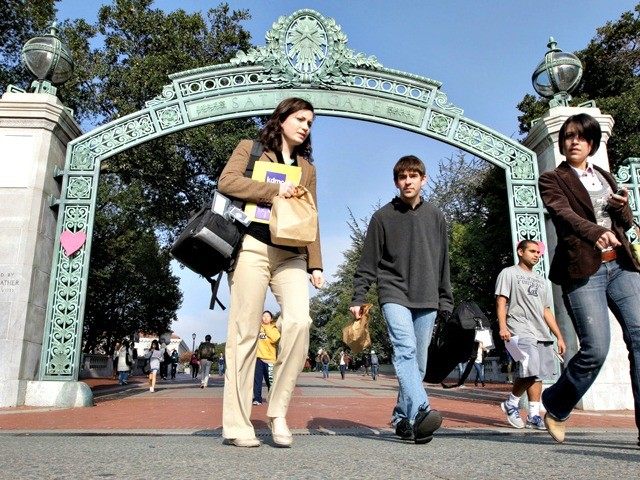

Hundreds of UC Berkeley graduate students are marching in opposition to the higher taxes they believe they will have to pay under the Republican House-sponsored tax reform bill.

California’s Panetta Institute found that 75 percent of college students in 2016 approved of President Obama’s job performance. That matched the students’ approval of President Obama’s in 2009, despite Obama raising the average American household federal tax rate over his eight-year term by almost three percentage points, from 17.3 to 20.1 percent.

The biggest reason college students were not opposed to the Obama administration’s historically large number of federal tax increases was that they viewed themselves as receiving more subsidies without personally having to pay any of those higher taxes.

But the House of Representatives’ “Tax Cuts and Jobs Act” (H.R.-1) would cut back on certain subsidies and expand the tax incidence for certain college and student activities, according to a statement released on Nov. 28 by the University of California (UC).

UC graduate students will lose Qualified Tuition Reductions (QTR) that currently allow tax-exempt treatment of work performed as research and teaching assistants to reduce tuitions. According to the UC, about 23,000 UC graduate students earned over $250 million in QTR benefits in the 2015-2016 school year.

Margaret Spellings, president of the University of North Carolina system and a former U.S. secretary of education under President George W. Bush, estimated a 30 to 60 percent increase in the tax burden facing graduate students by “asking them to kick in $5.4 billion more in taxes on theoretical income over the next decade” (original link).

The UC also is expressing concern that the House legislation would eliminate private activity municipal bonds that colleges have used to raise tens of billions of dollars to finance capital projects that do not conform to the educational mission of the university.

One of the main reason the U.S. House of Representatives’ tax reform would eliminate QTR tax-exempt treatment of student income and drastically cut back on the use of tax-free municipal bonds for funding of college activities is the highly questionable expansion of college activities that go far beyond the universities’ mission.

As an example, the most recent independent audit revealed that the UC spent $32.5 billion on expenses during the 2015-16 school year. Despite claiming that its “fundamental missions are teaching, research and public service,” the UC only spent $6.7 billion (21 percent) on teaching, 4.6 billion (14 percent) on research, and $630 million (2 percent) on public service.

The other $20.6 billion (63 percent) of U.C. spending went to support non-fundamental activities, including funding 5 hospitals, a number of science laboratories, and other functions that often perform commercial contract work.

The UC issued a request for its students, their parents, and the public to lobby Congress in opposition to numerous elements of the tax reform proposal, because “at least 30 percent of our students and their families rely heavily on the current law’s tax provisions.”

COMMENTS

Please let us know if you're having issues with commenting.