From The Fiscal Times:

Should we keep 10,000 Syrian refugees from coming into the United States? It’s all anyone can seem to talk about in the wake of the Paris terror attacks.

Which is odd. I figured the political discussion would focus on how hard to bomb Islamic State terrorists, how we’re going to reconstitute a Syrian state or even how we can justify the slow-burn policy bungle that brought us here. Instead, everyone is focusing on the Statue of Liberty, the veracity of vetting interviews and the proper balance of compassion vs. security.

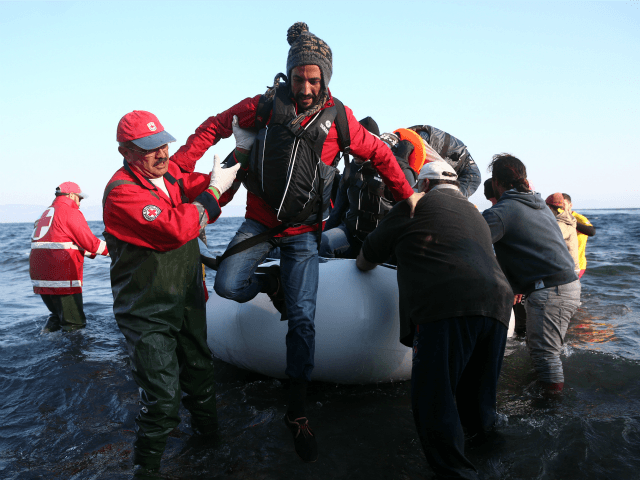

Europe has been the front line for all of this, with over half a million migrants from the Middle East and Africa flowing in so far this year, according to the International Rescue Committee. Since 2012 the number totals 1.9 million. And, in the realm of unexpected consequences, Europe’s immigration issues could very well threaten the return of the EU debt crisis and undermine the Eurozone itself.

The problem, according to Alberto Gallo, head of macro credit research at RBS, is that the influx of migrants has resulted in an increase in political risk and radicalization — helping anti-euro parties in France, Italy and Finland gain in the polls.

Remember, Europe’s debt crisis has waxed and waned in response to electoral developments (the rise of the leftist Syriza party to power in Athens, for instance) and the ability of the European Central Bank to soothe the situation with bond-buying stimulus (which has suppressed the bond yields of too-big-to-fail Spain and Italy).

A quiet has followed, bolstering market sentiment, lifting stock and bond prices and helping to support a halting, fragile economic recovery. But structural indebtedness and too-high youth unemployment remain persistent problems. Bringing in hundreds of thousands of poor, low-skilled, welfare-dependent immigrants and refugees is only set to exacerbate the problem.

Read the rest of Anthony Mirhaydari’s piece here.

COMMENTS

Please let us know if you're having issues with commenting.