The Establishment Media Have No Idea What the PPI Measures…

Evidence is mounting that economic forces responsible for slowing the pace of rising prices in the first half of last year have run their course.

The Department of Labor said on Friday that its producer price index (PPI) for final demand fell by 0.1 percent compared with a month earlier. Compared with a year ago, the PPI is up just one percent.

At first glance, this looks like good news on inflation. Predictably, the financial press reported only the first glance and ignored the details that indicate that the era of disinflation has come to a close and risks of higher inflation are increasing.

“Wholesale inflation falls for third month in a row, PPI shows, and points to less inflation in pipeline of the economy,” Dow Jones’ MarketWatch proclaimed.

“Wholesale inflation in US declined last month, signaling that price pressures are still easing,” the Associated Press declared.

These headlines are wrong from the very start. The PPI is not a gauge of wholesale inflation. It is also not a measure of “the prices firms pay for before selling to consumers,” as an economics reporter for the New York Times put it on Friday.

The PPI referred to in those headlines is officially called producer price index for final demand, or PPI-FD for short. It is a measure of prices received by domestic producers of goods and services for personal consumption, capital investment, government use, and export. It’s not a measure of wholesale prices or a measure of what businesses paid for goods or services before they sell those to consumers.

The producer price part of the measure’s name comes from the fact that the price changes are measured from the point of view of the seller of the goods rather than the buyer. That means they do not include sales or excise taxes or government subsidies that go to consumers. Shipping costs that are paid by consumers are also excluded. The prices of imports are not included because those are not received by U.S. producers but by foreign producers.

The consumer price index (CPI), on the other hand, measures prices from the point of view of buyers. It includes sales taxes and subsidies. Imports are included because households pay for imported goods. The CPI does not include prices paid by the federal, state, or local governments.

The final demand part of the measure’s name comes from the fact what is measured is the prices of sales to what are sometimes called end-users. That is, these are not sales of components or materials that are directly employed to create goods and services sold to consumers. These are products sold to customers who are government buyers, household buyers, businesses buying capital goods, and foreign buyers.

While what the Department of Labor calls the “target set” of goods and services included in the PPI is the entire marketed output of U.S. producers, the target set of goods and services for the CPI are those purchased for consumption purposes by U.S. households. So, the PPI is broader in some senses—it includes some goods and services sold by domestic producers that are excluded from CPI—and narrower in others—it doesn’t include some goods and services purchased by American families because they are made abroad.

Importantly, there’s no particular connection of the PPI’s headline final demand figure to wholesale prices. The confusion comes from the fact that the index was once officially called the wholesale price index. But that was always a misnomer because the index never really focused on wholesale prices. And it was changed way back in 1978.

This is not some big secret. The Department of Labor’s website explains this (emphasis added):

The Wholesale Price Index (WPI) was the name of the program from its inception in 1902 until 1978, when it was renamed the Producer Price Index. At the same time, emphasis was shifted from one index encompassing the whole economy to the SOP system consisting of three main indexes covering stages of production in the economy. By changing emphasis, BLS minimized the double counting phenomenon inherent in aggregate commodity-based indexes. In 2014, PPI shifted from the SOP system to the FD-ID system. The FD-ID system expands primary aggregate index coverage beyond the SOP system through the addition of prices and weights for services, construction, government purchases, and exports.

The change in name from Wholesale Price Index to Producer Price Index did not include a change in index methodology, and the continuity of the price index data was unaffected. The name change reflects the theoretical model of the output price index that underlies the PPI. (See BLS Working Paper 44, “On the Theory of Industrial Price Measurement: Output Price Indexes.”) In addition, the term Wholesale Price Index was misleading in that the index never measured price change in the wholesale market. No indexes were discontinued as a result of the changes in terminology or analytical emphasis.

Describing the PPI as wholesale prices or prices paid by firms is simply wrong. There is a measure that includes wholesale margins (but not wholesale prices) reported deep inside the PPI report—more on that later—but it is just a small part of the overall picture.

It’s probably too much to ask the Associated Press and the rest of the establishment media to run 45 years worth of corrections on their reporting. But perhaps one day they will stop making this error every single month. Maybe someone will alert the disinformation police and get the process started.

…And They Also Do Not Understand What It Says About Future Inflation

The other ends of those headlines are also misleading. The PPI data do not suggest price pressures are easing or that there is less inflation in the pipeline. Quite the opposite. The data show that disinflation has run out of steam and inflation is at best stuck and perhaps even headed higher.

To begin with, the decline in PPI-FD was driven by a 0.4 percent decline in the price of final demand goods, according to the Labor Department. Nearly 60 percent of the decline in goods prices was do to a 1.2 percent demand in final demand energy. Since energy prices are extremely volatile and subject to geopolitical risk—oil and natural gas prices surged on Friday after the U.S. and U.K. launched missile strikes at the Houthis overnight—their decline should not be interpreted as a sign of future disinflation.

What’s more, almost all analysts agree that the disinflation from repairing supply chains after the mess created by the pandemic is coming to an end. We cannot expect further disinflation from the goods side of the economy.

Which means that if inflation is going to continue to decline, the disinflation will have to come from the services side. The December figures show the PPI-FD for all services was flat for the month, the third month in a row in which this index has been unchanged. But there was a sharp rise in core services inflation, defined as services prices less prices of energy, food, and a measure of wholesale and retail margins called trade services.

It’s worth pausing to take a moment to consider trade services in a bit more depth. The index for final demand trade services measures the change in the margins received by wholesalers and retailers. The government uses margin as a measure of price of the service that wholesalers and retailers charge for things like displaying and marketing goods and services because those prices are not directly observable. This has been showing shrinking margins for the past five months, which undermines the argument of the greedflationists who want to attribute inflation to corporate greed. Did retailers and wholesalers just become less greedy in the second half of last year?

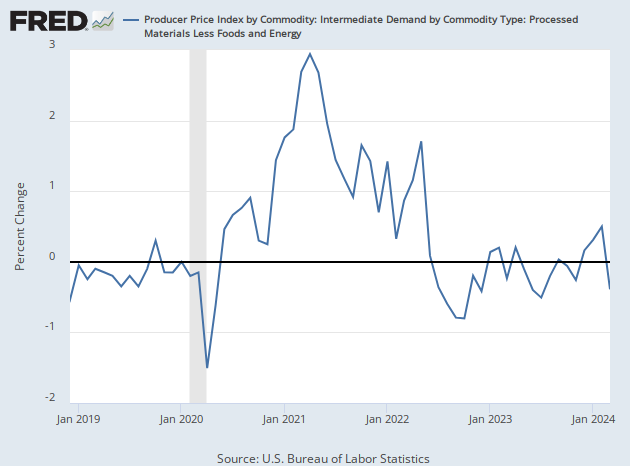

The part of the PPI that looks at inflationary pressures in the so-called “pipeline” is categorized as intermediate demand, or PPI-ID for short, and is universally ignored by the financial media that insists the pipeline is in final demand. The intermediate index primarily measures prices of goods and services—excluding capital goods— sold to businesses that then are used to produce goods and services for final demand. In other words, the intermediate demand index is pretty close to what the financial press mistakenly thinks the final demand index is.

The data here show a 0.2 percent rise in core intermediate demand processed goods and an upward trend that’s been in place since July, with higher increases and shallower declines. Some of the basic building blocks of growth—including steel, electricity, and fabricated metals—rose sharply. Cold rolled steel and strip steel were up 14.6 percent. Core unprocessed goods for intermediate demand also rose by 0.2 percent.

In short, the disinflationary pressures in the goods pipeline are all coming from energy prices.

The PPI also has a gauge of prices on intermediate demand services. These rose 0.4 percent in December, the largest increase since the 0.6 jump in July. Over 80 percent of the surge came from a 0.5 percent increase in core prices—services excluding trade, transportation, and warehousing. That’s a serious amount of services inflation building in the background.

The message from the PPI report confirmed what we learned from the consumer price index on Thursday. Disinflation is over. At best, inflation is stuck at a high level, and there are signs that inflation could once again re-ignite.

COMMENTS

Please let us know if you're having issues with commenting.