While the story of ridding Ireland of serpents will always be Saint Patrick’s best-known achievement, there are countless other miracles attributed to the man. Many of them revolve around wells or springs. In one of the tales, freshly melted winter snow overflowed a brook so badly that it threatened to flood the surrounding village. Saint Patrick is said to have dipped a finger in water and used it to make a sign of the cross on a loaf of bread, causing the flood tide to recede immediately.

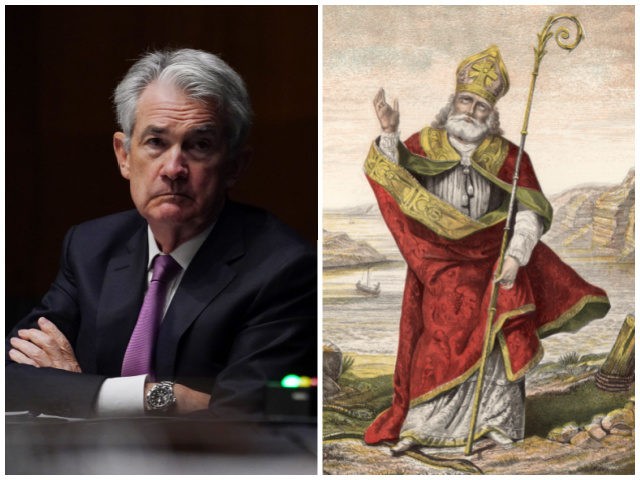

The idea of miraculously stemming the flood brings to mind Federal Reserve chairman Jerome Powell’s conviction that the central bank will be able to turn back the tide of inflation without even so much as pushing up unemployment, much less causing a recession. The latest set of projections from the members of the Federal Open Market Committee (FOMC) show that officials expect inflation to fall from 5.8 percent to 2.7 percent over the course 21 months – even while the economy grows at 2.8 percent this year and 2.2 percent next year.

The projections show that the median expectation is for unemployment to end the year at 3.5 percent and to stay that low the following year. That’s a half a percent below the Fed’s estimate for the long-run neutral rate. Meanwhile, the Fed’s interest rate target is seen as rising to just 1.9 percent this year and 2.8 percent next year. That averages to slightly below the 2.4 percent long-run average estimated by Fed officials.

To sum up, the Fed appears to believe it can bring down the highest inflation in 40 years with interest rate targets that fall short of the long-run neutral rate. It will, of course, eventually get around to shrinking its balance sheet, an untested monetary tightening that might wind up depressing financial asset prices but do little to affect the short-term trajectory of the labor market, consumer prices, or the real economy.

In fairness to the Fed, it has finally got around to admitting that inflation will not just vanish on its own. Back in September of last year, after a summer of raging inflation, the FOMC’s projections had inflation falling from its overly optimistic year-end projection of 4.3 percent for 2021 to 2.2 percent in 2022. That was to be accomplished with an interest rate hike of merely one-quarter of a point for all of 2022. So at least the Fed now admits it will have to hike rates, even if it is in denial about how far those hikes will have to go and what sort of economic pain they will need to inflict.

We owe a debt of gratitude to Gabriel Chodorow-Reich, an associate professor of economics at Harvard, for coining the phrase “immaculate disinflation” to describe the Fed’s persistent belief that it can bring down inflation painlessly. While it is not unimaginable that inflation could largely fall on its own, the Fed has not clearly articulated a theory about why it expects this to happen. Is it expecting an imminent loosening of supply constraints? Does it think energy prices will plunge soon? Or something else? It would probably help if the Fed let us in on the source of its faith.

In another story about Saint Patrick, the rock he was baptized upon supposedly became a kind of medieval lie detector. The local officials would hear testimony from witnesses seated upon the rock; and if anyone dared lie, the rock would start to flow with water that sometimes were called the tears of Saint Patrick. We cannot help but wonder what would happen if Powell were forced to discuss the Fed’s inflation policy while seated upon that stone.

COMMENTS

Please let us know if you're having issues with commenting.