Shipping rates from China to Europe are soaring as a growing number of companies suspend and restrict transit through the Red Sea, fearful of missile strikes, drone attacks, and hijacking by the Iran-backed Houthi terrorists of Yemen.

The Houthis have all but shut down a route that normally handles about 12 percent of the world’s shipping.

The South China Morning Post (SCMP) noted that shipping rates were already rising, “reflecting a traditional uptick at the end of the year as Chinese exporters rush to send out goods ahead of Lunar New Year and ocean carriers push up prices during long-term contract negotiations.”

“The price of the Mediterranean route is soaring now. The freight rate of early January may double that of early December,” predicted Tianjin-based freight executive Xia Xaioqiang. That would be quite a one-two punch after shipping rates already increased by up to 70 percent from November to December.

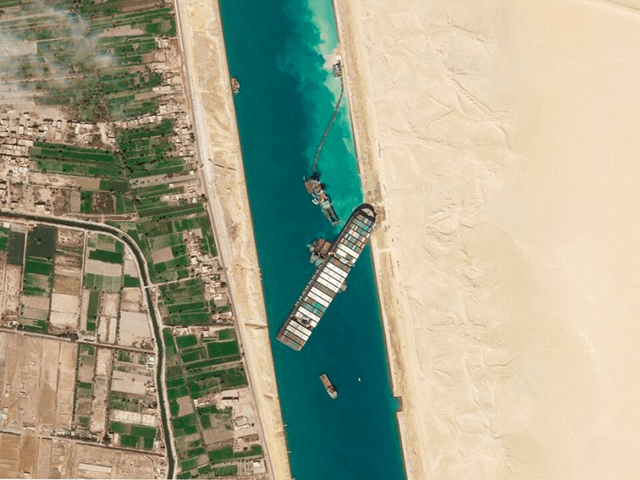

Many industry analysts sought to put the anticipated costs of the Red Sea disruption into context by recalling the saga of the MV Ever Given, the immense cargo ship that got stuck in the Suez Canal in 2021, shutting the canal down for six days. The Red Sea trade route currently menaced by the Houthis leads to the Suez Canal.

In this March 28, 2021, satellite file image the cargo ship MV Ever Given sits stuck in the Suez Canal near Suez, Egypt. Consumers may face shortages and higher prices for electronics, toys, furniture and other goods should attempts to free the mammoth container ship stuck in Egypt’s Suez Canal drag on several weeks. (Planet Labs Inc. via AP)

Reuters on Tuesday quoted analysts who said the surge in shipping costs will probably be less than prices at the height of the Wuhan coronavirus pandemic when limited cargo ship availability plus high demand pushed shipping costs to over $14,000 per container. The current price is about $2,400, so if Houthi piracy continues and Xia’s projections are correct, costs could approach $5,000 per container next month – worrisome, but far less than pandemic peaks.

High prices will be passed along to consumers already reeling from high inflation and customers could face supply shortages and long delivery delays as well.

If the Houthi terrorist blockade continues for long enough, it might inspire some companies to seek permanent alternatives to Red Sea shipping. The most likely beneficiary of such a move would be the China-Europe Railway Express (CRE), which the SCMP said is already receiving a surge of inquiries as more companies announce they will suspend Red Sea operations.

The CRE was built as part of China’s Belt and Road Initiative (BRI) to recreate ancient Silk Road trade routes with modern infrastructure. The CRE saw a surge of cargo activity during the coronavirus pandemic, but many shipping companies have been reluctant to consider it as an alternative to Red Sea cargo lines because they fear trains passing through Ukraine and Russia could be affected by the war in that region, or by sanctions against Russia.

Two other alternatives for shippers are sailing around the Cape of Good Hope to avoid the region threatened by the Houthis, adding up to ten days to shipping times and increasing fuel consumption, or forming into World War II-style convoys and hoping the recently announced U.S.-led “Operation Prosperity Guardian” initiative can fend off Houthi attacks.

COMMENTS

Please let us know if you're having issues with commenting.