U.S. stocks fell sharply on Monday as investors worried about contagion from China.

The Dow Jones Industrial Average fell by 614 points, around 1.8 percent. The S&P 500 fell 1.7 percent. The Nasdaq Composite dropped by 2.2 percent. The small-cap Russell 2000 declined 2.4 percent.

All of the major indexes had been down by more earlier in the day before rebounding in the final hour of trading.

Investors are worried about financial and economic contagion from the potential collapse of a giant Chinese property developer—rather than viral contagion from coronavirus.

These are the biggest declines in the major indexes in several months. The sell-off was broad-based, with all 11 sectors of the S&P in the red. The energy sector was off by a steep three percent. Financials fell 2.2 percent, dragged down by a 2.9 percent decline in bank stocks. The automobile sector fell four percent.

Homebuilder stocks also saw a steep sell-off despite a better than expected report from the National Home Builders Association. Shares of D.R. Horton fell 4.2 percent after the company said ongoing supply chain disruptions were forcing it to lower its guidance for sales this year. The broader construction sector fell 2.7 percent.

Many on Wall Street pointed to the potential failure of property developer China Evergrande Group as the source of Monday’s sell-off. Evergrande’s debt burden is the biggest for any publicly traded real estate management company in the world, according to the Wall Street Journal. The company has about $355 billion in assets and employs 200,000 workers. Many analysts say it is unclear whether the Chinese government will let Evergrande fail or act to support it so that it can continue to pay its creditors. Alternatively, the Chinese government could allow the company to default on bond payments owed to outside bond investors while preserving its ability to pay employees and trade creditors.

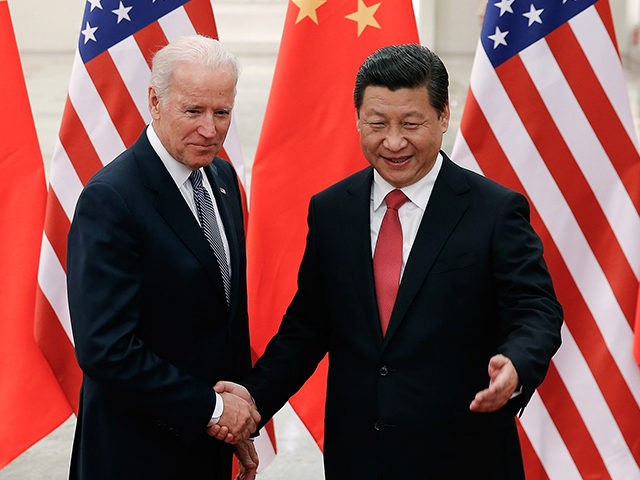

Chinese dictator Xi Jinping has been cracking down on some of the biggest Chinese companies and wealthiest businessmen, including levying fines against Alibaba and Tencent and advising business leaders to “self-rectify” their misconduct.

“In his overriding quest for re-election to a record third term at the 20th Party Congress in fall 2022, Mr. Xi has apparently chosen to put the solidification of his own domestic political standing ahead of China’s unfinished economic reform project,” former Australian Prime Minister Kevin Rudd wrote in an op-ed for the Wall Street Journal.

“The Chinese President is not just trying to rein in a few big tech and other companies and show who is boss in China,” the Wall Street Journal reported on Monday. “He is trying to roll back China’s decadeslong evolution toward Western-style capitalism and put the country on a different path entirely, a close examination of Mr. Xi’s writings and his discussions with party officials, and interviews with people involved in policy making, show.”

Xi has for years been attempting to discourage speculation in real estate and may see the teetering of Evergrande as a way of bringing discipline into an important part of the Chinese economy.

Broad stock indexes were down in London, Paris, and Germany. Japan’s Nikkei was a half a percentage point in positive territory.

COMMENTS

Please let us know if you're having issues with commenting.