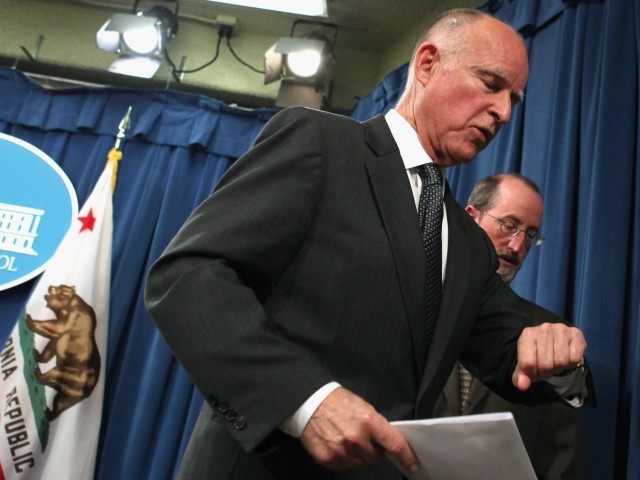

Governor Jerry Brown warned in his May Revised Budget last week that California is expected to suffer a $20 billion tax crash in it next recession.

Brown and the Democrat-controlled majority in the state legislature have been crowing about the governor’s 2017-2018 May Budget Revision update, which predicts the State of California will collect another $2.5 billion in tax revenue over the three fiscal years from July 1, 2015 through June 30, 2018.

Brown’s budget update states that the extra tax revenue will help fund more social justice programs, including: 1) raising the minimum wage to $11 per hour in 2018; 2) expanding health care coverage for Obamacare and undocumented children; 3) increasing Medi‑Cal primary care; 4) providing an increase to Supplemental Security Income; 5) repealing the welfare maximum family grant rule; 6) creating the state’s first Earned Income Tax Credit; and 7) reserving $575 million in a “rainy day fund.”

Estimates for California personal income tax collection were increased by $2.9 billion in the 2017-18 Governor’s Budget released on January 10, due to all-time-record capital gains tax collections from the hot Donald Trump stock market bump. But the same report estimated that sales taxes, which are considered the best measure of the health of the state’s economy, “were revised down by $1.2 billion, reflecting weak cash receipts.”

Despite the nonpartisan Legislative Analyst’s Office commenting that forecasting capital gains are notoriously unreliable, the Governor’s May Budget Revision dramatically increased its estimate for California residents’ capital gains from $110 billion to $133 billion in 2017, and from $107 billion to $126 billion in 2018.

California has America’s highest marginal tax rate on personal income, at 13.3 percent. Unlike the federal government, which cuts the personal income rate in half for holding a capital asset for at least one-year, there is no special capital gains tax break in California. Combining the federal long-term-capital gains rate of 20 percent and state’s 13.3 percent explains why Californians suffer the planet’s second highest long-term-capital gains tax rate.

Given that high-income residents dominate capital investments in real estate and stocks, the top 1 percent of California income-earners paid a record 48 percent of all state personal income taxes in 2015. The state’s confiscatory taxation of the richest 1 percent has been over 40 percent for 11 of the last 12 years.

The governor’s May revised budget highlights that capital gains in the last recession crashed from about $131 billion in 2008 to $29 billion in 2010. With California’s average effective capital gains tax rate of 10 percent, the Great Recession saw personal income tax revenues crash by over $10 billion. That is about the same amount as the state’s total annual budget for all state employee wages and benefits.

But Brown warns: “… economic expansions do not last forever. In the post‑war period, the average expansion has been about five years, and the current expansion is approaching three years longer than that. A moderate recession will drop state revenues by about $20 billion annually for several years.”

That means the State of California’s finances are so precarious, the tax revenue crash in the next recession is now expected to be about twice the cost of the state’s annual payroll and benefits.

COMMENTS

Please let us know if you're having issues with commenting.