Ride-on lawn mowers, golf buggies and mobility scooters will all need to be insured if EU lawmakers get their way. Judges at the European Court of Justice recently ruled that a 43-year-old insurance law should be extended to all motorised vehicles, even when driven on private land. The ruling could see owners of the vehicles forking out upwards of £100 a year.

Under current British rules, “niche” vehicles such as lawnmowers and mobility scooters don’t have to be insured to be driven on roads, although it is recommended that owners taking their vehicles into public places take out some form of insurance.

“Uninsured people have, in the past, lost their homes after being sued for negligence because they have insured people with their scooters. Therefore insurance is recommended to avoid this,” Cecilia Frodsham of Stephensons Solicitors told the Daily Telegraph.

That could all change, thanks to a recent case in the ECJ involving a Slovenian, Damijan Vnuk, who was injured after falling from a ladder when it was hit by a reversing tractor trailer. Motor insurers refused to cover the claim as the accident had involved an agricultural vehicle and had taken place on private land.

But last September, EU judges decided that the claim should have been covered by compulsory vehicle insurance, even though it took place on private property, because tractors are “consistent with the normal function” of motorised vehicles and therefore subject to the same rules as cars and motorbikes. They insisted that the EU directive, which dates back to 1972, covers “any motor vehicle intended for travel on land and propelled by mechanical power”.

The ruling has thrown the UK insurance industry into turmoil. The Department of Transport is currently sitting down with the industry body, the Association of British Insurers to decide which types of vehicle will need to be covered and at what level.

“Everybody is confused as to what the EU is up to,” said Mark Effenberg, of Blue Badge, a specialist insurer for mobility scooters. “We’re now waiting to see how the directive will be interpreted.”

Blue Badge currently charges £87 a year for third party insurance with breakdown cover for a mobility scooter. “The whole issue is on the verge of explosion,” said Mr Effenberg. “While many mobility scooter users say they can’t afford it, there’s the argument that they are also unlikely to be able to afford a six-figure personal injury claim.”

John Garrard of Fish Insurance told the Telegraph: “The debate over whether cover for mobility scooters should be mandatory has raged for years.

“As one of the leading players in the mobility scooter insurance market it’s probably not an issue which we should take a line on but we would certainly echo the Department of Transport’s strong advice that scooter users take out cover to protect their safety and that of other people. There is, of course, also the value of the scooter to consider.”

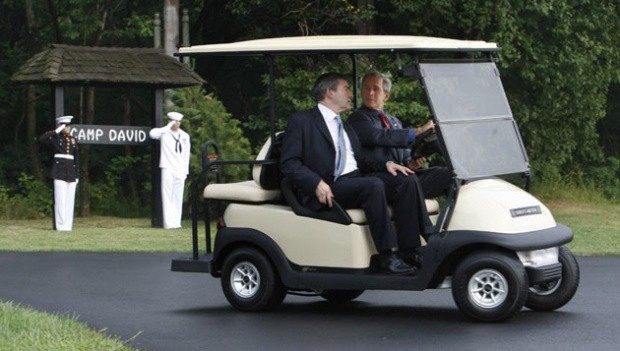

Meanwhile lawnmowers, golf buggies and quad bikes already require insurance if driven on a public road, although not if they’re only used on private land. NFU have quoted costs of around 100 a year, whilst BJP Insurance Brokers have said that policies for a lawnmower cost in the region of £180-200.

A spokesman from insurer More Than said: “We would generally interpret that grass cutting machines are not vehicles intended or adapted for use on a road – their purpose being to cut grass. Therefore, currently, compulsory motor insurance is not required,” although professional landscapers can get commercial policies for use of the vehicles on other peoples’ land.

And cover for golf buggies currently costs £23 a year from industry specialist Golf Care, whose director Catherine Rees said: “Golfers may want to drive their buggy from their home, or drive on a golf course which may require a road crossing. Generally people are more worried about hitting someone with a golf ball and causing an injury claim than they are with vehicle insurance.”

Jeanette Miller, of the Association of Motor Offence Lawyers said that the ruling was likely to have “massive consequences” for the industry. “It could potentially cover any vehicle used on land unless it runs on rails”, she said.

A Department for Transport spokesman told This is Money: “It is too soon to understand exactly how this ruling will apply in the UK. We are working with the European Commission and other member states to agree what it will mean in practice and these discussions are ongoing.”

COMMENTS

Please let us know if you're having issues with commenting.