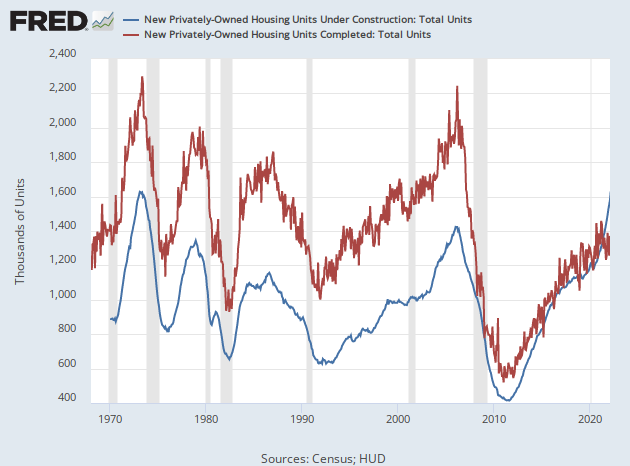

The number of homes under construction in the U.S. rose in February to the highest level since 1974, likely a reflection of supply constraints acting as a drag on building even as demand for homes remains sky-high.

For the ninth consecutive month, the number of units under construction has exceeded completions, something that has rarely happened before and never for a sustained period.

The total number of housing units under construction at the end of February rose to a seasonally adjusted, annual rate of 1.583 million. That is the highest since August of 1974. That is 1.9 percent higher than in January and 22.8 percent higher than a year prior.

The National Association of Home Builders’ index gauging home builder confidence declined in March, falling to its worst level since last September. Builders cited increased costs, supply chain issues, a short supply of labor, and expectations of higher interest rates for the decline.

Housing starts, which are measured when work on a new home is begun, were up sharply in February. These climbed to a seasonally adjusted, annual rate of 1.769 million, a big 6.8 percent jump from January’s disappointing number and 22.3 percent above the year-prior rate.

It was also better than expected. Economists had predicted that starts would come in at 1.7 million.

Permits, however, dropped, suggesting that builders may be expecting a slowdown. The number of homes authorized by building permits in February were at a seasonally adjusted annual rate of 1.859 million, 1.9 percent below the revised January rate. Still this 7.7 percent above the February 2021 rate.

Single-family authorizations in February were at a rate of 1,207,000, half a percentage point below the prior month. Single family housing starts in February were at a rate of 1,215,000, 5.7 percent higher than January. Single-family completions in February were at a seasonally adjusted annual rate of 1,309,000. This is 5.9 above January but 2.8 percent below a year prior.

The ratio of completions to homes under construction inverted, with more houses under construction in recent months than get completed. That reflects the supply shortages and increased costs that have delayed many projects and are helping push up the price of housing.

That is largely due to an increase in the number of multifamily homes under construction but not completed. This figure rose to its highest level since 1974.

While the ratio of single-family homes under construction to completions has not inverted, it has narrowed considerably over the past six months.

This inversion in the overall market and narrowing in the single-family market is unprecedented and highlights the difficulties supply chain problems are causing for homebuilders and home buyers.

COMMENTS

Please let us know if you're having issues with commenting.