and Fedwire Securities Service and additional settlement files to the National Settlement Service.

The Fed said in a statement that it is investigating a disruption to multiple services, listing Fedwire and FedACH.

“Our technical teams have determined that the cause is a Federal Reserve operational error. We will provide updates via service status as more information becomes available,” the Fed said in a service alert Wednesday afternoon.

The affected services amount to the circulatory system for the U.S. banking system. These transfer services are what make the Fed the center of the banking system. On a typical day, Fedwire transactions amount to over $3.3 trillion. Last year, Fedwire saw 184 million transactions totaling more than $840 trillion.

The Fed blamed an “operational error” for the crash.

COMMENTS

Please let us know if you're having issues with commenting.