Things Have Not Been This Bad Since Biden Was Obama’s Vice President

The last time Americans saw a drop in household income as large as we did last year, Barack Obama was president.

The Census Bureau on Tuesday released its calculations for the change in real median household income for last year. By its calculations, the median income of U.S. households fell in 2022 by 2.3 percent, the worst decline since 2010.

History may not necessarily repeat or even rhyme, but it certainly rings a bell on occasion. The last time household income suffered a decline as large as it did in the second year of Biden’s presidency was in the second year of Biden’s vice presidency.

That’s before taxes. Once you calculate in changes to the taxes paid and subsidies handed out, household income fell 8.8 percent. A lot of the post-tax decline had to do with the lapsing of the Biden administration’s pandemic “rescue” policies—like child tax credits and the super-sized earned income tax credit—that pumped up incomes and contributed to the worst inflation in decades.

The real median earnings of all workers—which includes part-time and full-time workers—declined 2.2 percent. Median earnings of those who worked full-time, year-round fell 1.3 percent.

The Biden White House and its establishment media allies keep acting like the Big Guy’s low approval rating on the economy—and low approval rating overall—is some big, unfathomable mystery. The same with depressed consumer sentiment and surveys showing that large numbers of Americans believe we were in a recession this year.

Some have even speculated that this was the result of a mass delusion or Republican propaganda. The answer, of course, is much simpler. People got poorer because inflation ate away the value of their incomes. That’s left a lot of people with a bad taste in their mouths when they are forced to speak the name Joe Biden.

The “Family” Secrets: Income Details Are Even Uglier

Digging down into the details of the Census report on income for 2022 only makes things look worse.

Family household income actually fell by even more than the median, dropping 2.9 percent. Non-family households saw a climb of 0.8 percent. Older Americans saw an income decline of 2.1 percent, worse than the 1.4 percent decline for people under 65. So, families and the elderly have suffered the most.

That chaos at the southern border? It is not helping Americans earn better incomes. Native-born incomes fell 2.5 percent while foreign-born incomes actually edged up 0.2 percent.

Incomes were down across the country. The region that got hit the hardest was the Midwest, where income fell by a stunning 4.7 percent. In the Northeast, where Biden dominated electoral results in 2020, median household income fell 3.8 percent. In the West, income fell 3.2 percent. In the South, income ticked down just 0.1 percent.

The damage to incomes in the Midwest and the Northeast may be a factor for voters in swing states like Pennsylvania, Wisconsin, and Michigan next year.

While Joe Biden claims his programs will rebuild the economy from “the bottom up,” the numbers do not support that contention. The official poverty rate was 11.5 percent, with 37.9 million people in poverty. “Neither the rate nor the number in poverty was significantly different from 2021,” the Census Bureau said.

There was a big jump in a confusing gauge called the “supplementary poverty measure.” Remember when Biden claimed that child poverty had been cut nearly in half? (A claim he repeated on Tuesday, by the way.) This was not as measured by the official poverty rate but the supplemental measure, which includes government handouts. Biden could not muster enough support to continue some of his pandemic handouts now that the crisis has passed, so this measure of child poverty went up by 4.6 percent, the biggest single-year drop ever.

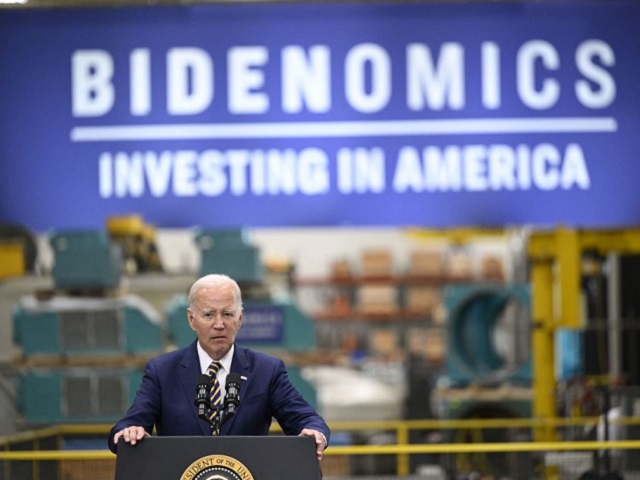

President Joe Biden speaks about Bidenomics in Milwaukee, Wisconsin, on August 15, 2023. (ANDREW CABALLERO-REYNOLDS/AFP via Getty Images)

The Biden administration wants you to think this is evidence of the cruelty of Republicans who refused to vote to continue the American Rescue Plan Act (ARPA) welfare measures. A better interpretation is that ARPA never did much to reduce child poverty in the first place. It just papered it over by sending checks to extremely low-income households. Remove the handouts and suddenly the impoverished kids are seen to be impoverished again.

Bidenflation Resurgent?

Joe Biden memorably said 15 months ago that bringing down inflation was his “top domestic priority.”

“Look, the bottom line is this: Americans have a choice right now between two paths, reflecting two very different sets of values,” Biden said in a speech at the White House in May of 2022. “My plan attacks inflation and grows the economy by lowering costs for working families, giving workers well-deserved raises, reducing the deficit by historic levels and making big corporations and the very wealthiest Americans pay their fair share.”

We now know how that worked out. The culprit in the decline in real income last year was inflation. The measure the Census Bureau uses to adjust for inflation rose to 7.8 percent last year, the biggest jump since 1981. No wonder 63 percent of the public say they disapprove of Biden’s handling of inflation.

On Wednesday, the Labor Department will release the August consumer price index (CPI). The consensus estimate has moved from an expectation for inflation to be basically flat with July’s monthly rise of 0.2 percent to an increase of 0.6 percent, largely because energy prices have risen sharply. The year-over-year headline figure is seen as coming in at 3.6 percent, up from July’s 3.2 percent.

Core CPI is expected to fall by more even though the annual numbers will still be higher. The forecast is for 0.2 percent month-over-month, matching July, and 4.4 percent year-over-year, down from July’s 4.7 percent.

The Cleveland Fed’s nowcast is less hopeful on inflation. It sees headline rising by around 0.8 percent for the month and 3.8 percent for the year. Core inflation is nowcasted at nearly 0.4 percent for the month and 4.5 percent for the year.

COMMENTS

Please let us know if you're having issues with commenting.