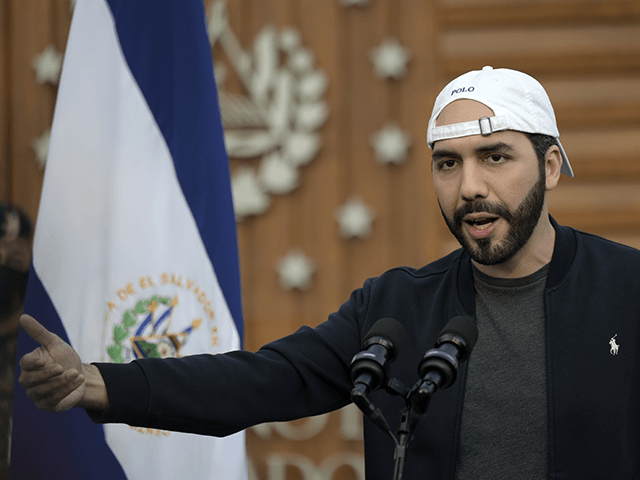

El Salvador’s President Nayib Bukele told his constituents on Saturday night to stop worrying about the price of bitcoin and “enjoy life.” At Bukele’s urging, El Salvador became the first country to accept bitcoin as legal tender in June 2021.

On Sunday, as the value of bitcoin dropped to less than half of what Bukele’s government paid when buying $105 million of it last year, Bukele appealed to the public for calm and patience:

“I see that some people are worried or anxious about the Bitcoin market price. My advice: stop looking at the graph and enjoy life,” Bukele wrote on Twitter.

“If you invested in Bitcoin, your investment is safe and its value will immensely grow after the bear market. Patience is the key,” he said.

Salvadoran Finance Minister Alejandro Zelaya said his government “has not had any losses” due to the bitcoin collapse. He insisted the financial risk from El Salvador’s embrace of the cryptocurrency is “extremely minimal.” Like Bukele, Zelaya anticipated a bitcoin rally in the future.

The International Monetary Fund (IMF) did not share Bukele and Zelaya’s optimism, having warned in early 2022 that using bitcoin as legal tender exposed the Salvadoran treasury to “large risks” that could threaten “financial stability, financial integrity, and consumer protection.”

Bukele’s government angrily rejected the IMF’s criticism, rejecting it as an attack on El Salvador’s sovereignty.

“No international organization is going to make us do anything, anything at all,” Zelaya snapped in January.

Bukele himself sarcastically responded “OK boomers” when a bipartisan group of U.S. senators introduced legislation in February to “mitigate potential risks to the U.S. financial system” by firewalling it against El Salvador’s bitcoin.

“You have zero jurisdiction on a sovereign and independent nation. We are not your colony, your backyard, or your front yard. Stay out of our internal affairs,” he told the Senate group.

When the value of bitcoin began crashing in May, Bukele proudly announced his government had “bought the dip” by snapping up another 500 bitcoin for $15.3 million. Bitcoin was worth $30,744 at the time. On Monday, it was trading at $19,965.

University of Georgia business professor Julio Sevilla told NPR on Sunday that since bitcoin only accounts for about four percent of El Salvador’s reserves, a crypto crash is unlikely to bring the government down, and since Bukele remains highly popular with his constituents, his request for patience from the public will probably be granted.

On the other hand, Sevilla thought Bukele might regret burning so many bridges with his pugnacious defense of his bitcoin initiative.

“El Salvador is heavily in debt, and the president has been trying to negotiate with the International Monetary Fund to get this financing. But they have expressed that they are concerned with, in general, how the country is being managed with the fact that the president, you know, has no checks in the Supreme Court and that he is implementing these outlandish initiatives,” Sevilla said.

COMMENTS

Please let us know if you're having issues with commenting.