The UK’s Competition and Markets Authority (CMA) has said 21st Century Fox’s proposed takeover of Sky Plc is “not in the public interest” and could block the acquisition.

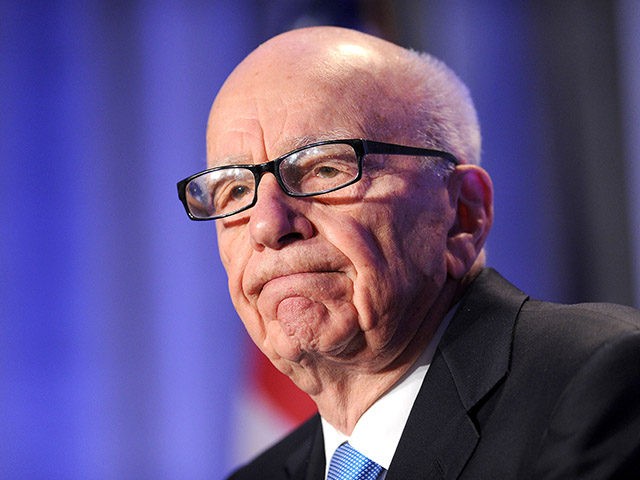

The body argued that the Rupert Murdoch and his family would have too much control over Britain’s media landscape in a provisional finding.

Mr. Murdoch’s company already owns 39 per cent of Sky and tabled their £11.7 billion bid for full control in 2016. They already own the Sun and Times newspapers.

Anne Lambert, Chair of the CMA’s independent investigation Group, commented: “Media plurality goes to the heart of our democratic process.

“It is very important that no group or individual should have too much control of our news media or too much power to affect the political agenda.

“We have provisionally found that if the Fox/Sky merger went ahead as proposed, it would be against the public interest.

“It would result in the Murdoch family having too much control over news providers in the UK, and too much influence over public opinion and the political agenda.”

UKIP warns of Murdoch media monopoly https://t.co/ksqxt1yknL

— Breitbart London (@BreitbartLondon) November 1, 2017

The CMA also found, however, that Fox’s commitment to broadcasting standards was not in question, saying that “overall, Fox has a genuine commitment to broadcasting standards in the UK”. They have held licences in the UK for more than 20 years.

Disney has proposed a takeover of Fox, which is yet to be approved by U.S. regulators. If Fox takes over Sky, the whole of Sky could eventually be transferred into Disney’s ownership.

In a statement, Fox said it was “disappointed” by the findings. “We will continue to engage with the CMA ahead of the publication of its final report in May,” they said.

“We welcome the CMA’s provisional finding that the company has a genuine commitment to broadcasting standards and the transaction would not be against the public interest in this respect.”

They also said they would make a further announcement “as and when appropriate”.

COMMENTS

Please let us know if you're having issues with commenting.