The economic downturn appears to have narrowed the north-south divide as wages between the two regions converge, with statistics released today indicating any gaps in earning power are due to age not geographical location.

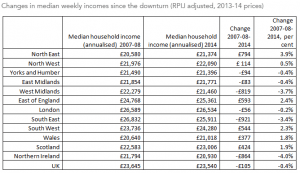

Households in the north-east and east of England have seen the biggest percentage increase in living standards since the economic slump while Northern Ireland, the West Midlands and the south east have seen the largest decline, according to independent think tank Resolution Foundation.

The report’s author, Matthew Whittaker said the results mean during the election campaign, “voters will hear confusing messages on living standards that they may struggle to relate to.”

The main parties have been fighting about standards of living, with the Tories saying households are better off thanks to five years of a Conservative led coalition and Labour leading with a decline in the standards of living.

Typical weekly incomes in the north-east were the lowest in the UK on the eve of the downturn – and still remain near the bottom of the table – but unlike the wealthier areas in the country they have seen a material increase in average wages, up from £20,580 in 2007/8 to £21,374 in 2014.

Conversely, the south-east has seen a drop of 3.4 per cent, or £921 per annum in the same time period.

“The fall and rise of living standards since the crash is a key election debate. But the experience has been felt very differently across different generations and parts of the UK,” Mr Whittaker said.

“The UK entered the downturn with a sharp north-south divide, with typical household incomes in the south-east almost a third higher than in the north-east. Contrasting employment performances in the subsequent period has helped reduce that gap, but the mixed performance of other regions means that it would be wrong to conclude that the north-south divide is closing. The picture has become more complicated.”

Since the downturn, the north-east has seen an employment rate of 2.9 per cent above its pre-recession level with a comparatively shallow pay squeeze of 6.1 per cent compared to a nationwide average of 9.3 per cent, although starting from a lower base level.

Typical weekly incomes in the UK initially rose after the crash and peaked in 2009-10, before falling until 2011-12. They have since recovered and in 2014 were approaching their pre-downturn level.

This has led to household incomes rising by nearly four per cent since 2007-08, working out at around £800 a year although it is still the lowest paid region in England.

The biggest squeeze was in Northern Ireland where typical incomes fell by 6.7 per cent between between 2007-08 and 2011-12. They have recovered relatively well since but were still 4 per cent – or £860 a year – below their pre-downturn level last year.

The think tank explained Ulster’s figures by its poor job performance with employment still two per cent below pre-recession levels and by far the biggest pay squeeze in the UK, with wages falling on average by 13.4 per cent. This has meant it has fallen behind the north-east in terms of median income, followed by Wales.

Perhaps surprisingly, London has now overtaken the south-east – where typically the well paid professionals live – to have the highest median income in the UK at £26,534 a year compared to £25,911 in the Home Counties although both are well above the national average. The capital has experienced the second strongest employment performance of any region since 2007-08 but also the second deepest pay squeeze bringing it in line with the rest of the country.

The statistics showed that rather than geographical differences, the divide is now a generational gap with pensioner households 9.4 per cent above their pre-downturn levels while those in work were still 4.6 per cent worse off.

“To add to the confusion, the stark generational divide means that many working age households in the north east will have experienced a tighter squeeze in living standards than pensioner households in Northern Ireland,” the economist highlighted.

COMMENTS

Please let us know if you're having issues with commenting.